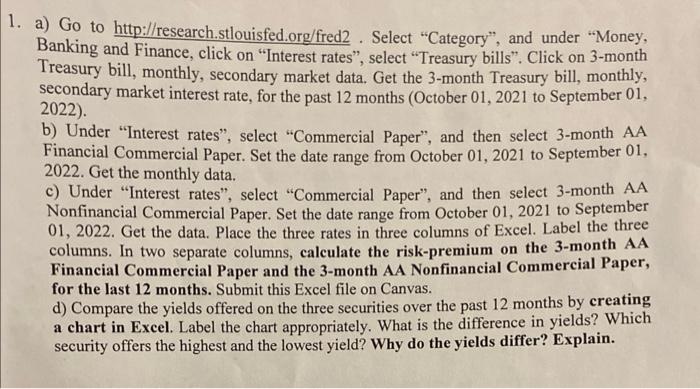

a) Go to http://research.stlouisfed.org/fred2 . Select "Category", and under "Money, Banking and Finance, click on "Interest rates", select "Treasury bills". Click on 3-month Treasury bill, monthly, secondary market data. Get the 3 -month Treasury bill, monthly, secondary market interest rate, for the past 12 months (October 01, 2021 to September 01, 2022). b) Under "Interest rates", select "Commercial Paper", and then select 3-month AA Financial Commercial Paper. Set the date range from October 01, 2021 to September 01, 2022. Get the monthly data. c) Under "Interest rates", select "Commercial Paper", and then select 3-month AA Nonfinancial Commercial Paper. Set the date range from October 01, 2021 to September 01, 2022. Get the data. Place the three rates in three columns of Excel. Label the three columns. In two separate columns, calculate the risk-premium on the 3-month AA Financial Commercial Paper and the 3-month AA Nonfinancial Commercial Paper, for the last 12 months. Submit this Excel file on Canvas. d) Compare the yields offered on the three securities over the past 12 months by creating a chart in Excel. Label the chart appropriately. What is the difference in yields? Which security offers the highest and the lowest yield? Why do the yields differ? Explain. a) Go to http://research.stlouisfed.org/fred2 . Select "Category", and under "Money, Banking and Finance, click on "Interest rates", select "Treasury bills". Click on 3-month Treasury bill, monthly, secondary market data. Get the 3 -month Treasury bill, monthly, secondary market interest rate, for the past 12 months (October 01, 2021 to September 01, 2022). b) Under "Interest rates", select "Commercial Paper", and then select 3-month AA Financial Commercial Paper. Set the date range from October 01, 2021 to September 01, 2022. Get the monthly data. c) Under "Interest rates", select "Commercial Paper", and then select 3-month AA Nonfinancial Commercial Paper. Set the date range from October 01, 2021 to September 01, 2022. Get the data. Place the three rates in three columns of Excel. Label the three columns. In two separate columns, calculate the risk-premium on the 3-month AA Financial Commercial Paper and the 3-month AA Nonfinancial Commercial Paper, for the last 12 months. Submit this Excel file on Canvas. d) Compare the yields offered on the three securities over the past 12 months by creating a chart in Excel. Label the chart appropriately. What is the difference in yields? Which security offers the highest and the lowest yield? Why do the yields differ? Explain