Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A commercial real estate company evaluates vacancy rates, square footage, rental rates, and operating expenses for commercial properties in a large metropolitan area in

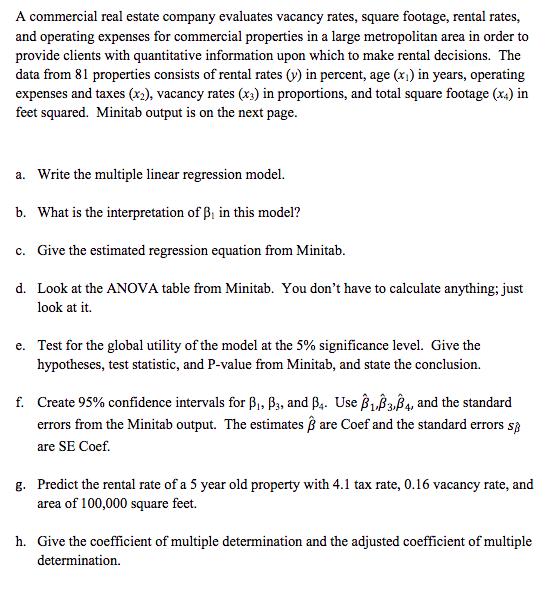

A commercial real estate company evaluates vacancy rates, square footage, rental rates, and operating expenses for commercial properties in a large metropolitan area in order to provide clients with quantitative information upon which to make rental decisions. The data from 81 properties consists of rental rates (y) in percent, age (x)) in years, operating expenses and taxes (x2), vacancy rates (x3) in proportions, and total square footage (x4) in feet squared. Minitab output is on the next page. a. Write the multiple linear regression model. b. What is the interpretation of , in this model? c. Give the estimated regression equation from Minitab. d. Look at the ANOVA table from Minitab. You don't have to calculate anything; just look at it. e. Test for the global utility of the model at the 5% significance level. Give the hypotheses, test statistic, and P-value from Minitab, and state the conclusion. f. Create 95% confidence intervals for B1, B3, and B.4. Use B1, B3, B4, and the standard errors from the Minitab output. The estimates are Coef and the standard errors s are SE Coef. g. Predict the rental rate of a 5 year old property with 4.1 tax rate, 0.16 vacancy rate, and area of 100,000 square feet. h. Give the coefficient of multiple determination and the adjusted coefficient of multiple determination.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started