Answered step by step

Verified Expert Solution

Question

1 Approved Answer

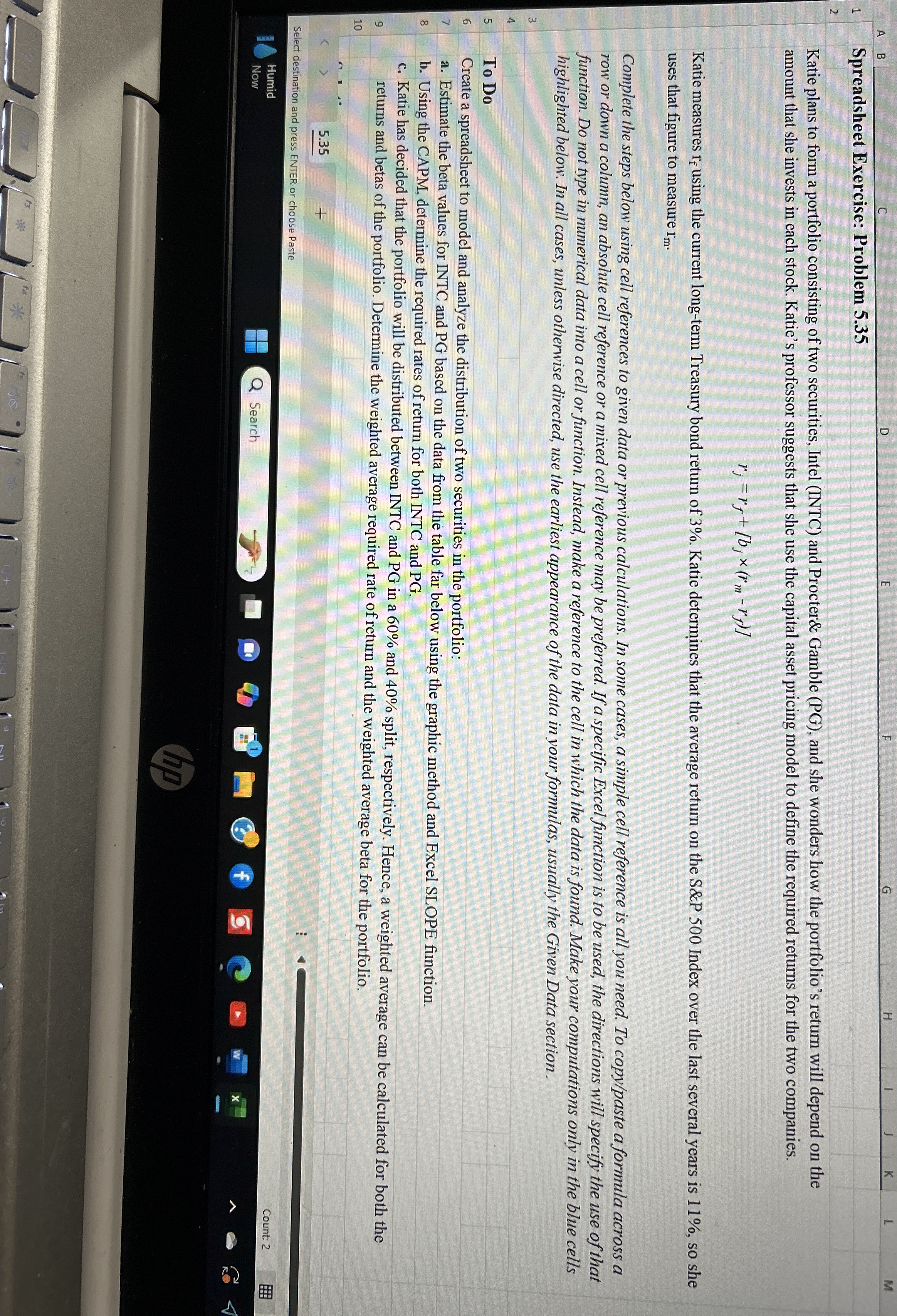

A B q , C D E F G H 1 J K L M 1 2 Spreadsheet Exercise: Problem 5 . 3 5 Katie

A B

C

D

E

F

G

H

J

K

L

M

Spreadsheet Exercise: Problem

Katie plans to form a portfolio consisting of two securities Intel INTC and Procter& Gamble PG and she wonders how the portfolio's return will depend on the amount that she invests in each stock. Katie's professor suggests that she use the capital asset pricing model to define the required returns for the two companies.

Katie measures using the current longterm Treasury bond return of Katie determines that the average return on the & Index over the last several years is so she uses that figure to measure

Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copypaste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section.

To Do

Create a spreadsheet to model and analyze the distribution of two securities in the portfolio:

a Estimate the beta values for INTC and PG based on the data from the table far below using the graphic method and Excel SLOPE function. Beta for INTC Beta for PG

b Using the CAPM, determine the required rates of return for both INTC and PG Risk free rate Expected market return required rate of return for INTC required rate of return for PG

c Katie has decided that the portfolio will be distributed between INTC and PG in a and split, respectively. Hence, a weighted average can be calculated for both the returns and betas of the portfolio. Determine the weighted average required rate of return and the weighted average beta for the portfolio. Weight of INTC in the portfolio weight of PG in the portfolio weighted average required rate of return weighted average beta

Select destination and press ENTER or choose Paste

Humid

Now

Search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started