Question

A bank offers 30-year, $250,000 mortgages at 6.1 percent and charges a $4,100 refundable loan application fee. The current disclosure law requires that any

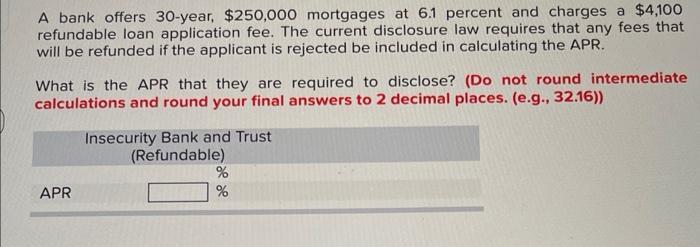

A bank offers 30-year, $250,000 mortgages at 6.1 percent and charges a $4,100 refundable loan application fee. The current disclosure law requires that any fees that will be refunded if the applicant is rejected be included in calculating the APR. What is the APR that they are required to disclose? (Do not round intermediate calculations and round your final answers to 2 decimal places. (e.g., 32.16)) Insecurity Bank and Trust (Refundable) APR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Annual Percentage Rate APR that the bank is required to disclose we need to conside...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance Core Principles and Applications

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

5th edition

1259289907, 978-1259289903

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App