Answered step by step

Verified Expert Solution

Question

1 Approved Answer

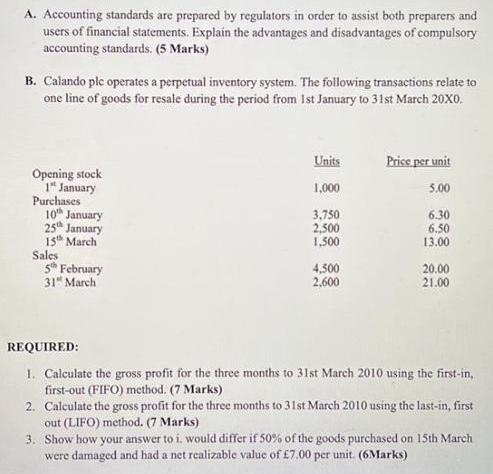

A. Accounting standards are prepared by regulators in order to assist both preparers and users of financial statements. Explain the advantages and disadvantages of

A. Accounting standards are prepared by regulators in order to assist both preparers and users of financial statements. Explain the advantages and disadvantages of compulsory accounting standards. (5 Marks) B. Calando ple operates a perpetual inventory system. The following transactions relate to one line of goods for resale during the period from Ist January to 31st March 20X0. Units Prics per unit Opening stock 1" January Purchases 10 January 25 January 15" March Sales 5* February 31" March 1,000 5.00 3,750 2,500 1,500 6.30 6.50 13.00 4,500 2,600 20.00 21.00 REQUIRED: 1. Calculate the gross profit for the three months to 31st March 2010 using the first-in, first-out (FIFO) method. (7 Marks) 2. Calculate the gross profit for the three months to 31st March 2010 using the last-in, first out (LIFO) method. (7 Marks) 3. Show how your answer to i. would differ if 50% of the goods purchased on 15th March were damaged and had a net realizable value of 7.00 per unit. (6Marks) A. Accounting standards are prepared by regulators in order to assist both preparers and users of financial statements. Explain the advantages and disadvantages of compulsory accounting standards. (5 Marks) B. Calando ple operates a perpetual inventory system. The following transactions relate to one line of goods for resale during the period from Ist January to 31st March 20X0. Units Prics per unit Opening stock 1" January Purchases 10 January 25 January 15" March Sales 5* February 31" March 1,000 5.00 3,750 2,500 1,500 6.30 6.50 13.00 4,500 2,600 20.00 21.00 REQUIRED: 1. Calculate the gross profit for the three months to 31st March 2010 using the first-in, first-out (FIFO) method. (7 Marks) 2. Calculate the gross profit for the three months to 31st March 2010 using the last-in, first out (LIFO) method. (7 Marks) 3. Show how your answer to i. would differ if 50% of the goods purchased on 15th March were damaged and had a net realizable value of 7.00 per unit. (6Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answers Abbreviation used COGS Cost of goods sold CAS Compulsory accounting standard A Ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started