Answered step by step

Verified Expert Solution

Question

1 Approved Answer

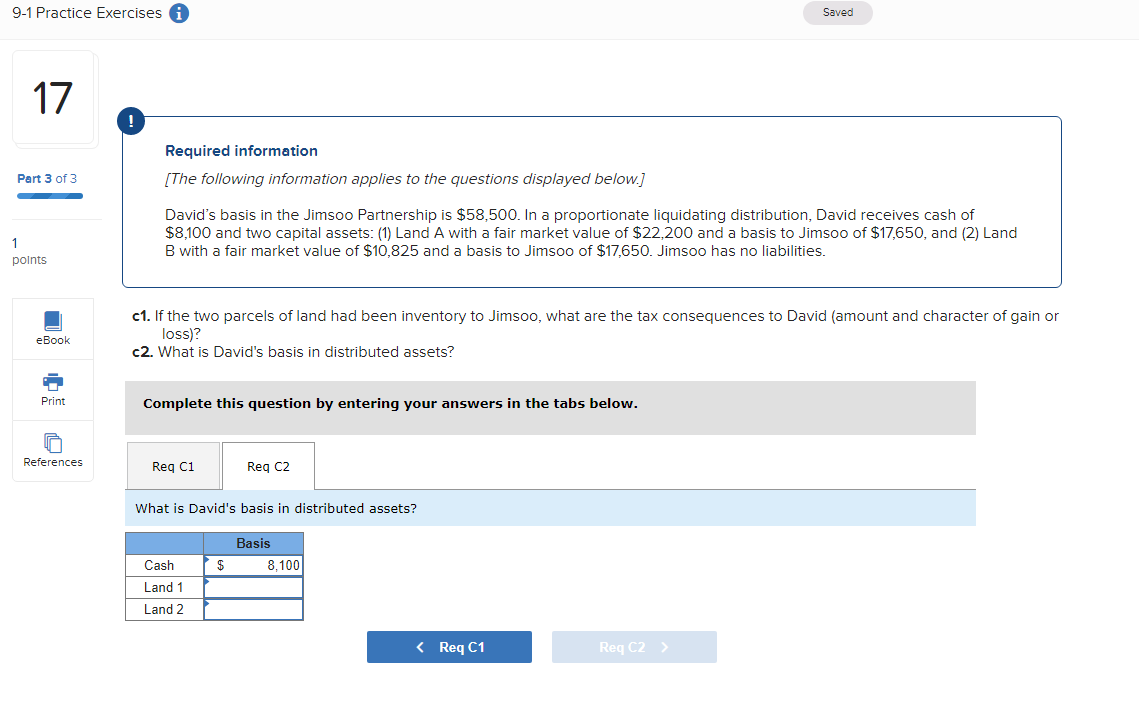

9-1 Practice Exercises 1 17 Required information Saved Part 3 of 3 [The following information applies to the questions displayed below.] David's basis in

9-1 Practice Exercises 1 17 Required information Saved Part 3 of 3 [The following information applies to the questions displayed below.] David's basis in the Jimsoo Partnership is $58,500. In a proportionate liquidating distribution, David receives cash of $8,100 and two capital assets: (1) Land A with a fair market value of $22,200 and a basis to Jimsoo of $17,650, and (2) Land B with a fair market value of $10,825 and a basis to Jimsoo of $17,650. Jimsoo has no liabilities. points eBook Print c1. If the two parcels of land had been inventory to Jimsoo, what are the tax consequences to David (amount and character of gain or loss)? c2. What is David's basis in distributed assets? Complete this question by entering your answers in the tabs below. References Req C1 Req C2 What is David's basis in distributed assets? Basis Cash Land 1 $ 8,100 Land 2 < Req C1 Req C2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started