A building owner is evaluating the following four alternatives for leasing space in an office building for the next five years. As part of the lease option evaluation, calculate the effective rent to the owner (after expenses) for each lease alternative using a 9% discount rate. Gross lease with expense stop and CPI adjustment: Rent will be $22 the first year and increased by the full amount of any change in the CPI after the first year with the expense stop at $9 per square foot. The CPI and operating expenses are assumed to change by the same amount as outlined above. (prepare an excel spreadsheet).

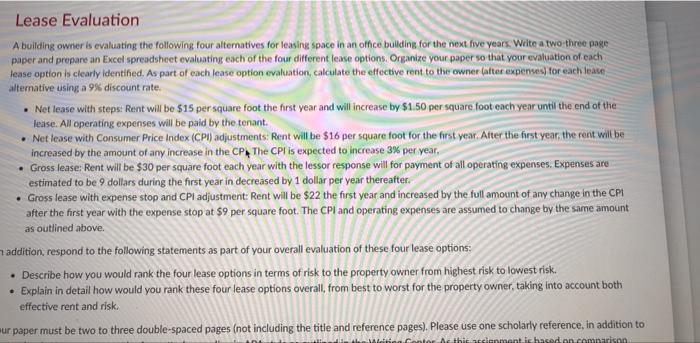

Lease Evaluation A building owner is evaluating the following four alternatives for leasing space in an office building for the next five years. Welte a two three page paper and prepare an Excel spreadsheet evaluating each of the four different lease options. Organize your paper so that your evaluation of each lease option is clearly identified. As part of each lease option evaluation, calculate the effective rent to the owner latter expenses) for each lean alternative using a 9% discount rate. Net lease with steps: Rent will be $15 per square foot the first year and will increase by $1.50 per square foot each year until the end of the lease. All operating expenses will be paid by the tenant Net tease with Consumer Price Index (CP) adjustments: Rent will be $16 per square foot for the first year. After the first year, the rent will be increased by the amount of any increase in the CPA The CPI is expected to increase 3% per year. Gross lease: Rent will be $30 per square foot each year with the lessor response will for payment of all operating expenses. Expenses are estimated to be 9 dollars during the first year in decreased by 1 dollar per year thereafter. Gross lease with expense stop and CPI adjustment: Rent will be $22 the first year and increased by the full amount of any change in the CPI after the first year with the expense stop at $9 per square foot. The CPI and operating expenses are assumed to change by the same amount as outlined above addition, respond to the following statements as part of your overall evaluation of these four lease options: Describe how you would rank the four lease options in terms of risk to the property owner from highest risk to lowest risk. . Explain in detail how would you rank these four lease options overall, from best to worst for the property owner, taking into account both effective rent and risk. eur paper must be two to three double-spaced pages (not including the title and reference pages). Please use one scholarly reference, in addition to Ar this assignment is based on comparison