Answered step by step

Verified Expert Solution

Question

1 Approved Answer

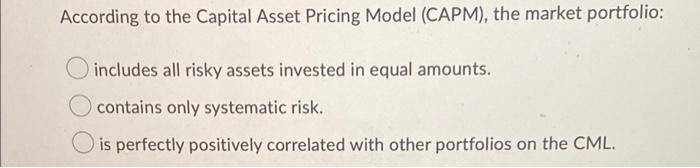

a. b. According to the Capital Asset Pricing Model (CAPM), the market portfolio: includes all risky assets invested in equal amounts. contains only systematic risk.

a.  b.

b.

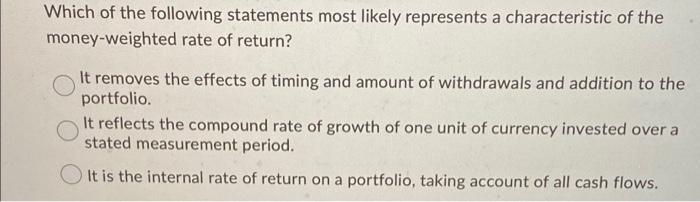

According to the Capital Asset Pricing Model (CAPM), the market portfolio: includes all risky assets invested in equal amounts. contains only systematic risk. O is perfectly positively correlated with other portfolios on the CML. Which of the following statements most likely represents a characteristic of the money-weighted rate of return? It removes the effects of timing and amount of withdrawals and addition to the portfolio It reflects the compound rate of growth of one unit of currency invested over a stated measurement period. It is the internal rate of return on a portfolio, taking account of all cash flows  b.

b.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started