Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A stock price is currently R30. During each 2-month period for the next 4 months it will increase by 8% or reduce by

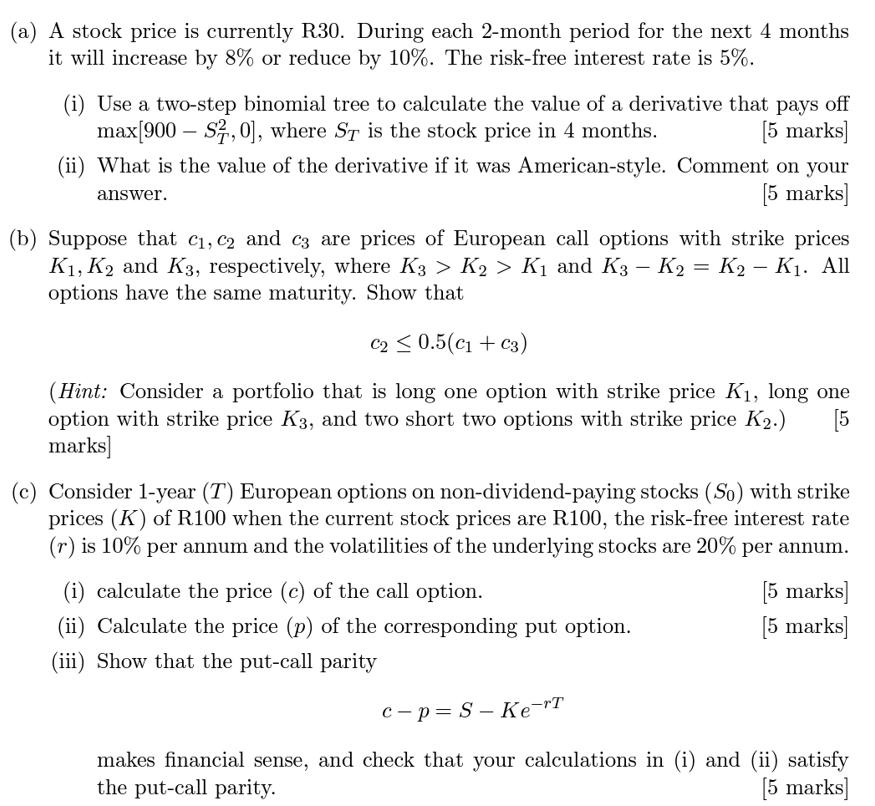

(a) A stock price is currently R30. During each 2-month period for the next 4 months it will increase by 8% or reduce by 10%. The risk-free interest rate is 5%. answer. - (i) Use a two-step binomial tree to calculate the value of a derivative that pays off max[900 S2,0], where ST is the stock price in 4 months. [5 marks] (ii) What is the value of the derivative if it was American-style. Comment on your [5 marks] (b) Suppose that C1, C2 and c3 are prices of European call options with strike prices K1, K2 and K3, respectively, where K3 > K2 > K and K3 - K = K2 - K. All options have the same maturity. Show that C2 0.5(C1+C3) (Hint: Consider a portfolio that is long one option with strike price K, long one option with strike price K3, and two short two options with strike price K2.) [5 marks] (c) Consider 1-year (T) European options on non-dividend-paying stocks (So) with strike prices (K) of R100 when the current stock prices are R100, the risk-free interest rate (r) is 10% per annum and the volatilities of the underlying stocks are 20% per annum. (i) calculate the price (c) of the call option. (ii) Calculate the price (p) of the corresponding put option. (iii) Show that the put-call parity [5 marks] [5 marks] c-p=S-Ke-T makes financial sense, and check that your calculations in (i) and (ii) satisfy the put-call parity. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To tackle these problems lets break them down step by step a Binomial Tree and Derivative Pricing i Twostep Binomial Tree for European Option Paramete...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started