Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Company has become the subject of a takeover offer. The Companys current share price is $12.40 per share, and shareholders have been offered $17.00

A Company has become the subject of a takeover offer. The Companys current share price is $12.40 per share, and shareholders have been offered $17.00 per share.

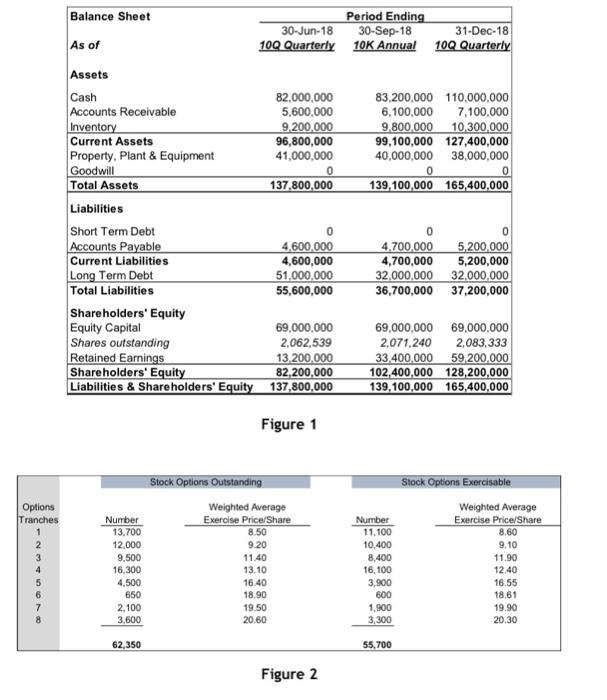

Calculate the fully diluted shares outstanding given the following information about the Company from Figure 1 and Figure 2 (next page) and the fact that the Company has convertible bonds outstanding with the following financial statement note regarding the bonds: the Company has outstanding $10 million of 5.25% convertible notes which are included in Long-term debt on the Balance Sheet. The notes are payable in cash at maturity unless holders exercise their option to convert the notes into shares of common stock. The initial conversion rate, provided under the terms of the Notes, is 76.9231 shares of common stock per $1,000 principal amount of notes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started