Answered step by step

Verified Expert Solution

Question

1 Approved Answer

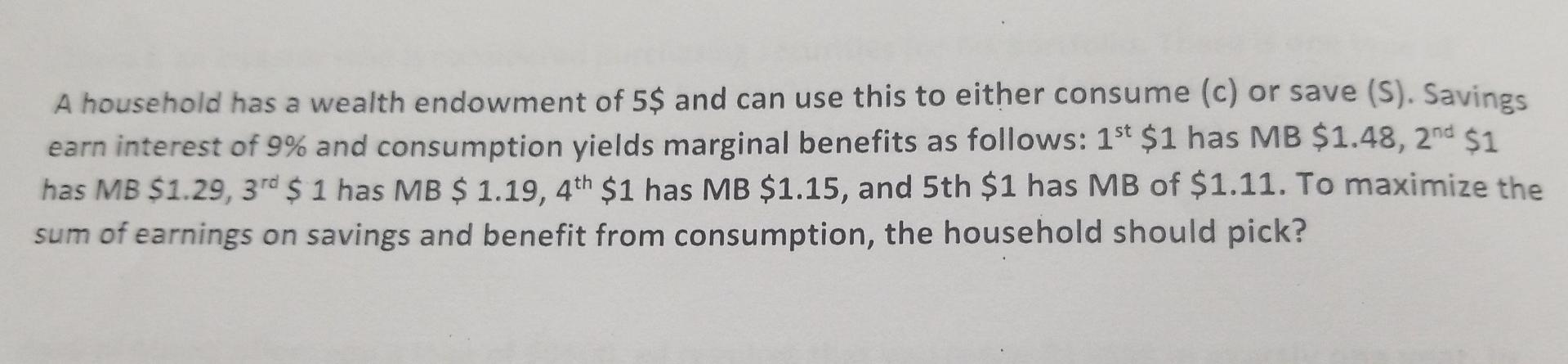

A household has a wealth endowment of 5$ and can use this to either consume (c) or save (s). Savings earn interest of 9% and

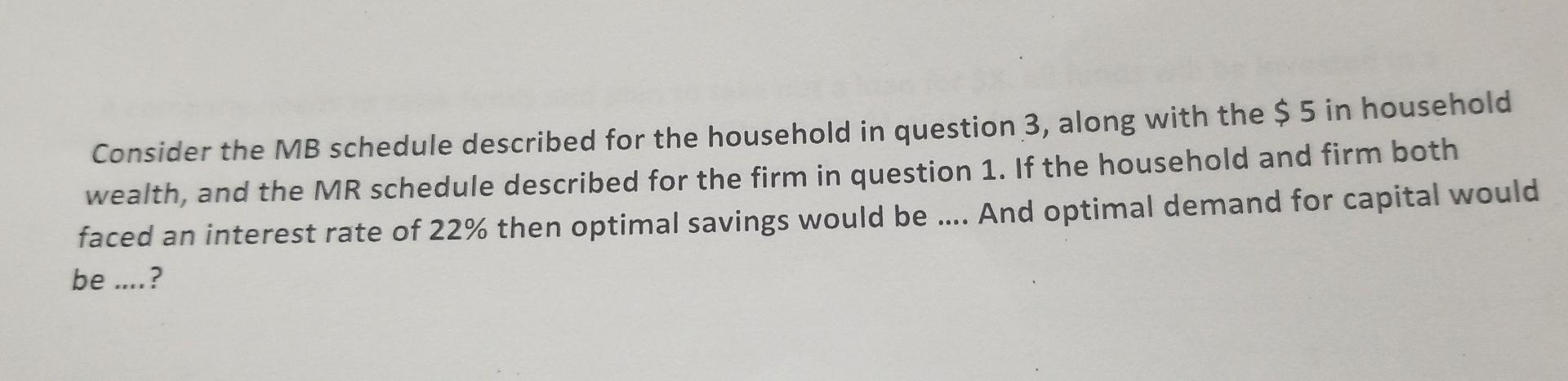

A household has a wealth endowment of 5$ and can use this to either consume (c) or save (s). Savings earn interest of 9% and consumption yields marginal benefits as follows: 1st $1 has MB $1.48, 2nd $1 has MB $1.29, 3rd $ 1 has MB $ 1.19, 4th $1 has MB $1.15, and 5th $1 has MB of $1.11. To maximize the sum of earnings on savings and benefit from consumption, the household should pick? Consider the MB schedule described for the household in question 3, along with the $ 5 in household wealth, and the MR schedule described for the firm in question 1. If the household and firm both faced an interest rate of 22% then optimal savings would be .... And optimal demand for capital would be ...? A consumer that takes a one year loan of $8340 from a bank. If the bank is charging an interest rate of 2.2% then what is the required loan replacement one year later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started