Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A) calculation with percent-of-sales method, determine whether Longbranch Western Wear has external financing needs B) creat a pro forma balance sheet with any financing adjustment

A) calculation with percent-of-sales method, determine whether Longbranch Western Wear has external financing needs

B) creat a pro forma balance sheet with any financing adjustment made to notes payable and excess, if any, shall reduce long term debt.

C) the current ratio and total debt to assets ratio for each year

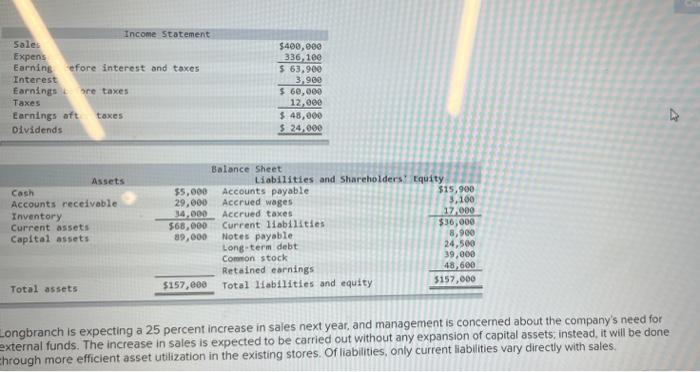

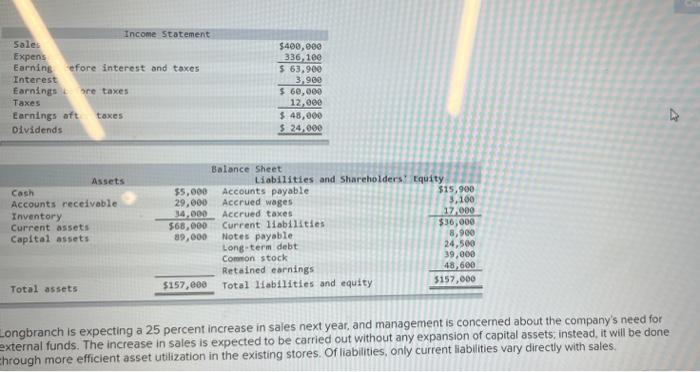

The Longbranch Western Wear Company has the following financial statements, which are representative of the companys historical average. according to image please explain A to c using tables as required

ongbranch is expecting a 25 percent increase in sales next year, and management is concerned about the company's need for external funds. The increase in sales is expected to be carried out without any expansion of capital assets, instead, it will be done hrough more efficient asset utilization in the existing stores. Of liabilities, only current liabilities vary directly with sales Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started