Question

A college friend of mine just filed for a patent for a new product - the bowling buddy bowlers' training aid (Google it after

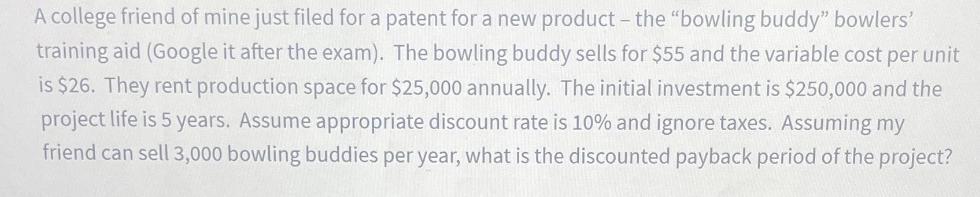

A college friend of mine just filed for a patent for a new product - the "bowling buddy" bowlers' training aid (Google it after the exam). The bowling buddy sells for $55 and the variable cost per unit is $26. They rent production space for $25,000 annually. The initial investment is $250,000 and the project life is 5 years. Assume appropriate discount rate is 10% and ignore taxes. Assuming my friend can sell 3,000 bowling buddies per year, what is the discounted payback period of the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the discounted payback period of the project we need to determine how long it takes for the net cash flows to recover the initial investm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting in Canada

Authors: Hilton Murray, Herauf Darrell

8th edition

1259087557, 1057317623, 978-1259087554

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App