Answered step by step

Verified Expert Solution

Question

1 Approved Answer

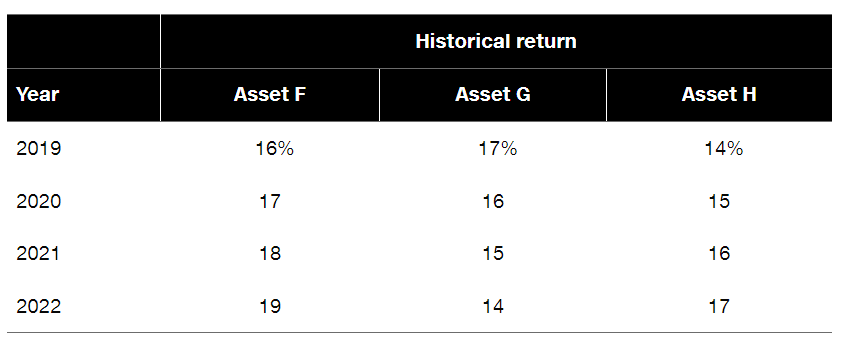

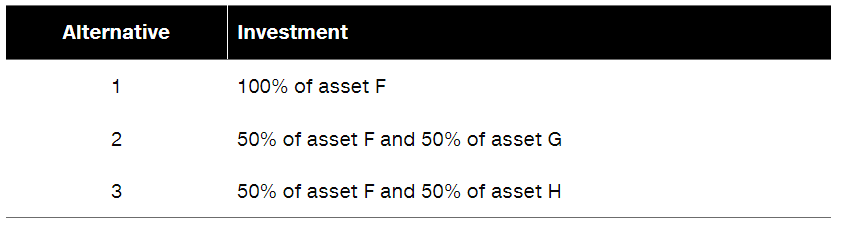

a. Calculate the average return over the four-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the four-year

a. Calculate the average return over the four-year period for each of the three alternatives.

b. Calculate the standard deviation of returns over the four-year period for each of the three alternatives.

c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives.

d. On the basis of your findings, which of the three investment alternatives do you think performed better over this period? Why?

*please show work for me to understand and put in excel sheet showing formulas

\begin{tabular}{l|c|c|c} \hline & \multicolumn{3}{|c}{ Historical return } \\ \hline Year & Asset F & Asset G & Asset H \\ \hline 2019 & 16% & 17% & 14% \\ 2020 & 17 & 16 & 15 \\ 2021 & 18 & 15 & 16 \\ 2022 & 19 & 14 & 17 \\ \hline \end{tabular} \begin{tabular}{cll} Alternative & Investment \\ \hline 1 & 100% of asset F \\ 2 & 50% of asset F and 50% of asset G \\ 3 & 50% of asset F and 50% of asset H \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started