Question

9. DuPont identity.For the firms in the popup window, LOADING..., find the return on equity using the three components of the DuPont identity: operating efficiency,

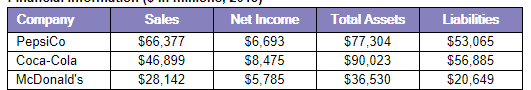

9. DuPont identity.For the firms in the popup window, LOADING..., find the return on equity using the three components of the DuPont identity: operating efficiency, as measured by the profit margin (net income/sales); asset management efficiency, as measured by asset turnover (sales/total assets); and financial leverage, as measured by the equity multiplier (total assets/total equity).

What is the equity for PepsiCo, Coca-Cola, and McDonalds? (Round to the nearest million dollars)

What is the profit margin for PepsiCo, Coca-Cola, and McDonalds? (Round to two decimal places)

What is the asset turnover for PepsiCo, Coca-Cola, and McDonalds? (Round to four decimal places)

What is the equity multiplier for PepsiCo, Coca-Cola, and McDonalds? (Round to four decimal places)

What is the ROE for PepsiCo, Coca-Cola, and McDonalds? (Round to two decimal places)

Company PepsiCo Coca-Cola McDonald's Sales $66,377 $46,899 $28,142 Net Income $6,693 $8,475 $5,785 Total Assets $77,304 $90,023 $36,530 Liabilities $53,065 $56,885 $20,649Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started