Answered step by step

Verified Expert Solution

Question

1 Approved Answer

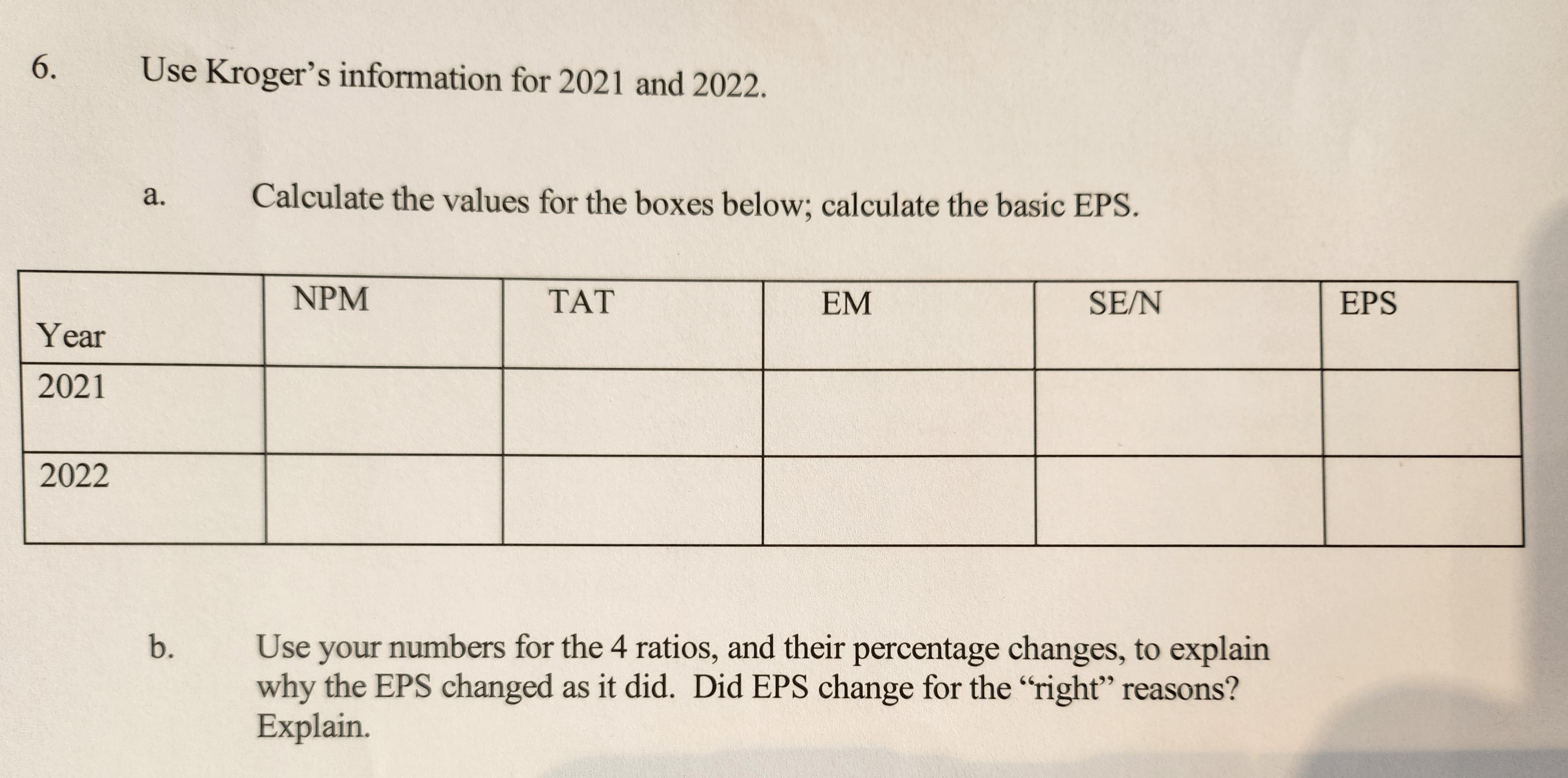

a. Calculate the values for the boxes below; calculate the basic EPS. b. Use your numbers for the 4 ratios, and their percentage changes, to

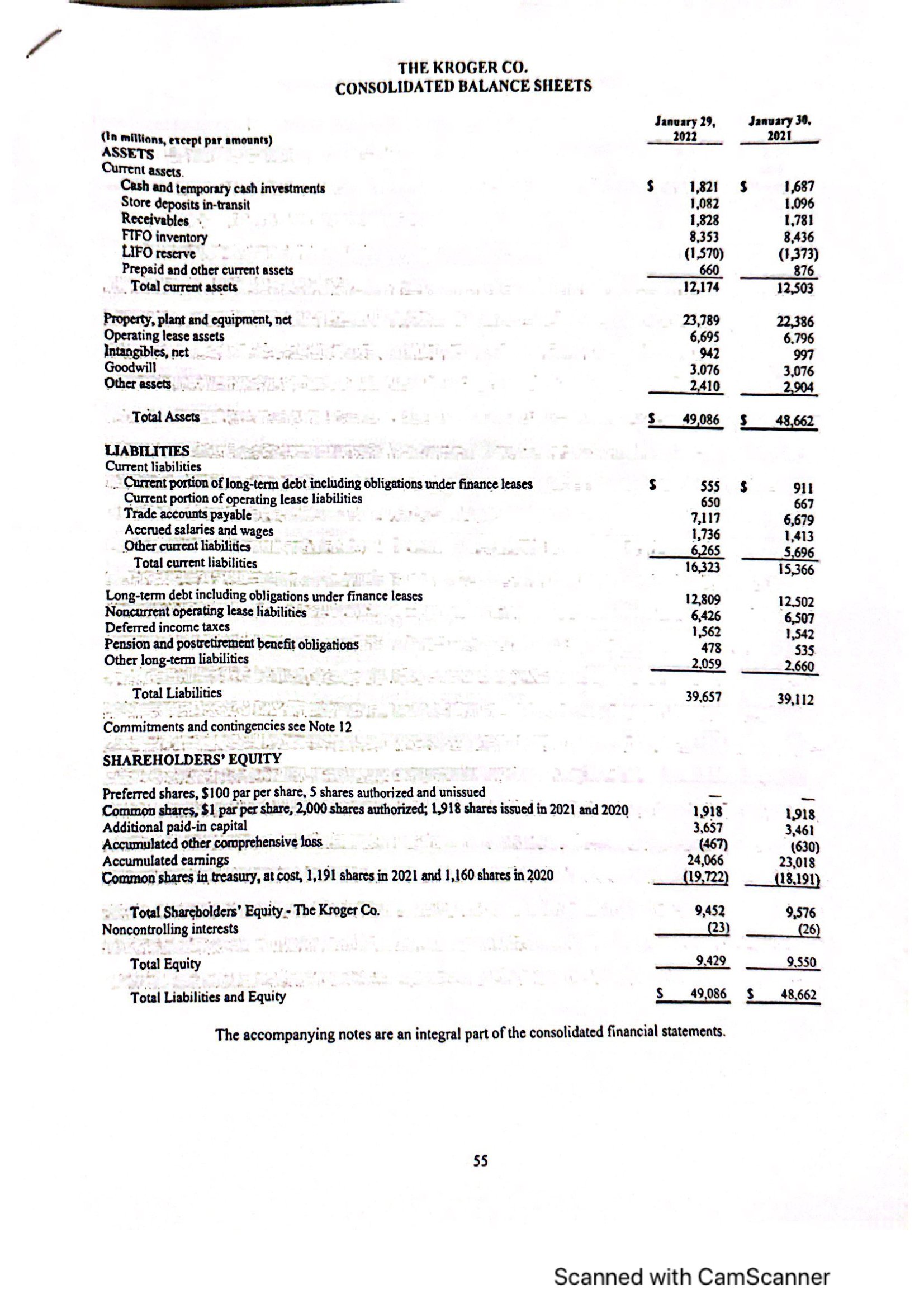

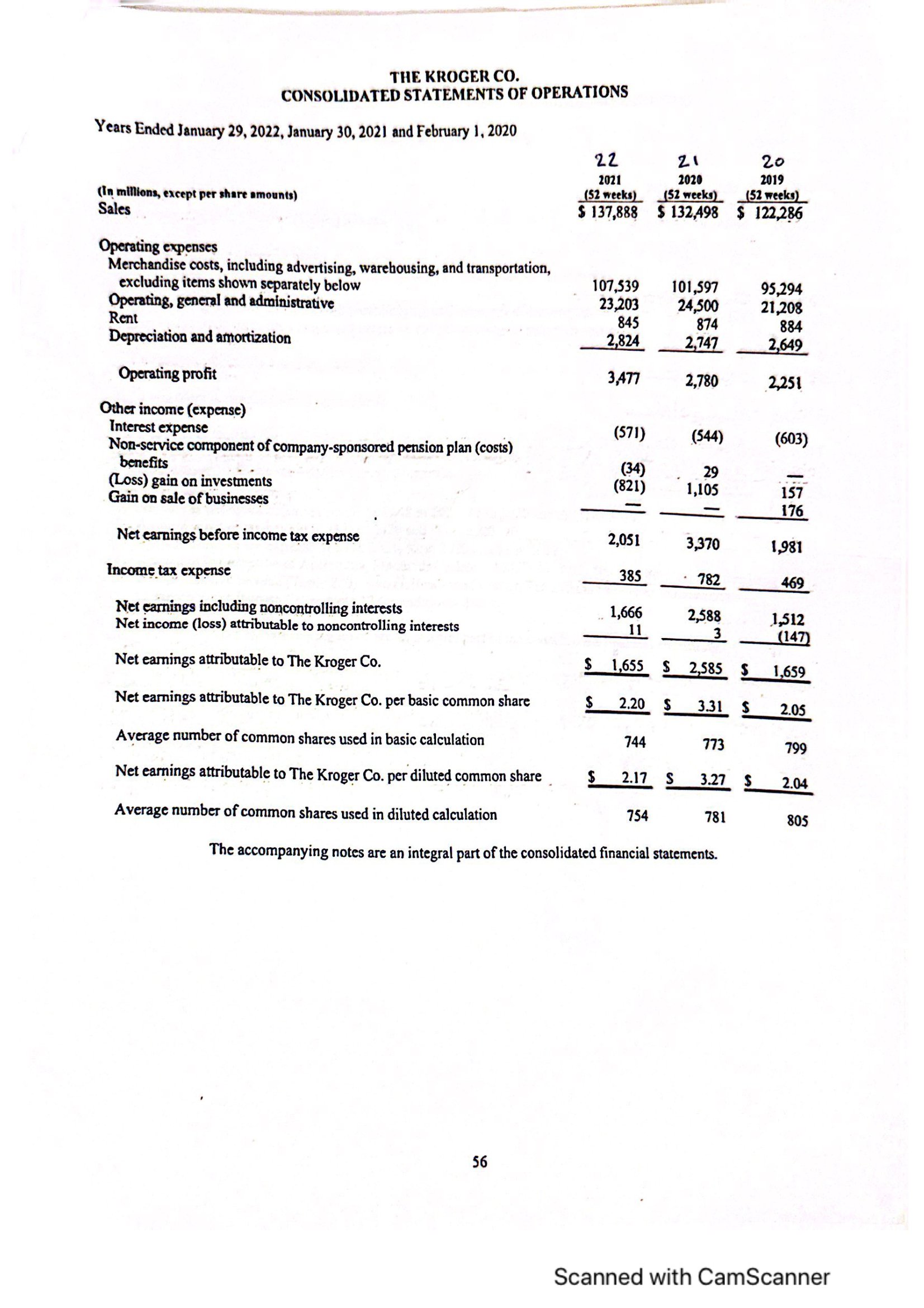

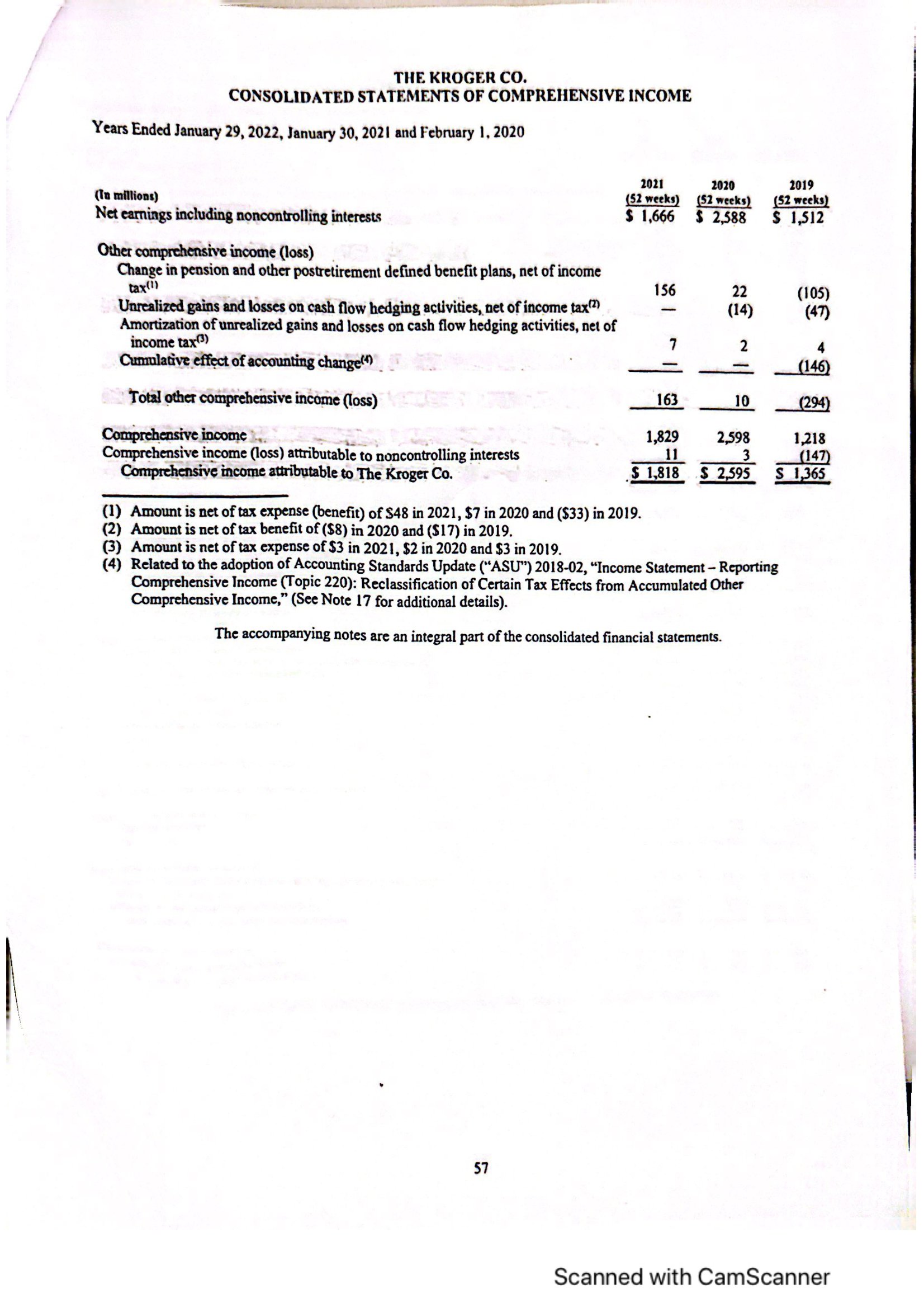

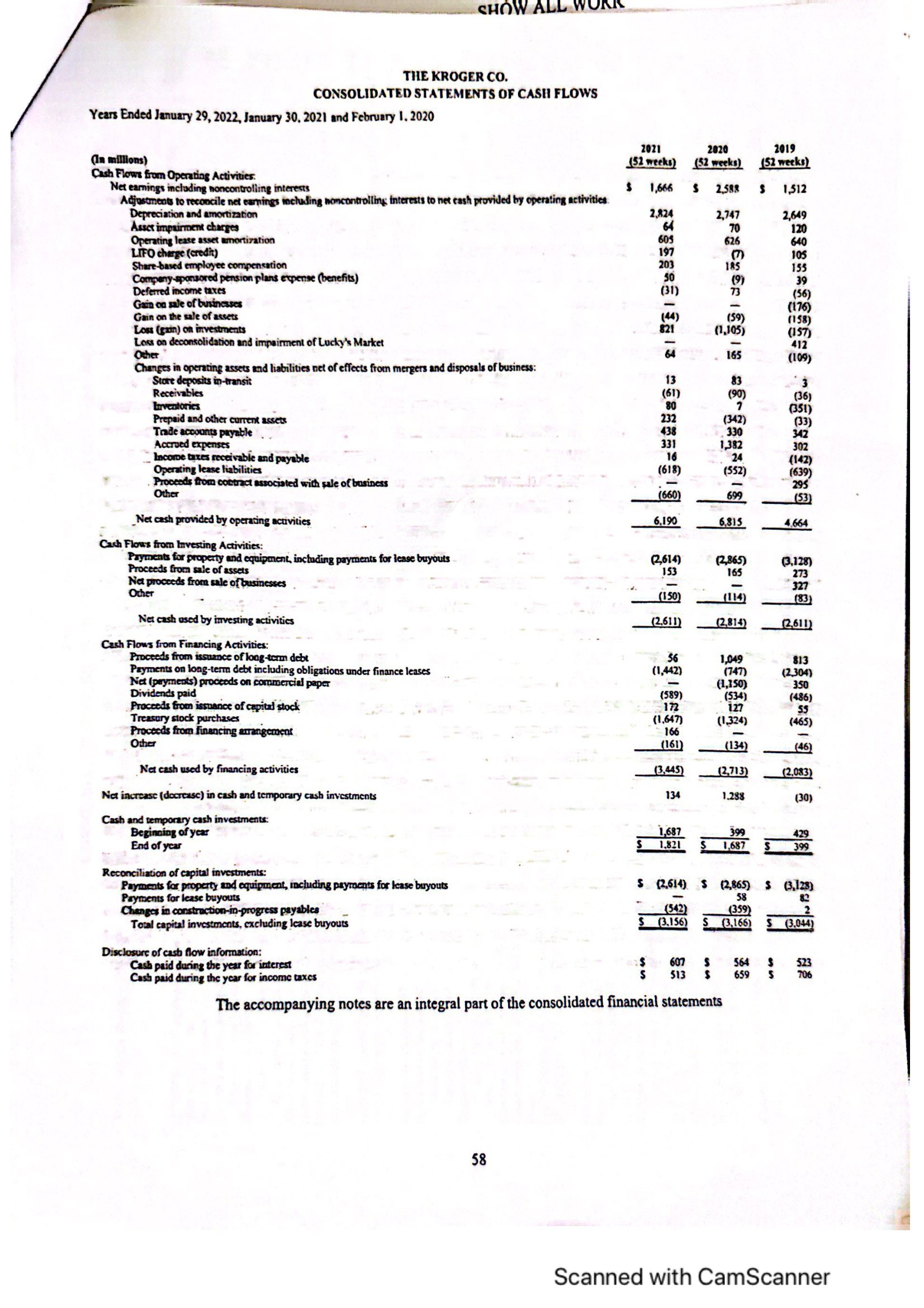

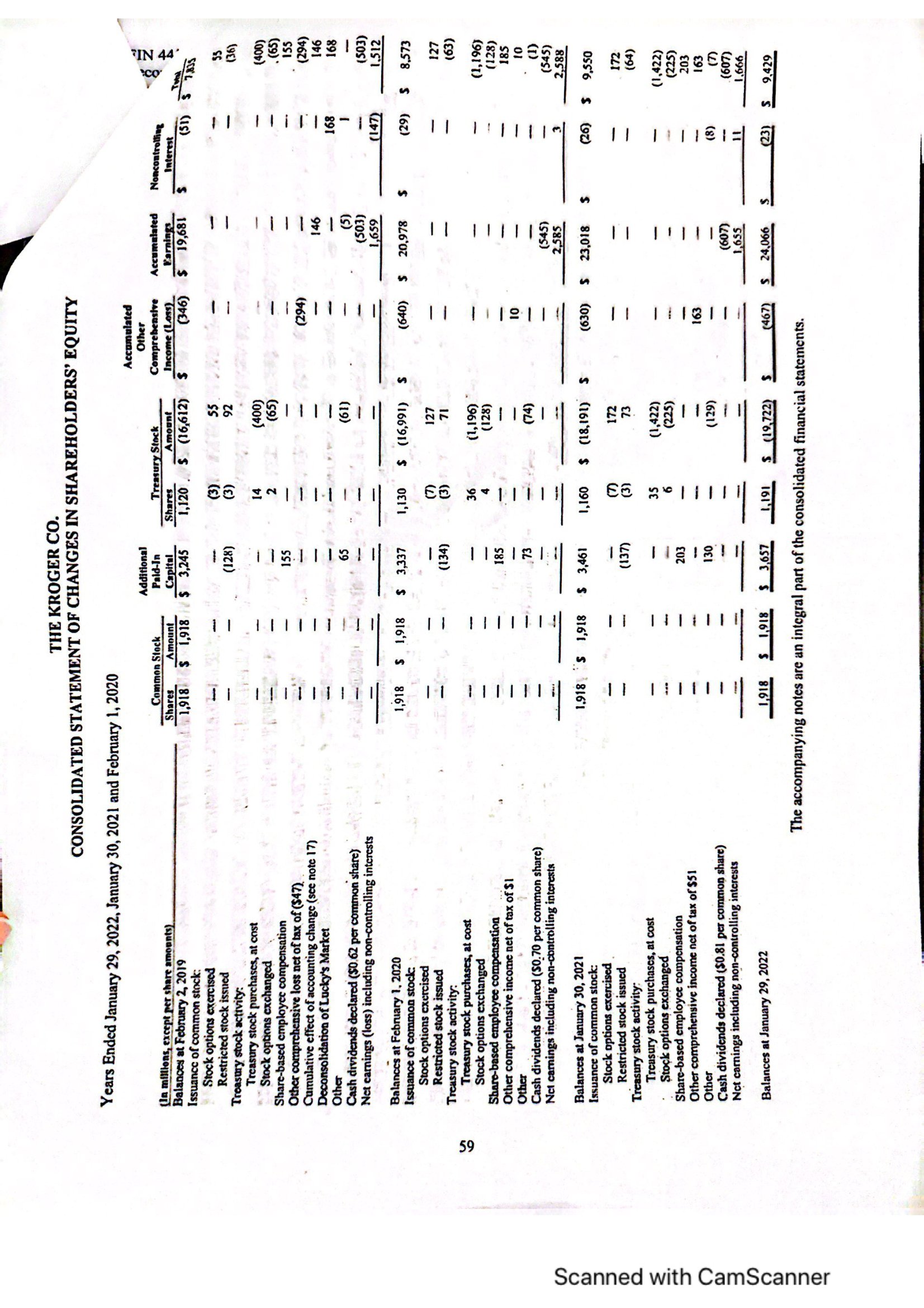

a. Calculate the values for the boxes below; calculate the basic EPS. b. Use your numbers for the 4 ratios, and their percentage changes, to explain why the EPS changed as it did. Did EPS change for the "right" reasons? Explain. THE KROGER CO. CONSOLIDATED BALANCE SHEETS (In millions, except par amounts) ASSETS Current assets. Cash and temporary cash investments Store deposits in-transit Receivables FTFO inventory LIFO reserve Prepaid and other current assets Total current assets Property, plant and equipment, net Operating lease assets Intangibles, net Goodwill Other assets Total Assets UABILTTIES Current liabilities Current portion of long-term debt including obligations under finance leases Current portion of operating lease liabilities Trade accounts payable Accrued salaries and wages Other current liabilities Total current liabilities Long-term debt including obligations under finance leases Noncurrent operating lease liabilities Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities Total Liabilities \begin{tabular}{rrr} 1,821 & 5 & 1,687 \\ 1,082 & & 1,096 \\ 1,828 & & 1,781 \\ 8,353 & & 8,436 \\ (1,570) & & (1,373) \\ 660 & 876 \\ \cline { 3 - 3 } 12,174 & & 12,503 \\ 23,789 & & 22,386 \\ 6,695 & & 6,796 \\ 942 & & 997 \\ 3.076 & & 3,076 \\ 2,410 & & 2,904 \\ \hline \end{tabular} S. 49,086548,662 Commitments and contingencies see Note 12 SHAREHOLDERS' EQUITY Preferred shares, $100 par per share, 5 shares authorized and unissued Common shares, $1 par per share, 2,000 shares authorized; 1,918 shares issued in 2021 and 2020 Additional paid-in capital Accumulated other comprehensive loss Accumulated eamings Common shares in treasury, at cost, 1,191 shares in 2021 and 1,160 shares in 2020 Total Sharepolders' Equity. The Kroger Co. Noncontrolling interests Total Equity Total Liabilities and Equity The accompanying notes are an integral part of the consolidated financial statements. 55 Scanned with CamScanner THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended Januarv 30 9033 Jamuane 2n 3031 and Fahriarv 1930 THE, KROGER CO. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years Ended January 29, 2022, January 30, 2021 and February 1, 2020 (1) Amount is net of tax expense (benefit) of $48 in 2021,$7 in 2020 and (\$33) in 2019. (2) Amount is net of tax benefit of ($8) in 2020 and ($17) in 2019. (3) Amount is net of tax expense of $3 in 2021,$2 in 2020 and $3 in 2019. (4) Related to the adoption of Accounting Standards Update ("ASU") 2018-02, "Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income," (See Note 17 for additional details). The accompanying notes are an integral part of the consolidated financial statements. THE KROGER CO. CONSOLIDATED STATEMENTS OF CASH FLOWS THE KROGER CO. CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY Ihe accompanying notes are an integral part of the consolidated financial statements. a. Calculate the values for the boxes below; calculate the basic EPS. b. Use your numbers for the 4 ratios, and their percentage changes, to explain why the EPS changed as it did. Did EPS change for the "right" reasons? Explain. THE KROGER CO. CONSOLIDATED BALANCE SHEETS (In millions, except par amounts) ASSETS Current assets. Cash and temporary cash investments Store deposits in-transit Receivables FTFO inventory LIFO reserve Prepaid and other current assets Total current assets Property, plant and equipment, net Operating lease assets Intangibles, net Goodwill Other assets Total Assets UABILTTIES Current liabilities Current portion of long-term debt including obligations under finance leases Current portion of operating lease liabilities Trade accounts payable Accrued salaries and wages Other current liabilities Total current liabilities Long-term debt including obligations under finance leases Noncurrent operating lease liabilities Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities Total Liabilities \begin{tabular}{rrr} 1,821 & 5 & 1,687 \\ 1,082 & & 1,096 \\ 1,828 & & 1,781 \\ 8,353 & & 8,436 \\ (1,570) & & (1,373) \\ 660 & 876 \\ \cline { 3 - 3 } 12,174 & & 12,503 \\ 23,789 & & 22,386 \\ 6,695 & & 6,796 \\ 942 & & 997 \\ 3.076 & & 3,076 \\ 2,410 & & 2,904 \\ \hline \end{tabular} S. 49,086548,662 Commitments and contingencies see Note 12 SHAREHOLDERS' EQUITY Preferred shares, $100 par per share, 5 shares authorized and unissued Common shares, $1 par per share, 2,000 shares authorized; 1,918 shares issued in 2021 and 2020 Additional paid-in capital Accumulated other comprehensive loss Accumulated eamings Common shares in treasury, at cost, 1,191 shares in 2021 and 1,160 shares in 2020 Total Sharepolders' Equity. The Kroger Co. Noncontrolling interests Total Equity Total Liabilities and Equity The accompanying notes are an integral part of the consolidated financial statements. 55 Scanned with CamScanner THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended Januarv 30 9033 Jamuane 2n 3031 and Fahriarv 1930 THE, KROGER CO. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years Ended January 29, 2022, January 30, 2021 and February 1, 2020 (1) Amount is net of tax expense (benefit) of $48 in 2021,$7 in 2020 and (\$33) in 2019. (2) Amount is net of tax benefit of ($8) in 2020 and ($17) in 2019. (3) Amount is net of tax expense of $3 in 2021,$2 in 2020 and $3 in 2019. (4) Related to the adoption of Accounting Standards Update ("ASU") 2018-02, "Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income," (See Note 17 for additional details). The accompanying notes are an integral part of the consolidated financial statements. THE KROGER CO. CONSOLIDATED STATEMENTS OF CASH FLOWS THE KROGER CO. CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY Ihe accompanying notes are an integral part of the consolidated financial statements

a. Calculate the values for the boxes below; calculate the basic EPS. b. Use your numbers for the 4 ratios, and their percentage changes, to explain why the EPS changed as it did. Did EPS change for the "right" reasons? Explain. THE KROGER CO. CONSOLIDATED BALANCE SHEETS (In millions, except par amounts) ASSETS Current assets. Cash and temporary cash investments Store deposits in-transit Receivables FTFO inventory LIFO reserve Prepaid and other current assets Total current assets Property, plant and equipment, net Operating lease assets Intangibles, net Goodwill Other assets Total Assets UABILTTIES Current liabilities Current portion of long-term debt including obligations under finance leases Current portion of operating lease liabilities Trade accounts payable Accrued salaries and wages Other current liabilities Total current liabilities Long-term debt including obligations under finance leases Noncurrent operating lease liabilities Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities Total Liabilities \begin{tabular}{rrr} 1,821 & 5 & 1,687 \\ 1,082 & & 1,096 \\ 1,828 & & 1,781 \\ 8,353 & & 8,436 \\ (1,570) & & (1,373) \\ 660 & 876 \\ \cline { 3 - 3 } 12,174 & & 12,503 \\ 23,789 & & 22,386 \\ 6,695 & & 6,796 \\ 942 & & 997 \\ 3.076 & & 3,076 \\ 2,410 & & 2,904 \\ \hline \end{tabular} S. 49,086548,662 Commitments and contingencies see Note 12 SHAREHOLDERS' EQUITY Preferred shares, $100 par per share, 5 shares authorized and unissued Common shares, $1 par per share, 2,000 shares authorized; 1,918 shares issued in 2021 and 2020 Additional paid-in capital Accumulated other comprehensive loss Accumulated eamings Common shares in treasury, at cost, 1,191 shares in 2021 and 1,160 shares in 2020 Total Sharepolders' Equity. The Kroger Co. Noncontrolling interests Total Equity Total Liabilities and Equity The accompanying notes are an integral part of the consolidated financial statements. 55 Scanned with CamScanner THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended Januarv 30 9033 Jamuane 2n 3031 and Fahriarv 1930 THE, KROGER CO. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years Ended January 29, 2022, January 30, 2021 and February 1, 2020 (1) Amount is net of tax expense (benefit) of $48 in 2021,$7 in 2020 and (\$33) in 2019. (2) Amount is net of tax benefit of ($8) in 2020 and ($17) in 2019. (3) Amount is net of tax expense of $3 in 2021,$2 in 2020 and $3 in 2019. (4) Related to the adoption of Accounting Standards Update ("ASU") 2018-02, "Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income," (See Note 17 for additional details). The accompanying notes are an integral part of the consolidated financial statements. THE KROGER CO. CONSOLIDATED STATEMENTS OF CASH FLOWS THE KROGER CO. CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY Ihe accompanying notes are an integral part of the consolidated financial statements. a. Calculate the values for the boxes below; calculate the basic EPS. b. Use your numbers for the 4 ratios, and their percentage changes, to explain why the EPS changed as it did. Did EPS change for the "right" reasons? Explain. THE KROGER CO. CONSOLIDATED BALANCE SHEETS (In millions, except par amounts) ASSETS Current assets. Cash and temporary cash investments Store deposits in-transit Receivables FTFO inventory LIFO reserve Prepaid and other current assets Total current assets Property, plant and equipment, net Operating lease assets Intangibles, net Goodwill Other assets Total Assets UABILTTIES Current liabilities Current portion of long-term debt including obligations under finance leases Current portion of operating lease liabilities Trade accounts payable Accrued salaries and wages Other current liabilities Total current liabilities Long-term debt including obligations under finance leases Noncurrent operating lease liabilities Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities Total Liabilities \begin{tabular}{rrr} 1,821 & 5 & 1,687 \\ 1,082 & & 1,096 \\ 1,828 & & 1,781 \\ 8,353 & & 8,436 \\ (1,570) & & (1,373) \\ 660 & 876 \\ \cline { 3 - 3 } 12,174 & & 12,503 \\ 23,789 & & 22,386 \\ 6,695 & & 6,796 \\ 942 & & 997 \\ 3.076 & & 3,076 \\ 2,410 & & 2,904 \\ \hline \end{tabular} S. 49,086548,662 Commitments and contingencies see Note 12 SHAREHOLDERS' EQUITY Preferred shares, $100 par per share, 5 shares authorized and unissued Common shares, $1 par per share, 2,000 shares authorized; 1,918 shares issued in 2021 and 2020 Additional paid-in capital Accumulated other comprehensive loss Accumulated eamings Common shares in treasury, at cost, 1,191 shares in 2021 and 1,160 shares in 2020 Total Sharepolders' Equity. The Kroger Co. Noncontrolling interests Total Equity Total Liabilities and Equity The accompanying notes are an integral part of the consolidated financial statements. 55 Scanned with CamScanner THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended Januarv 30 9033 Jamuane 2n 3031 and Fahriarv 1930 THE, KROGER CO. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years Ended January 29, 2022, January 30, 2021 and February 1, 2020 (1) Amount is net of tax expense (benefit) of $48 in 2021,$7 in 2020 and (\$33) in 2019. (2) Amount is net of tax benefit of ($8) in 2020 and ($17) in 2019. (3) Amount is net of tax expense of $3 in 2021,$2 in 2020 and $3 in 2019. (4) Related to the adoption of Accounting Standards Update ("ASU") 2018-02, "Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income," (See Note 17 for additional details). The accompanying notes are an integral part of the consolidated financial statements. THE KROGER CO. CONSOLIDATED STATEMENTS OF CASH FLOWS THE KROGER CO. CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY Ihe accompanying notes are an integral part of the consolidated financial statements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started