Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company has $210,000 in taxable income. Using the rates from below rate table, how much in taxes must be paid by the company?

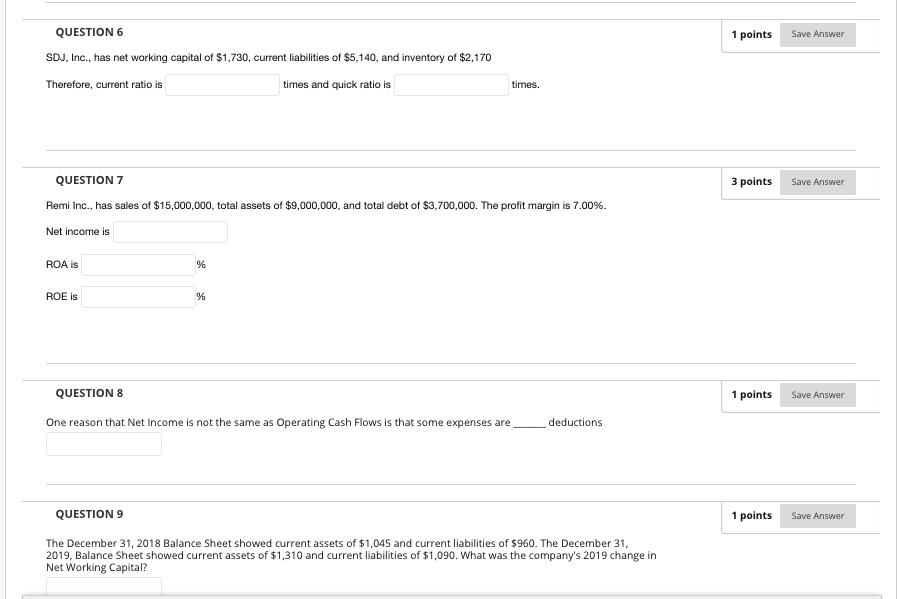

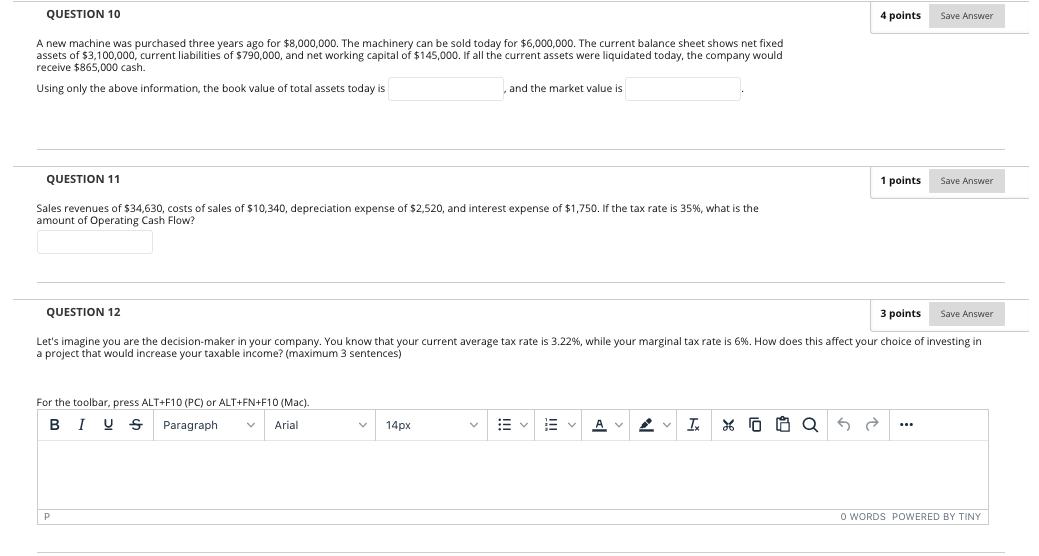

A company has $210,000 in taxable income. Using the rates from below rate table, how much in taxes must be paid by the company? Taxable Income Range $0 50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,334 50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 Tax Rate 15% 25% 34% 39% 34% 35% 38% 35% QUESTION 6 SDJ, Inc., has net working capital of $1,730, current liabilities of $5,140, and inventory of $2,170 Therefore, current ratio is times and quick ratio is QUESTION 7 Remi Inc., has sales of $15,000,000, total assets of $9,000,000, and total debt of $3,700,000. The profit margin is 7.00%. Net income is ROA is ROE is % % times. QUESTION 8 One reason that Net Income is not the same as Operating Cash Flows is that some expenses are deductions QUESTION 9 The December 31, 2018 Balance Sheet showed current assets of $1,045 and current liabilities of $960. The December 31, 2019, Balance Sheet showed current assets of $1,310 and current liabilities of $1,090. What was the company's 2019 change in Net Working Capital? 1 points Save Answer 3 points 1 points 1 points Save Answer Save Answer Save Answer QUESTION 10 A new machine was purchased three years ago for $8,000,000. The machinery can be sold today for $6,000,000. The current balance sheet shows net fixed assets of $3,100,000, current liabilities of $790,000, and net working capital of $145,000. If all the current assets were liquidated today, the company would receive $865,000 cash. Using only the above information, the book value of total assets today is and the market value is QUESTION 11 Sales revenues of $34,630, costs of sales of $10,340, depreciation expense of $2,520, and interest expense of $1,750. If the tax rate is 35%, what is the amount of Operating Cash Flow? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph V Arial P V 14px QUESTION 12 3 points Save Answer Let's imagine you are the decision-maker in your company. You know that your current average tax rate is 3.22 %, while your marginal tax rate is 6%. How does this affect your choice of investing in a project that would increase your taxable income? (maximum 3 sentences) E 13 Ix 4 points Q 1 points Save Answer " Save Answer O WORDS POWERED BY TINY

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount of taxes that must be paid by the company with a taxable income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started