Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. 2. Prepare an estimated income statement, comparing operating results if 25,000 and 30,000 units are manufactured in the variable costing format. If an amount

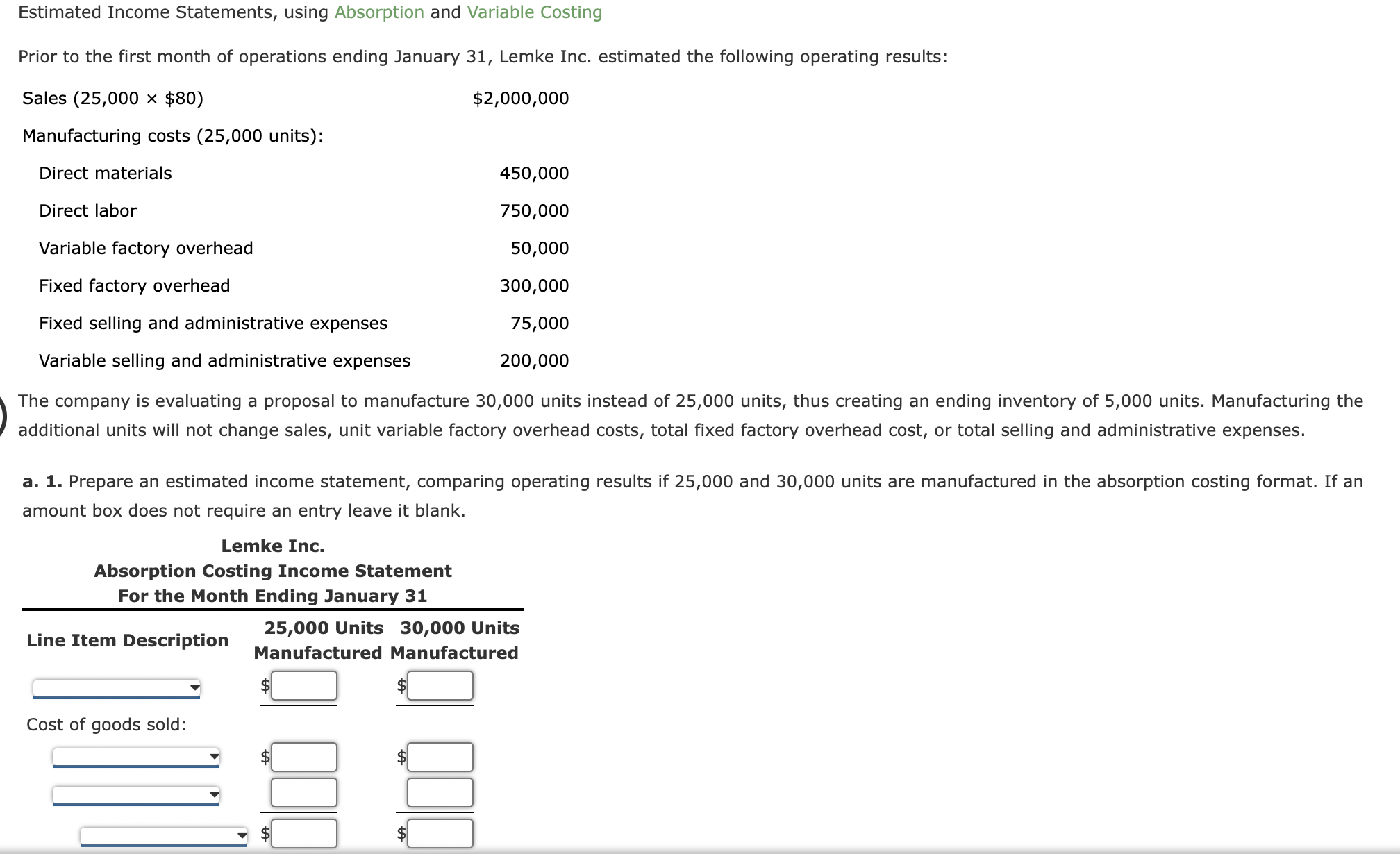

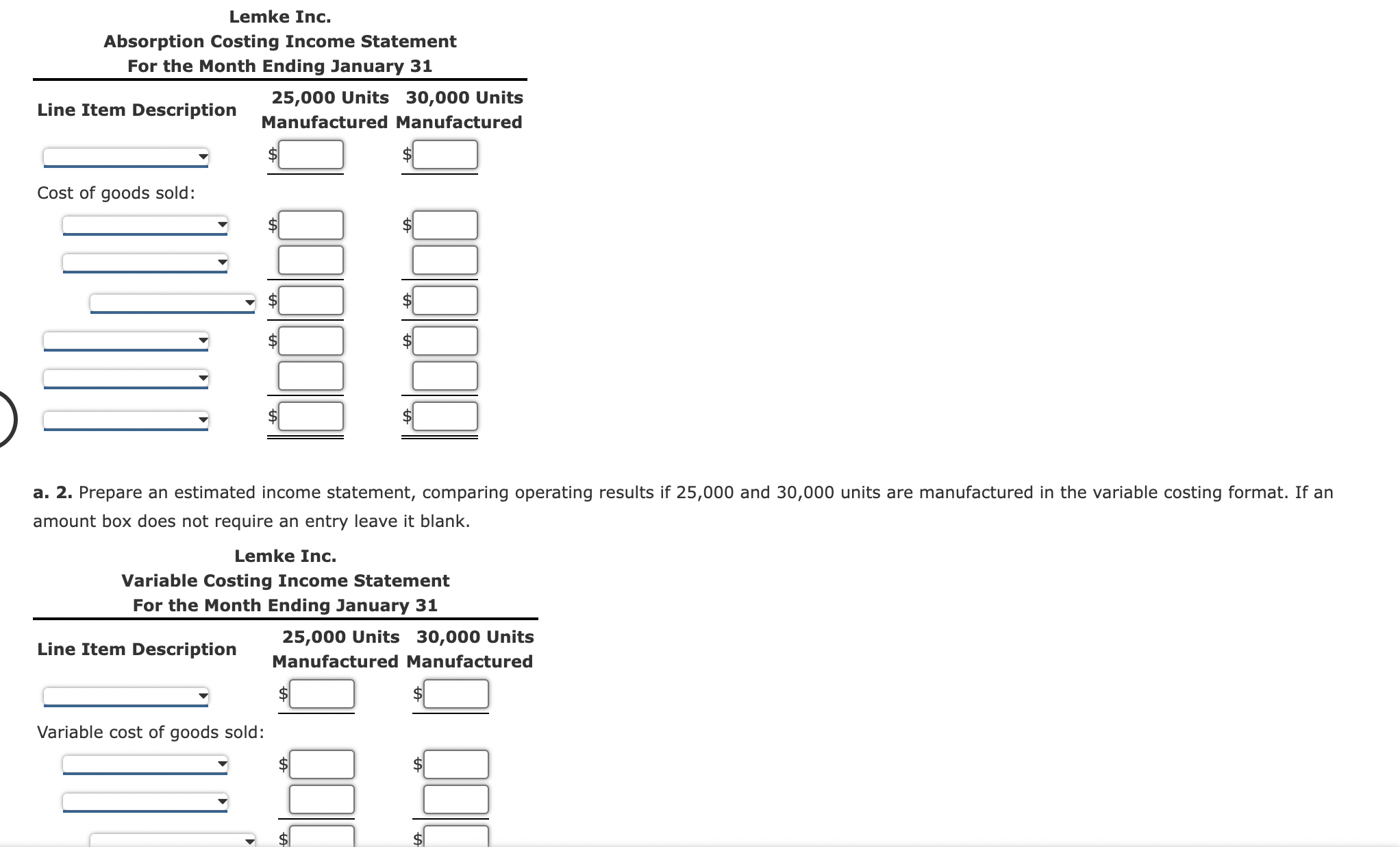

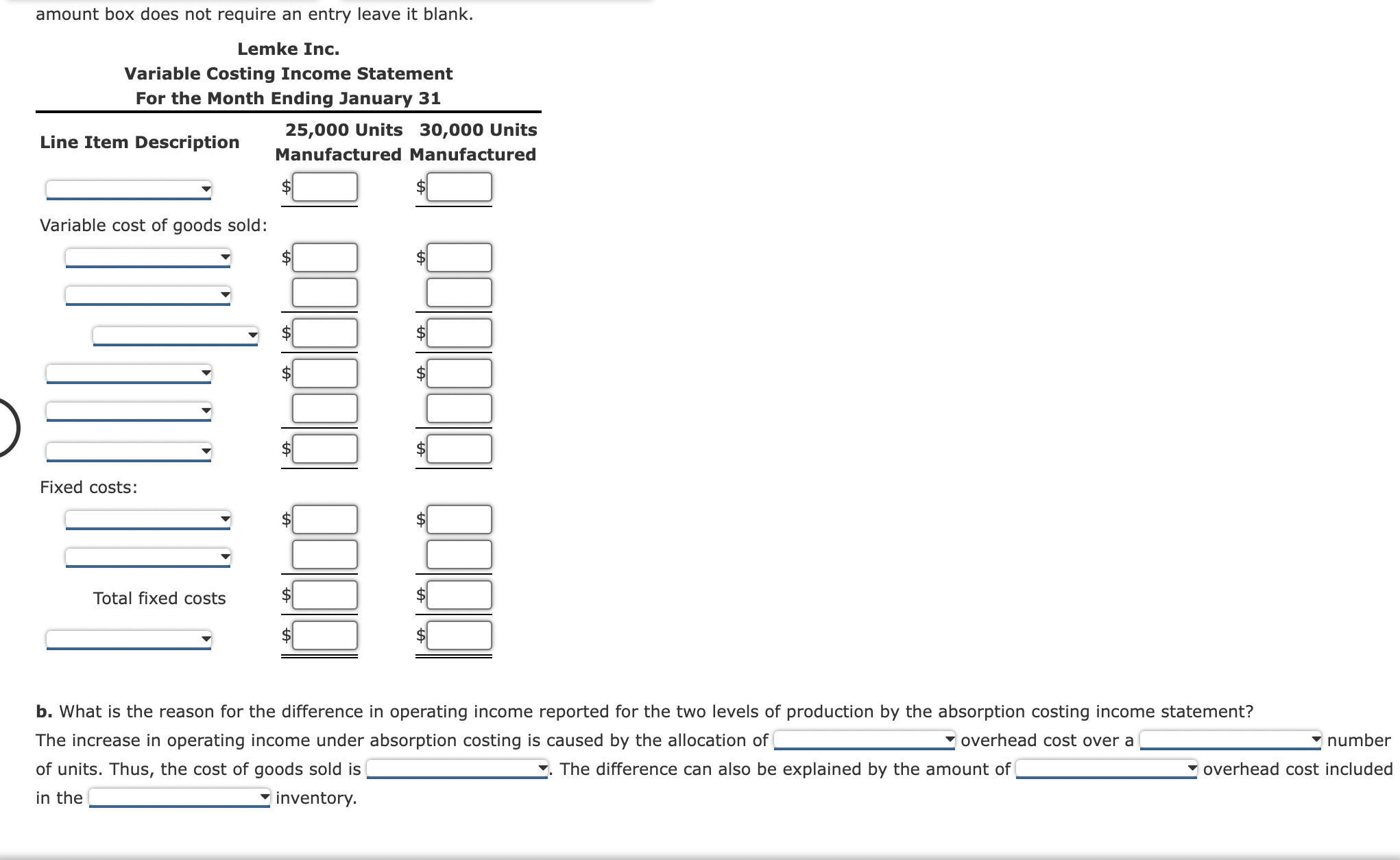

a. 2. Prepare an estimated income statement, comparing operating results if 25,000 and 30,000 units are manufactured in the variable costing format. If an amount box does not require an entry leave it blank. Estimated Income Statements, using Absorption and Variable Costing Prior to the first month of operations ending January 31, Lemke Inc. estimated the following operating results: The company is evaluating a proposal to manufacture 30,000 units instead of 25,000 units, thus creating an ending inventory of 5,000 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. 1. Prepare an estimated income statement, comparing operating results if 25,000 and 30,000 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank. amount box does not require an entry leave it blank. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement? The increase in operating income under absorption costing is caused by the allocation of overhead cost over a number of units. Thus, the cost of goods sold is The difference can also be explained by the amount of overhead cost included in the inventory

a. 2. Prepare an estimated income statement, comparing operating results if 25,000 and 30,000 units are manufactured in the variable costing format. If an amount box does not require an entry leave it blank. Estimated Income Statements, using Absorption and Variable Costing Prior to the first month of operations ending January 31, Lemke Inc. estimated the following operating results: The company is evaluating a proposal to manufacture 30,000 units instead of 25,000 units, thus creating an ending inventory of 5,000 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. 1. Prepare an estimated income statement, comparing operating results if 25,000 and 30,000 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank. amount box does not require an entry leave it blank. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement? The increase in operating income under absorption costing is caused by the allocation of overhead cost over a number of units. Thus, the cost of goods sold is The difference can also be explained by the amount of overhead cost included in the inventory Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started