Answered step by step

Verified Expert Solution

Question

1 Approved Answer

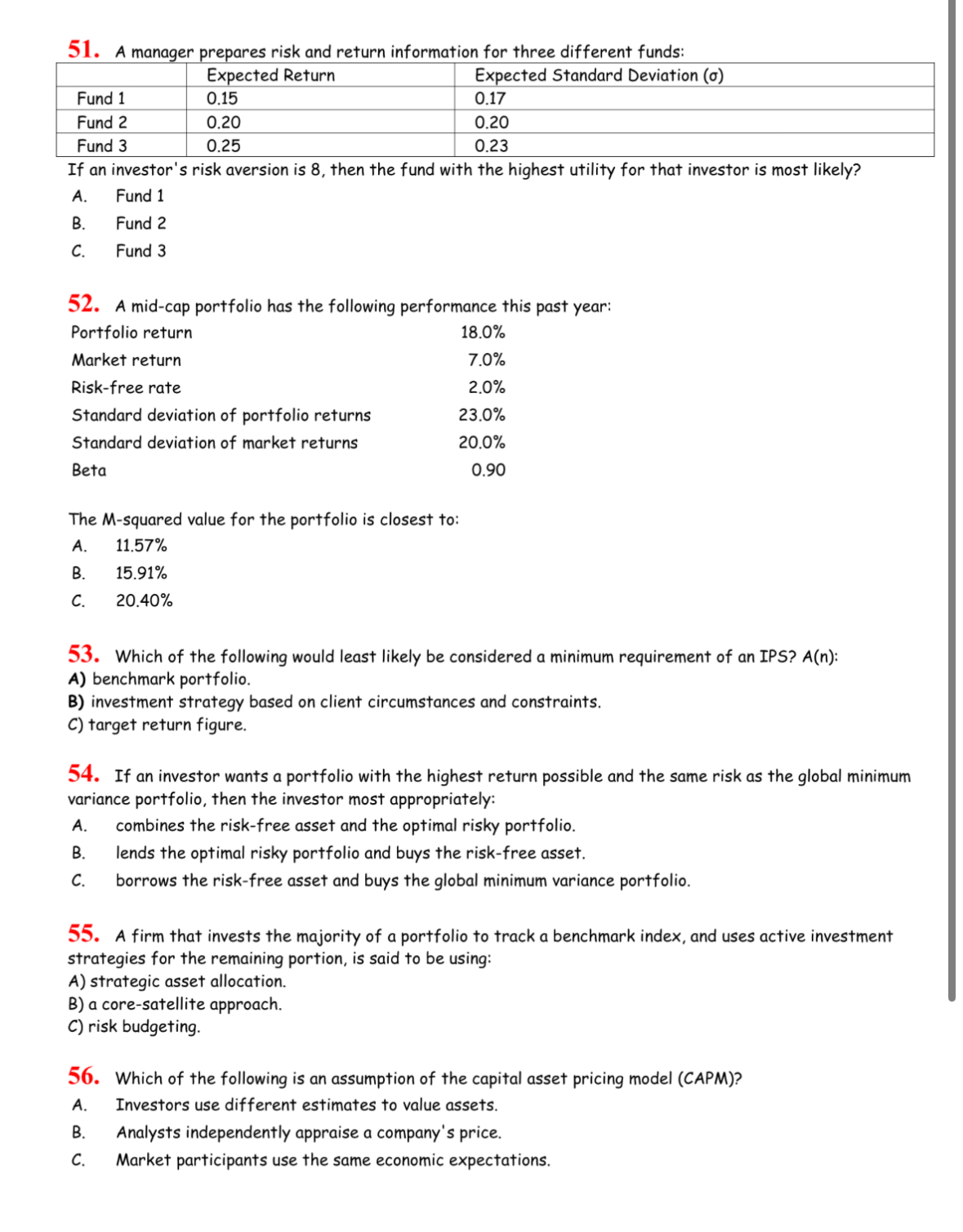

A manager prepares risk and return information for three different funds: If an investor's risk aversion is 8 , then the fund with the highest

A manager prepares risk and return information for three different funds:

If an investor's risk aversion is then the fund with the highest utility for that investor is most likely?

A Fund

B Fund

C Fund

A midcap portfolio has the following performance this past year:

The Msquared value for the portfolio is closest to:

A

B

C

Which of the following would least likely be considered a minimum requirement of an IPS? :

A benchmark portfolio.

B investment strategy based on client circumstances and constraints.

C target return figure.

If an investor wants a portfolio with the highest return possible and the same risk as the global minimum

variance portfolio, then the investor most appropriately:

A combines the riskfree asset and the optimal risky portfolio.

B lends the optimal risky portfolio and buys the riskfree asset.

C borrows the riskfree asset and buys the global minimum variance portfolio.

A firm that invests the majority of a portfolio to track a benchmark index, and uses active investment

strategies for the remaining portion, is said to be using:

A strategic asset allocation.

B a coresatellite approach.

C risk budgeting.

Which of the following is an assumption of the capital asset pricing model CAPM

A Investors use different estimates to value assets.

B Analysts independently appraise a company's price.

C Market participants use the same economic expectations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started