a.

b.

c.

d.

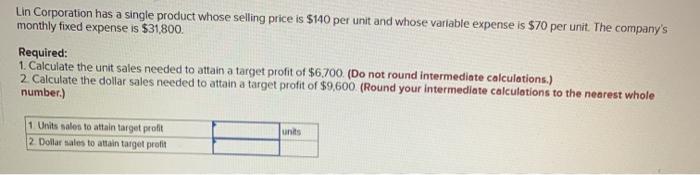

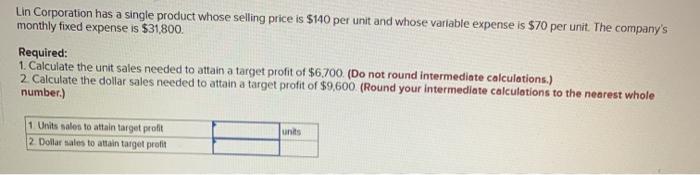

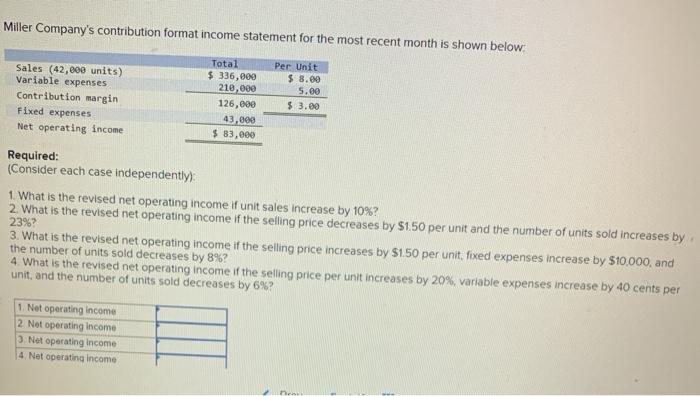

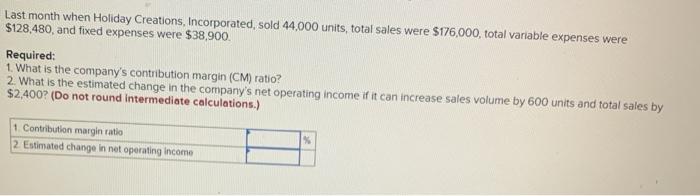

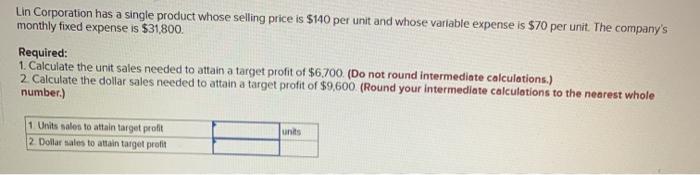

Lin Corporation has a single product whose selling price is $140 per unit and whose variable expense is $70 per unit. The company's monthly fixed expense is $31,800. Required: 1. Calculate the unit sales needed to attain a target profit of $6.700. (Do not round intermediate calculations.) 2. Calculate the dollar sales needed to attain a target profit of $9,600 (Round your intermediate calculations to the nearest whole number.) 1 Units sales to attain target profit 2. Dollar sales to attain target profit units Miller Company's contribution format income statement for the most recent month is shown below Sales (42,808 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 336,000 210,000 126,000 43,000 $ 83,000 Per Unit $ 8.00 5.00 $ 3.00 Required: (Consider each case independentlyy: 1. What is the revised net operating income if unit sales increase by 10%? 2. What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 23%? 3. What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $10,000, and the number of units sold decreases by 8%? 4 What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 40 cents per unit, and the number of units sold decreases by 6%? 1 Net operating income 2 Not operating income 3 Net operating income 4. Net operating income Whirly Corporation's contribution format income statement for the most recent month is shown below: Sales (7,900 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 268,600 158,000 110,600 54,700 $ 55,990 Per Unit $ 34.00 20.00 $ 14.00 Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 70 units? 2. What would be the revised net operating income per month if the sales volume decreases by 70 units? 3. What would be the revised net operating income per month if the sales volume is 6,900 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income Last month when Holiday Creations, Incorporated, sold 44,000 units, total sales were $176,000, total variable expenses were $128,480, and fixed expenses were $38,900. Required: 1. What is the company's contribution margin (CM) ratio? 2. What is the estimated change in the company's net operating income if it can increase sales volume by 600 units and total sales by $2,400? (Do not round intermediate calculations.) 1 Contribution margin ratio 2 Estimated change in net operating income