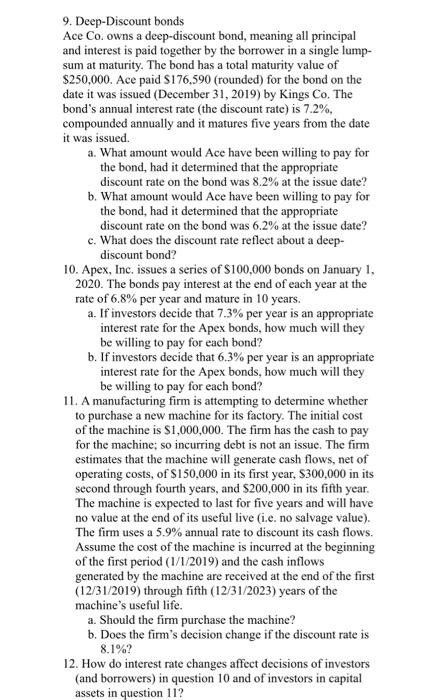

9. Deep-Discount bonds Ace Co. owns a deep-discount bond, meaning all principal and interest is paid together by the borrower in a single lump- sum at maturity. The bond has a total maturity value of $250,000. Ace paid $176,590 (rounded) for the bond on the date it was issued (December 31, 2019) by Kings Co. The bond's annual interest rate (the discount rate) is 7.2%, compounded annually and it matures five years from the date it was issued. a. What amount would Ace have been willing to pay for the bond, had it determined that the appropriate discount rate on the bond was 8.2% at the issue date? b. What amount would Ace have been willing to pay for the bond, had it determined that the appropriate discount rate on the bond was 6.2% at the issue date? c. What does the discount rate reflect about a deep- discount bond? 10. Apex, Inc. issues a series of $100,000 bonds on January 1, 2020. The bonds pay interest at the end of each year at the rate of 6.8% per year and mature in 10 years. a. If investors decide that 7.3% per year is an appropriate interest rate for the Apex bonds, how much will they be willing to pay for each bond? b. If investors decide that 6,3% per year is an appropriate interest rate for the Apex bonds, how much will they be willing to pay for each bond? 11. A manufacturing firm is attempting to determine whether to purchase a new machine for its factory. The initial cost of the machine is $1,000,000. The firm has the cash to pay for the machine; so incurring debt is not an issue. The fim estimates that the machine will generate cash flows, net of operating costs, of $150,000 in its first year, $300,000 in its second through fourth years, and S200,000 in its fifth year. The machine is expected to last for five years and will have no value at the end of its useful live (i.e. no salvage value). The firm uses a 5.9% annual rate to discount its cash flows. Assume the cost of the machine is incurred at the beginning of the first period (1/1/2019) and the cash inflows generated by the machine are received at the end of the first (12/31/2019) through fifth (12/31/2023) years of the machine's useful life. a. Should the firm purchase the machine? b. Does the firm's decision change if the discount rate is 8.1%? 12. How do interest rate changes affect decisions of investors (and borrowers) in question 10 and of investors in capital assets in question 11