Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Calculate performance of measures for each fund. They are Jensen's alpha, Sharpe index, and the information ratio. b. Compare and comment on your

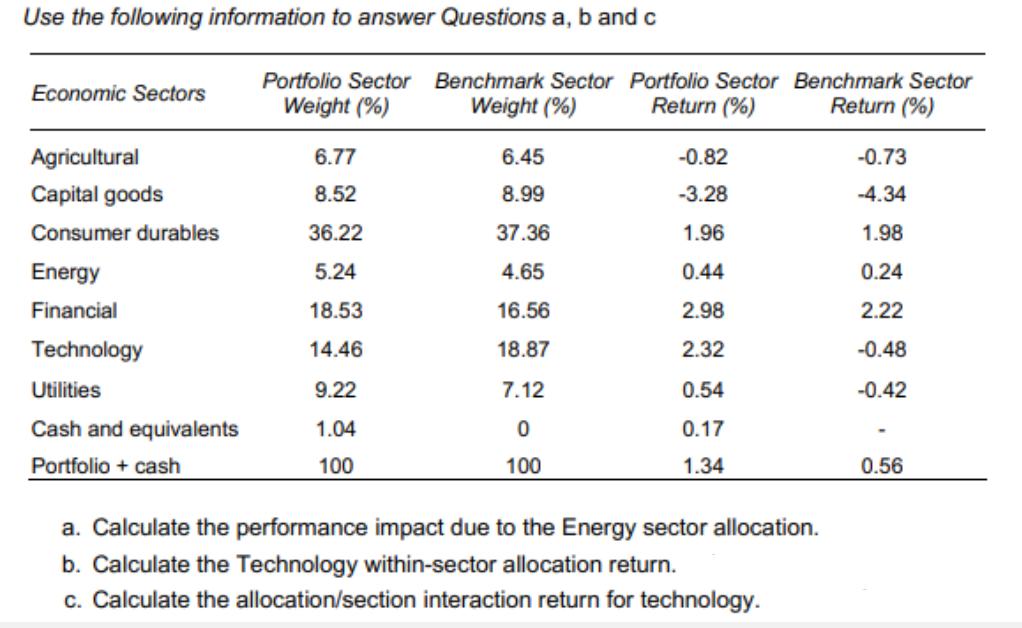

a. Calculate performance of measures for each fund. They are Jensen's alpha, Sharpe index, and the information ratio. b. Compare and comment on your answers from part a. c. Which fund has a better performance? Average Return % p.a. Standard Deviation % p.a. Beta Market index 11.20 20.00 1.00 Treasury Bond 5.20 0.00 Fund A 19.8 45.2 1.32 Fund B 9.8 6.5 0.75 Fund A-Market Index 35 Fund B-Market Index 10 Note: If discrete returns are used, that is fine. Use the following information to answer Questions a, b and c Economic Sectors Portfolio Sector Benchmark Sector Portfolio Sector Benchmark Sector Return (%) Weight (%) Weight (%) Return (%) Agricultural 6.77 6.45 -0.82 -0.73 Capital goods 8.52 8.99 -3.28 -4.34 Consumer durables 36.22 37.36 1.96 1.98 Energy 5.24 4.65 0.44 0.24 Financial 18.53 16.56 2.98 2.22 Technology 14.46 18.87 2.32 -0.48 Utilities 9.22 7.12 0.54 -0.42 Cash and equivalents 1.04 0 0.17 - Portfolio + cash 100 100 1.34 0.56 a. Calculate the performance impact due to the Energy sector allocation. b. Calculate the Technology within-sector allocation return. c. Calculate the allocation/section interaction return for technology.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started