Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is considering replacing a machine the company is currently using with a new machine. If sold now, the current machine would have a

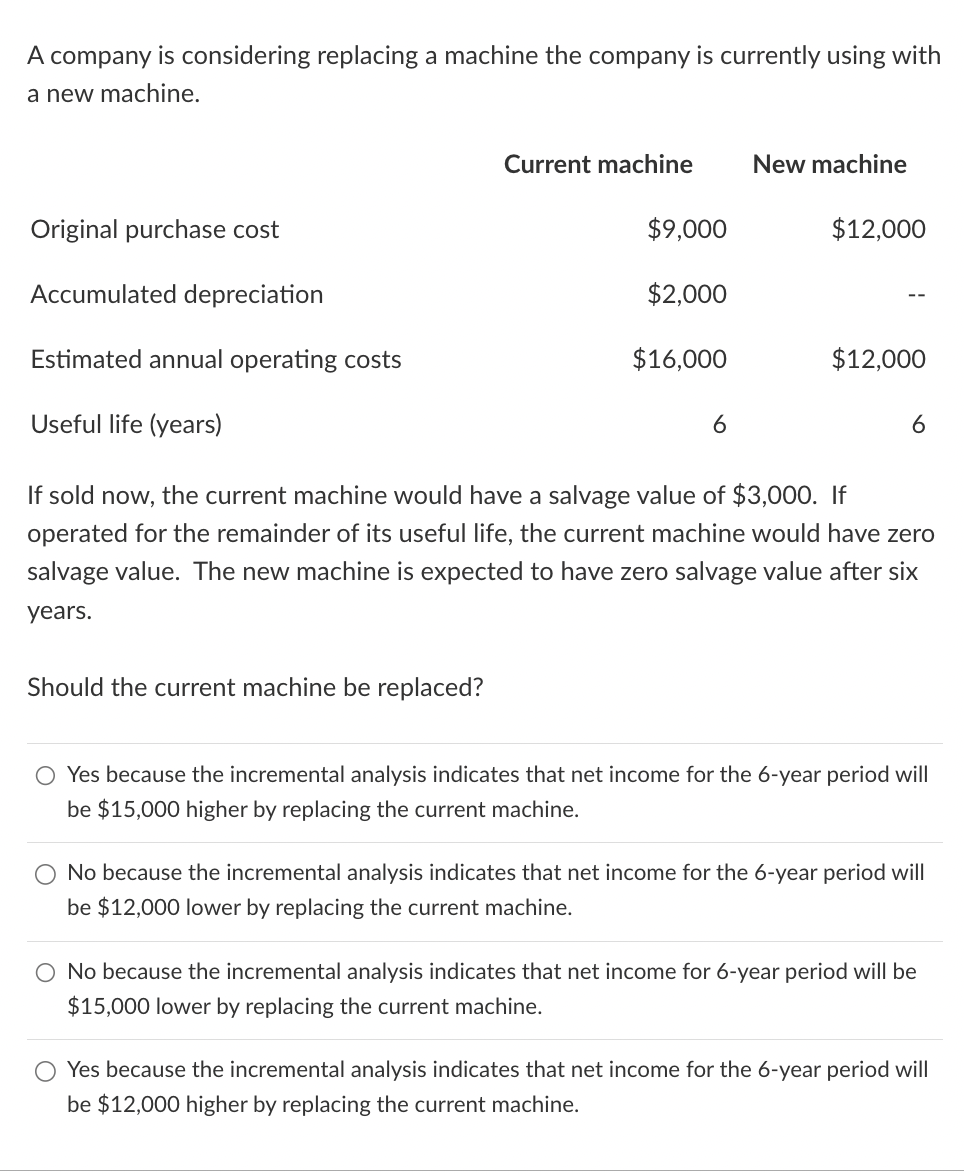

A company is considering replacing a machine the company is currently using with

a new machine.

If sold now, the current machine would have a salvage value of $ If

operated for the remainder of its useful life, the current machine would have zero

salvage value. The new machine is expected to have zero salvage value after six

years.

Should the current machine be replaced?

Yes because the incremental analysis indicates that net income for the year period will

be $ higher by replacing the current machine.

No because the incremental analysis indicates that net income for the year period will

be $ lower by replacing the current machine.

No because the incremental analysis indicates that net income for year period will be

$ lower by replacing the current machine.

Yes because the incremental analysis indicates that net income for the year period will

be $ higher by replacing the current machine.A company is considering replacing a machine the company is currently using with a new machine.

Current machine New machine

Original purchase cost $ $

Accumulated depreciation $

Estimated annual operating costs $ $

Useful life years

If sold now, the current machine would have a salvage value of $ If operated for the remainder of its useful life, the current machine would have zero salvage value. The new machine is expected to have zero salvage value after six years.

Should the current machine be replaced?

Group of answer choices

Yes because the incremental analysis indicates that net income for the year period will be $ higher by replacing the current machine.

No because the incremental analysis indicates that net income for the year period will be $ lower by replacing the current machine.

No because the incremental analysis indicates that net income for year period will be $ lower by replacing the current machine.

Yes because the incremental analysis indicates that net income for the year period will be $ higher by replacing the current machine.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started