Answered step by step

Verified Expert Solution

Question

1 Approved Answer

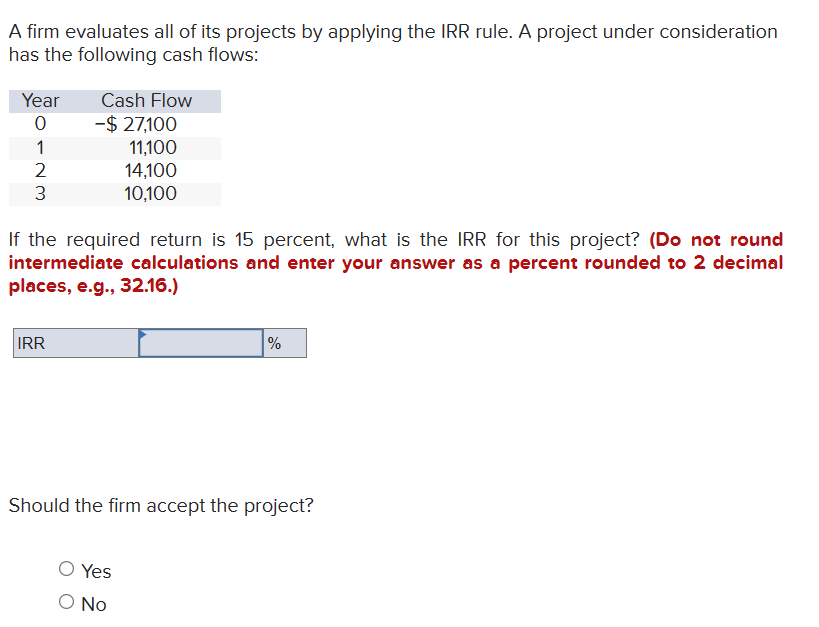

A firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: If the required return

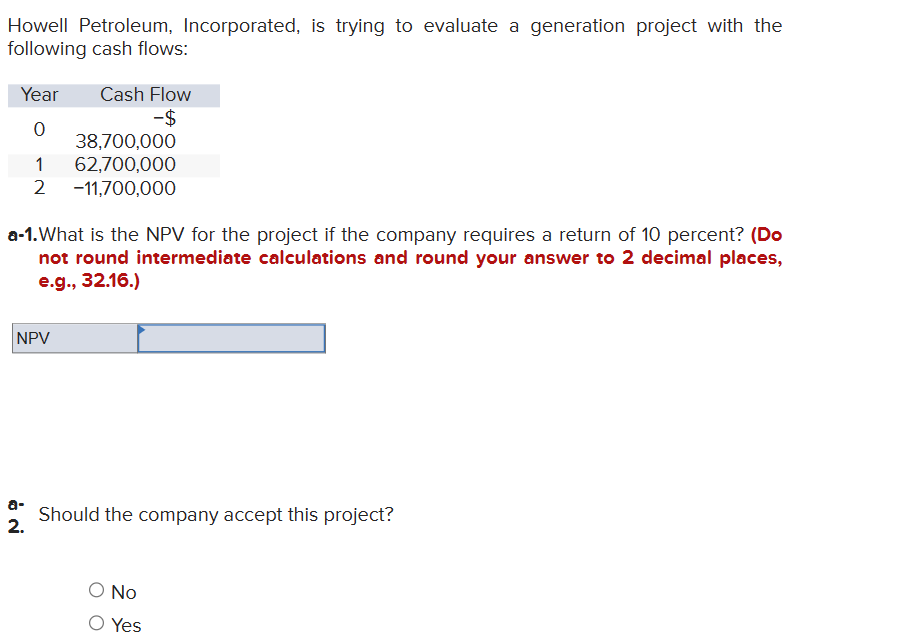

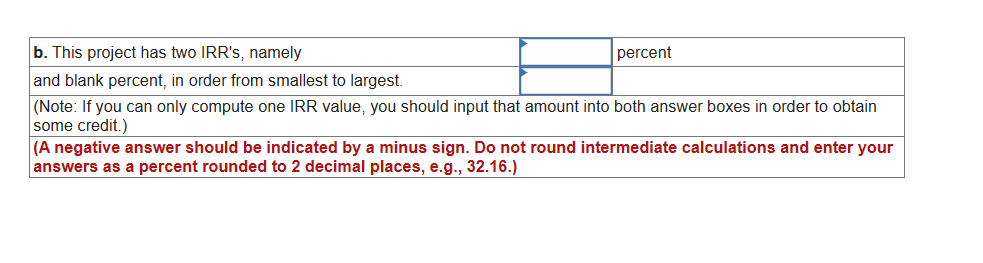

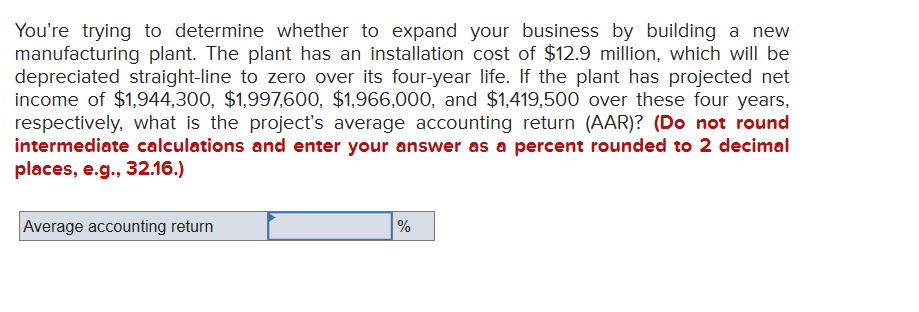

A firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: If the required return is 15 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Should the firm accept the project? Yes No You're trying to determine whether to expand your business by building a new manufacturing plant. The plant has an installation cost of $12.9 million, which will be depreciated straight-line to zero over its four-year life. If the plant has projected net income of $1,944,300,$1,997,600,$1,966,000, and $1,419,500 over these four years, respectively, what is the project's average accounting return (AAR)? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) \begin{tabular}{|l|l|} \hline b. This project has two IRR's, namely & percent \\ \hline and blank percent, in order from smallest to largest. \\ \hline (Note:IfyoucanonlycomputeoneIRRvalue,youshouldinputthatamountintobothanswerboxesinordertoobtainsomecredit.) \\ \hline (Anegativeanswershouldbeindicatedbyaminussign.Donotroundintermediatecalculationsandenteryouranswersasapercentroundedto2decimalplaces,e.g.,32.16.) \\ \hline \end{tabular} Howell Petroleum, Incorporated, is trying to evaluate a generation project with the following cash flows: a-1.What is the NPV for the project if the company requires a return of 10 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV a- Should the company accept this project? 2. No Yes

A firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: If the required return is 15 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Should the firm accept the project? Yes No You're trying to determine whether to expand your business by building a new manufacturing plant. The plant has an installation cost of $12.9 million, which will be depreciated straight-line to zero over its four-year life. If the plant has projected net income of $1,944,300,$1,997,600,$1,966,000, and $1,419,500 over these four years, respectively, what is the project's average accounting return (AAR)? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) \begin{tabular}{|l|l|} \hline b. This project has two IRR's, namely & percent \\ \hline and blank percent, in order from smallest to largest. \\ \hline (Note:IfyoucanonlycomputeoneIRRvalue,youshouldinputthatamountintobothanswerboxesinordertoobtainsomecredit.) \\ \hline (Anegativeanswershouldbeindicatedbyaminussign.Donotroundintermediatecalculationsandenteryouranswersasapercentroundedto2decimalplaces,e.g.,32.16.) \\ \hline \end{tabular} Howell Petroleum, Incorporated, is trying to evaluate a generation project with the following cash flows: a-1.What is the NPV for the project if the company requires a return of 10 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV a- Should the company accept this project? 2. No Yes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started