Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A business taxpayer sells inventory for ( $ 100,000 ). The adjusted basis of the property at the time of the sale is ( $

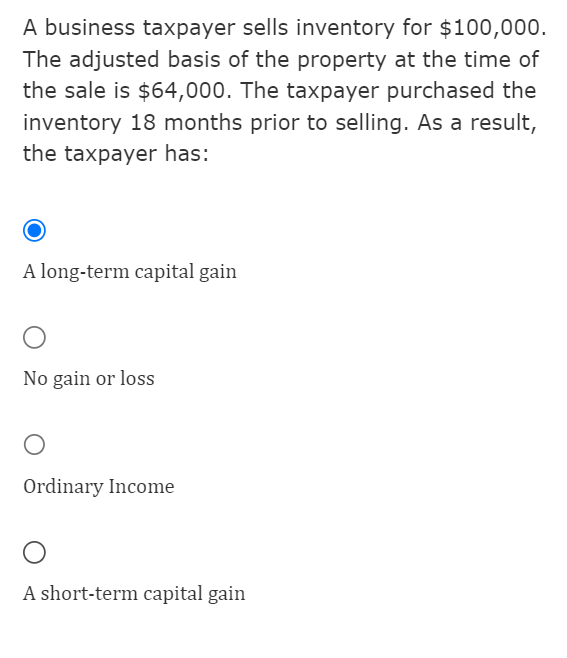

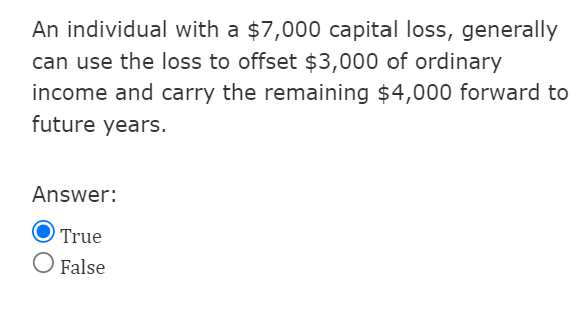

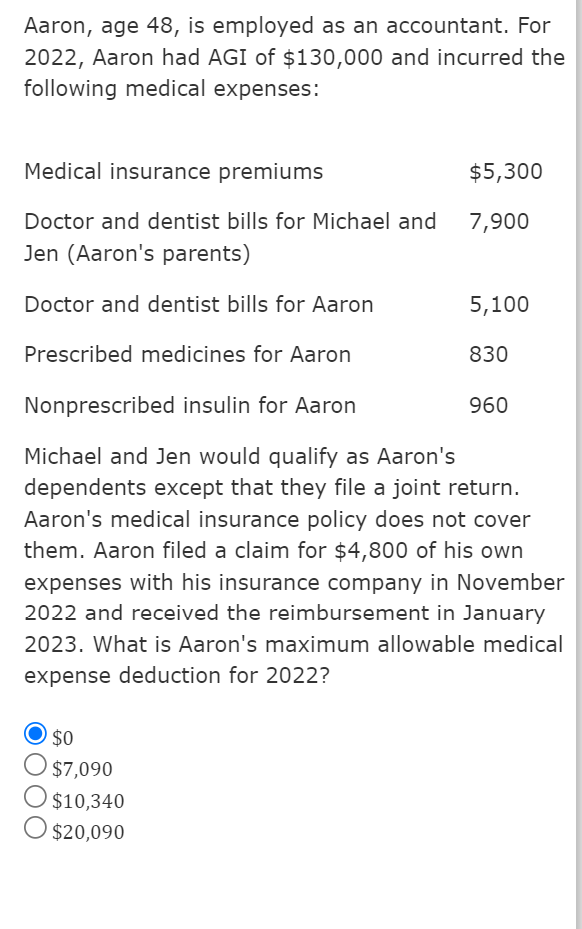

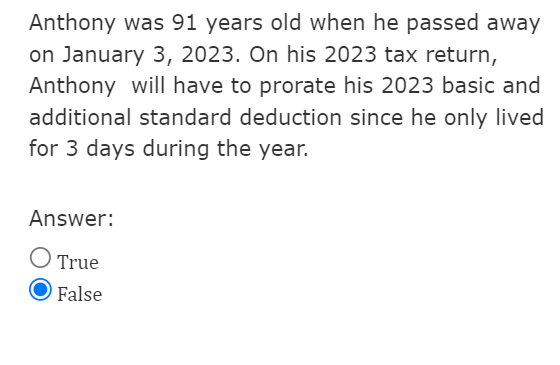

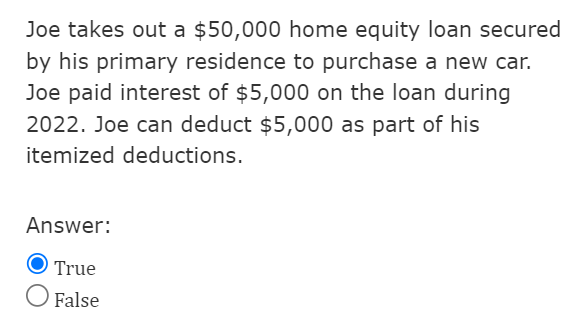

A business taxpayer sells inventory for \\( \\$ 100,000 \\). The adjusted basis of the property at the time of the sale is \\( \\$ 64,000 \\). The taxpayer purchased the inventory 18 months prior to selling. As a result, the taxpayer has: A long-term capital gain No gain or loss Ordinary Income A short-term capital gain An individual with a \\( \\$ 7,000 \\) capital loss, generally can use the loss to offset \\( \\$ 3,000 \\) of ordinary income and carry the remaining \\( \\$ 4,000 \\) forward to future years. Answer: True False Aaron, age 48 , is employed as an accountant. For 2022 , Aaron had AGI of \\( \\$ 130,000 \\) and incurred the following medical expenses: Michael and Jen would qualify as Aaron's dependents except that they file a joint return. Aaron's medical insurance policy does not cover them. Aaron filed a claim for \\( \\$ 4,800 \\) of his own expenses with his insurance company in November 2022 and received the reimbursement in January 2023. What is Aaron's maximum allowable medical expense deduction for 2022 ? \\( \\$ 0 \\) \\( \\$ 7,090 \\) \\( \\$ 10,340 \\) \\( \\$ 20,090 \\) Anthony was 91 years old when he passed away on January 3, 2023. On his 2023 tax return, Anthony will have to prorate his 2023 basic and additional standard deduction since he only lived for 3 days during the year. Answer: True False Joe takes out a \\( \\$ 50,000 \\) home equity loan secured by his primary residence to purchase a new car. Joe paid interest of \\( \\$ 5,000 \\) on the loan during 2022 . Joe can deduct \\( \\$ 5,000 \\) as part of his itemized deductions. Answer: True False

A business taxpayer sells inventory for \\( \\$ 100,000 \\). The adjusted basis of the property at the time of the sale is \\( \\$ 64,000 \\). The taxpayer purchased the inventory 18 months prior to selling. As a result, the taxpayer has: A long-term capital gain No gain or loss Ordinary Income A short-term capital gain An individual with a \\( \\$ 7,000 \\) capital loss, generally can use the loss to offset \\( \\$ 3,000 \\) of ordinary income and carry the remaining \\( \\$ 4,000 \\) forward to future years. Answer: True False Aaron, age 48 , is employed as an accountant. For 2022 , Aaron had AGI of \\( \\$ 130,000 \\) and incurred the following medical expenses: Michael and Jen would qualify as Aaron's dependents except that they file a joint return. Aaron's medical insurance policy does not cover them. Aaron filed a claim for \\( \\$ 4,800 \\) of his own expenses with his insurance company in November 2022 and received the reimbursement in January 2023. What is Aaron's maximum allowable medical expense deduction for 2022 ? \\( \\$ 0 \\) \\( \\$ 7,090 \\) \\( \\$ 10,340 \\) \\( \\$ 20,090 \\) Anthony was 91 years old when he passed away on January 3, 2023. On his 2023 tax return, Anthony will have to prorate his 2023 basic and additional standard deduction since he only lived for 3 days during the year. Answer: True False Joe takes out a \\( \\$ 50,000 \\) home equity loan secured by his primary residence to purchase a new car. Joe paid interest of \\( \\$ 5,000 \\) on the loan during 2022 . Joe can deduct \\( \\$ 5,000 \\) as part of his itemized deductions. Answer: True False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started