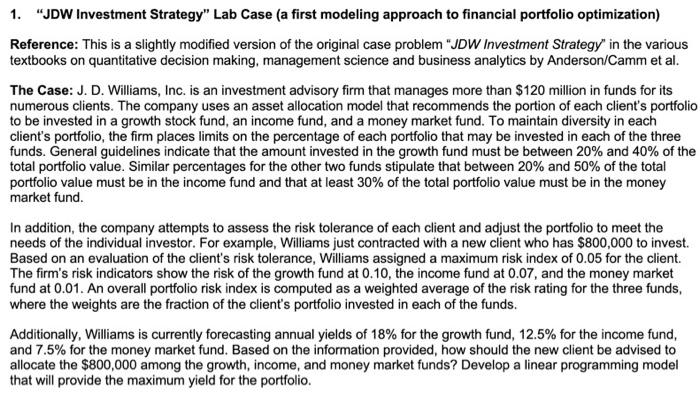

A) In the "JDW investment Strategy" case, using forecosted yields and risks of 18% and 0.10 for the growth fund, 12.5% and 0.07 for the income fund, and 7.5% and 0.01 for the money market fund, how much should you invest into each? Suppose that the maximally acceptable portfolio risk is 0.05 and that between 20% and 40% of the total portfolio value must be invested into the growth fund, between 20% and 50% into the income fund, and at least 30% into the money market fund. Determine your portfolio's investment allocations and its anticipated annual yield, and write your answers in percent rounded to a single decimal into Blank 1 (growth fund), Blank 2 (income fund), Blank 3 (money market fund) and Blank 4 (annual yield). Question a options: B) In the "JDW Investment Strategy" case, what is the expected annual yield for a maximally acceptable risk tolerance of 0.0503. Report this return as a percentoge rounded to four decimals (e.9. for an optimal return of 12.3456789%, enter 12.3457). C) In the "JDW investment Strategy" case, again using a maximally acceptable risk index of 0.05, how would the optimal investment allocation and expected annual yield change if the annual yield for the growth fund was revised downward from 18% to 14% ? Determine your portfolio's new investment allocations and anticipated annual yield, and write your answers in percent rounded to a single decimal into Blank 1 (growth fund), Blank 2 (income fund), Blank 3 (money market fund) and Blank 4 (annuol yield). 1. "JDW Investment Strategy" Lab Case (a first modeling approach to financial portfolio optimization) Reference: This is a slightly modified version of the original case problem "JDW Investment Strategy" in the various textbooks on quantitative decision making, management science and business analytics by Anderson/Camm et al. The Case: J. D. Williams, Inc. is an investment advisory firm that manages more than $120 million in funds for its numerous clients. The company uses an asset allocation model that recommends the portion of each client's portfolio to be invested in a growth stock fund, an income fund, and a money market fund. To maintain diversity in each client's portfolio, the firm places limits on the percentage of each portfolio that may be invested in each of the three funds. General guidelines indicate that the amount invested in the growth fund must be between 20% and 40% of the total portfolio value. Similar percentages for the other two funds stipulate that between 20% and 50% of the total portfolio value must be in the income fund and that at least 30% of the total portfolio value must be in the money market fund. In addition, the company attempts to assess the risk tolerance of each client and adjust the portfolio to meet the needs of the individual investor. For example, Williams just contracted with a new client who has $800,000 to invest. Based on an evaluation of the client's risk tolerance, Williams assigned a maximum risk index of 0.05 for the client. The firm's risk indicators show the risk of the growth fund at 0.10, the income fund at 0.07, and the money market fund at 0.01. An overall portfolio risk index is computed as a weighted average of the risk rating for the three funds, where the weights are the fraction of the client's portfolio invested in each of the funds. Additionally, Williams is currently forecasting annual yields of 18% for the growth fund, 12.5% for the income fund, and 7.5% for the money market fund. Based on the information provided, how should the new client be advised to allocate the $800,000 among the growth, income, and money market funds? Develop a linear programming model that will provide the maximum yield for the portfolio. A) In the "JDW investment Strategy" case, using forecosted yields and risks of 18% and 0.10 for the growth fund, 12.5% and 0.07 for the income fund, and 7.5% and 0.01 for the money market fund, how much should you invest into each? Suppose that the maximally acceptable portfolio risk is 0.05 and that between 20% and 40% of the total portfolio value must be invested into the growth fund, between 20% and 50% into the income fund, and at least 30% into the money market fund. Determine your portfolio's investment allocations and its anticipated annual yield, and write your answers in percent rounded to a single decimal into Blank 1 (growth fund), Blank 2 (income fund), Blank 3 (money market fund) and Blank 4 (annual yield). Question a options: B) In the "JDW Investment Strategy" case, what is the expected annual yield for a maximally acceptable risk tolerance of 0.0503. Report this return as a percentoge rounded to four decimals (e.9. for an optimal return of 12.3456789%, enter 12.3457). C) In the "JDW investment Strategy" case, again using a maximally acceptable risk index of 0.05, how would the optimal investment allocation and expected annual yield change if the annual yield for the growth fund was revised downward from 18% to 14% ? Determine your portfolio's new investment allocations and anticipated annual yield, and write your answers in percent rounded to a single decimal into Blank 1 (growth fund), Blank 2 (income fund), Blank 3 (money market fund) and Blank 4 (annuol yield). 1. "JDW Investment Strategy" Lab Case (a first modeling approach to financial portfolio optimization) Reference: This is a slightly modified version of the original case problem "JDW Investment Strategy" in the various textbooks on quantitative decision making, management science and business analytics by Anderson/Camm et al. The Case: J. D. Williams, Inc. is an investment advisory firm that manages more than $120 million in funds for its numerous clients. The company uses an asset allocation model that recommends the portion of each client's portfolio to be invested in a growth stock fund, an income fund, and a money market fund. To maintain diversity in each client's portfolio, the firm places limits on the percentage of each portfolio that may be invested in each of the three funds. General guidelines indicate that the amount invested in the growth fund must be between 20% and 40% of the total portfolio value. Similar percentages for the other two funds stipulate that between 20% and 50% of the total portfolio value must be in the income fund and that at least 30% of the total portfolio value must be in the money market fund. In addition, the company attempts to assess the risk tolerance of each client and adjust the portfolio to meet the needs of the individual investor. For example, Williams just contracted with a new client who has $800,000 to invest. Based on an evaluation of the client's risk tolerance, Williams assigned a maximum risk index of 0.05 for the client. The firm's risk indicators show the risk of the growth fund at 0.10, the income fund at 0.07, and the money market fund at 0.01. An overall portfolio risk index is computed as a weighted average of the risk rating for the three funds, where the weights are the fraction of the client's portfolio invested in each of the funds. Additionally, Williams is currently forecasting annual yields of 18% for the growth fund, 12.5% for the income fund, and 7.5% for the money market fund. Based on the information provided, how should the new client be advised to allocate the $800,000 among the growth, income, and money market funds? Develop a linear programming model that will provide the maximum yield for the portfolio