Question

a) Construct Northlands balance sheets under both scenarios. b. Based on your analysis, will Northland Corporation still be balance sheet insolvent in Year 3 under

a) Construct Northlands balance sheets under both scenarios.

b. Based on your analysis, will Northland Corporation still be balance sheet insolvent in Year 3 under scenario 1? If this trend continues, would you describe Northlands financial distress as a temporary or a permanent problem?

c. Based on your analysis, will Northland Corporation still be balance sheet insolvent in Year 3 under scenario 2? If this trend continues, would you describe Northlands financial distress as a temporary or a permanent problem?

d. There are two basic options in the situation of financial distress. Name and explain them.

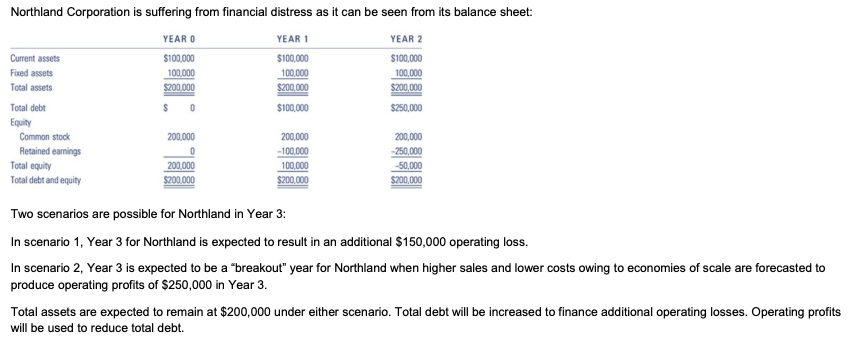

Northland Corporation is suffering from financial distress as it can be seen from its balance sheet: YEAR O YEAR 1 YEAR 2 Current assets $100,000 $100,000 $100,000 Fixed assets 100.000 100.000 100,000 Total assets $200,000 $200,000 $200,000 Total debt $ 0 $100,000 $250,000 Equity Common stock 200,000 200.000 200,000 Retained eamings -100.000 -250,000 Total equity 200,000 100,000 -50,000 Total debt and equity $200,000 $200,000 $200,000 Two scenarios are possible for Northland in Year 3: In scenario 1, Year 3 for Northland is expected to result in an additional $150,000 operating loss. In scenario 2, Year 3 is expected to be a breakout" year for Northland when higher sales and lower costs owing to economies of scale are forecasted to produce operating profits of $250,000 in Year 3. Total assets are expected to remain at $200,000 under either scenario. Total debt will be increased to finance additional operating losses. Operating profits will be used to reduce total debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started