Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) discuss the reasons for the differences between actual profit of 112 000 and the profit that would arise if variable costing method was to

(a) discuss the reasons for the differences between actual profit of 112 000 and the profit that would arise if variable costing method was to be used

(b) Advise the managing director on steps to take to enable the company to achieve its target profit before tax of 10% revenue

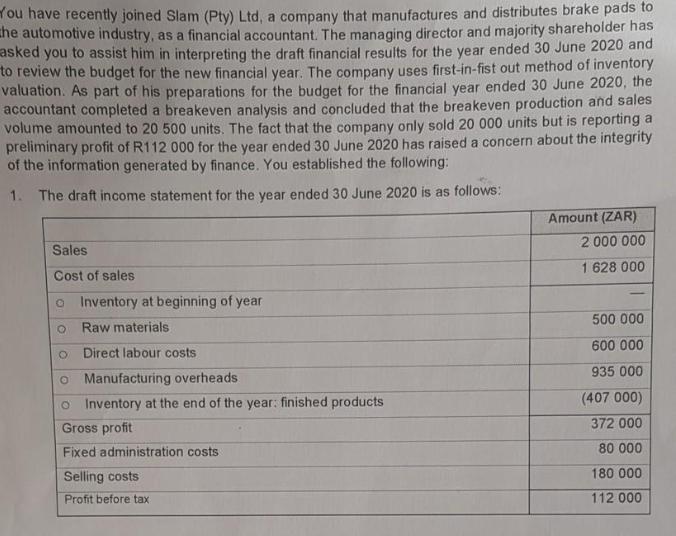

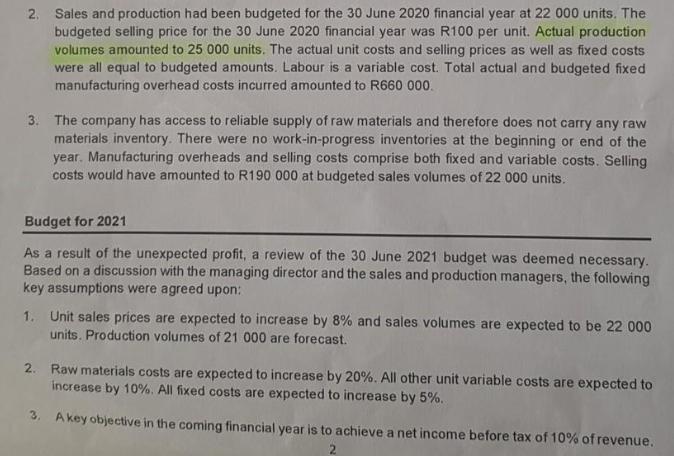

You have recently joined Slam (Pty) Ltd, a company that manufactures and distributes brake pads to The automotive industry, as a financial accountant. The managing director and majority shareholder has asked you to assist him in interpreting the draft financial results for the year ended 30 June 2020 and to review the budget for the new financial year. The company uses first-in-fist out method of inventory valuation. As part of his preparations for the budget for the financial year ended 30 June 2020, the accountant completed a breakeven analysis and concluded that the breakeven production and sales volume amounted to 20 500 units. The fact that the company only sold 20 000 units but is reporting a preliminary profit of R112 000 for the year ended 30 June 2020 has raised a concern about the integrity of the information generated by finance. You established the following: 1. The draft income statement for the year ended 30 June 2020 is as follows: Sales Cost of sales o Inventory at beginning of year O Raw materials Direct labour costs Amount (ZAR) 2 000 000 1 628 000 500 000 600 000 935 000 O Manufacturing overheads O Inventory at the end of the year: finished products Gross profit Fixed administration costs Selling costs Profit before tax (407 000) 372 000 80 000 180 000 112 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started