Question

A: All Star Enterprises anticipates a 19% growth in sales, but interest expense will grow by 7%. If they are operating at 96% capacity

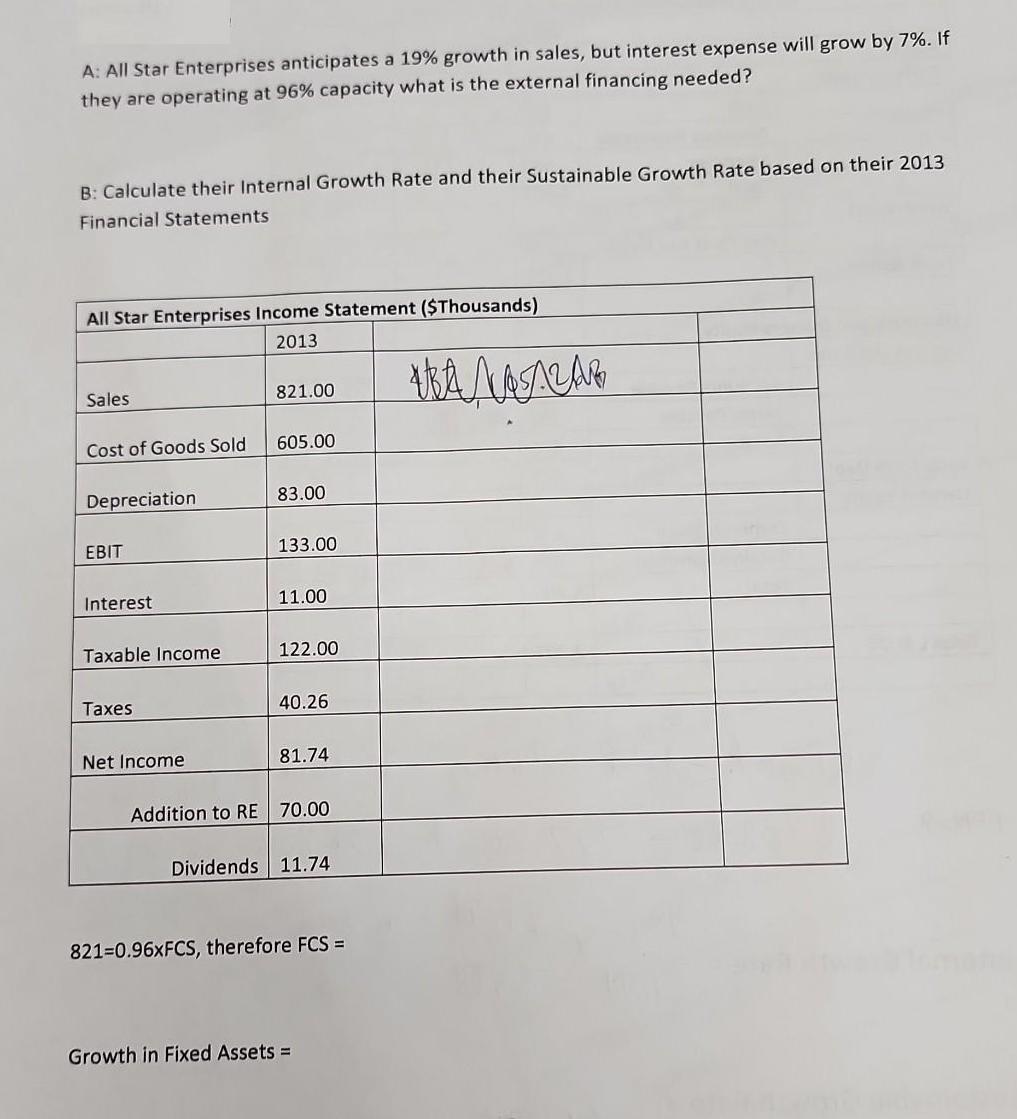

A: All Star Enterprises anticipates a 19% growth in sales, but interest expense will grow by 7%. If they are operating at 96% capacity what is the external financing needed? B: Calculate their Internal Growth Rate and their Sustainable Growth Rate based on their 2013 Financial Statements All Star Enterprises Income Statement ($Thousands) 2013 Sales Cost of Goods Sold Depreciation EBIT Interest Taxable Income Taxes Net Income 821.00 605.00 83.00 133.00 11.00 122.00 40.26 81.74 Addition to RE 70.00 Dividends 11.74 821-0.96xFCS, therefore FCS = Growth in Fixed Assets = ARA MASALAR

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION A To calculate the external financing needed we need to determine the increase in assets required to support the 19 growth in sales and the i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F Brigham, Phillip R Daves

14th Edition

0357516664, 978-0357516669

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App