Answered step by step

Verified Expert Solution

Question

1 Approved Answer

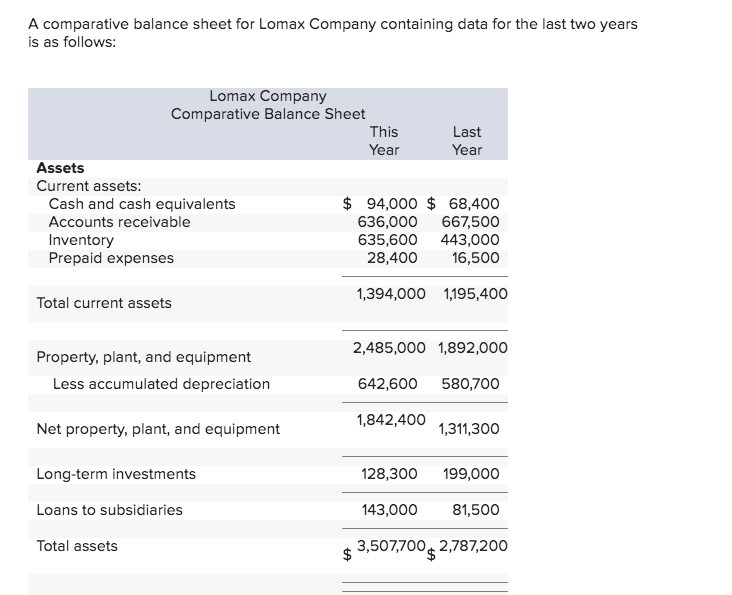

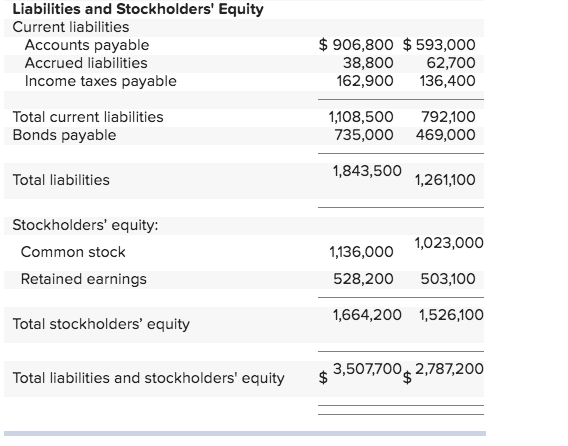

A comparative balance sheet for Lomax Company containing data for the last two years is as follows: Lomax Company Comparative Balance Sheet This Last

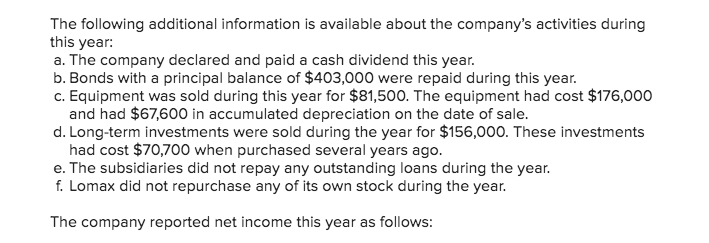

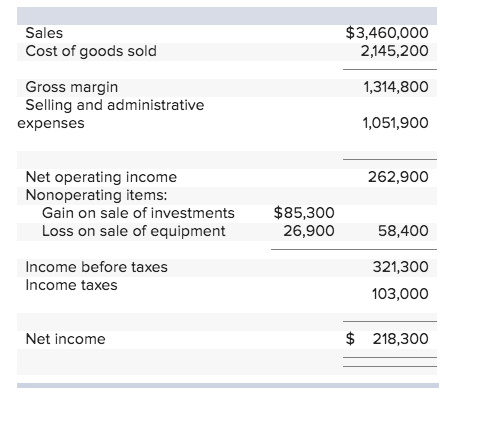

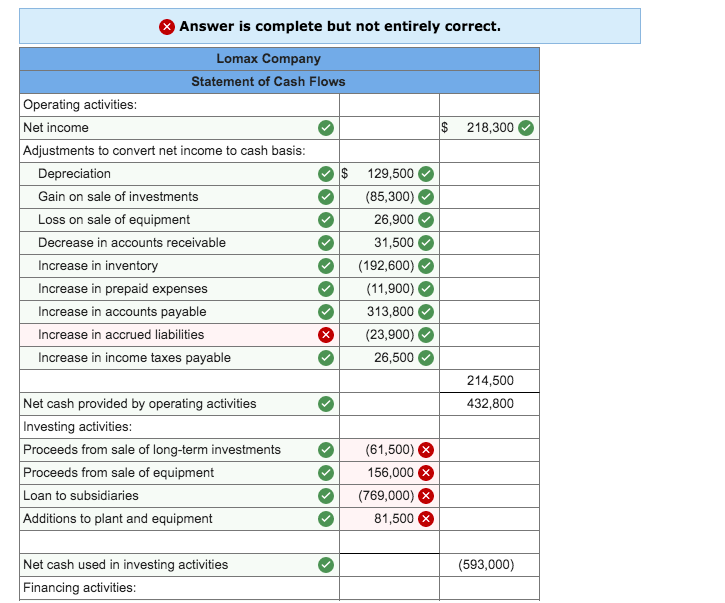

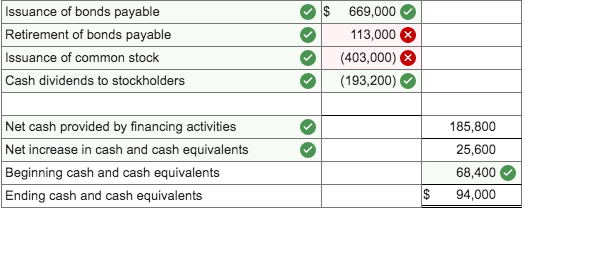

A comparative balance sheet for Lomax Company containing data for the last two years is as follows: Lomax Company Comparative Balance Sheet This Last Year Year Assets Current assets: Cash and cash equivalents Accounts receivable $ 94,000 $68,400 636,000 Inventory 667,500 635,600 443,000 28,400 16,500 Prepaid expenses 1,394,000 1,195,400 Total current assets 2,485,000 1,892,000 Property, plant, and equipment Less accumulated depreciation 642,600 580,700 1,842,400 Net property, plant, and equipment 1,311,300 Long-term investments 128,300 199,000 Loans to subsidiaries 143,000 81,500 Total assets $ 3,507,700 2,787,200 $ Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $906,800 $593,000 38,800 62,700 162,900 136,400 1,108,500 792,100 735,000 469,000 1,843,500 1,261,100 1,023,000 1,136,000 528,200 503,100 1,664,200 1,526,100 3,507,700$ 2,787,200 $ The following additional information is available about the company's activities during this year: a. The company declared and paid a cash dividend this year. b. Bonds with a principal balance of $403,000 were repaid during this year. c. Equipment was sold during this year for $81,500. The equipment had cost $176,000 and had $67,600 in accumulated depreciation on the date of sale. d. Long-term investments were sold during the year for $156,000. These investments had cost $70,700 when purchased several years ago. e. The subsidiaries did not repay any outstanding loans during the year. f. Lomax did not repurchase any of its own stock during the year. The company reported net income this year as follows: Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Gain on sale of investments Loss on sale of equipment Income before taxes Income taxes Net income $85,300 26,900 $3,460,000 2,145,200 1,314,800 1,051,900 262,900 58,400 321,300 103,000 $ 218,300 Answer is complete but not entirely correct. Lomax Company Statement of Cash Flows $ 218,300 $ Operating activities: Net income Adjustments to convert net income to cash basis: Depreciation Gain on sale of investments Loss on sale of equipment Decrease in accounts receivable Increase in inventory Increase in prepaid expenses Increase in accounts payable Increase in accrued liabilities Increase in income taxes payable Net cash provided by operating activities Investing activities: Proceeds from sale of long-term investments Proceeds from sale of equipment Loan to subsidiaries Additions to plant and equipment Net cash used in investing activities Financing activities: 129,500 (85,300) 26,900 31,500 (192,600) (11,900) 313,800 (23,900) 26,500 (61,500) X 156,000 X (769,000) 81,500 214,500 432,800 (593,000) Issuance of bonds payable Retirement of bonds payable Issuance of common stock Cash dividends to stockholders Net cash provided by financing activities Net increase in cash and cash equivalents Beginning cash and cash equivalents Ending cash and cash equivalents $ 669,000 113,000 (403,000) (193,200) $ 185,800 25,600 68,400 94,000

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Requirement Lomax Company Statement of Cash Flows Indirect Method Cash flows from operating activiti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started