Answered step by step

Verified Expert Solution

Question

1 Approved Answer

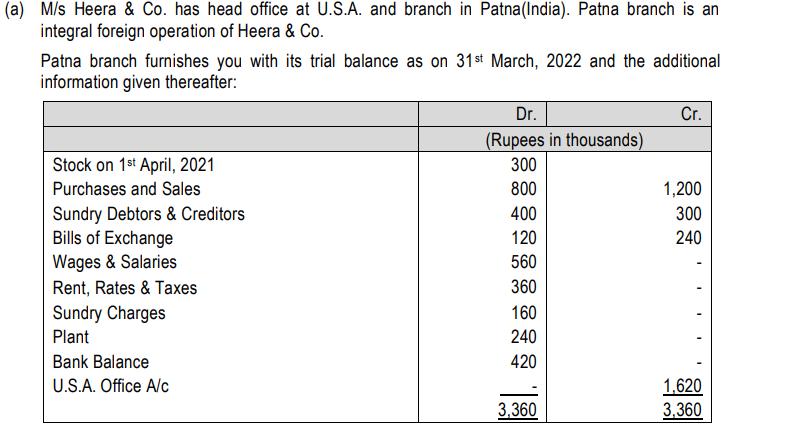

(a) M/s Heera & Co. has head office at U.S.A. and branch in Patna(India). Patna branch is an integral foreign operation of Heera &

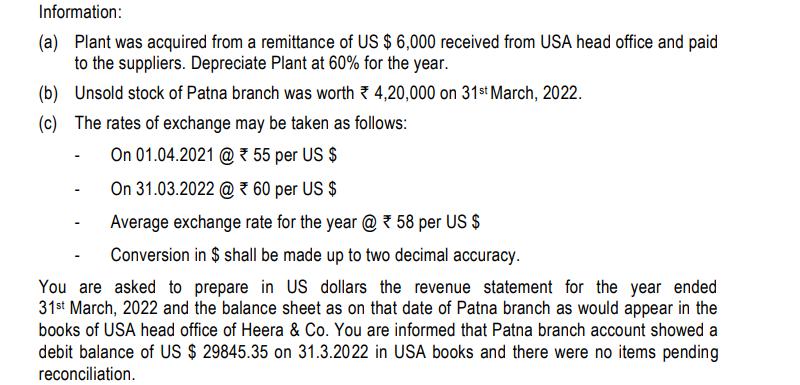

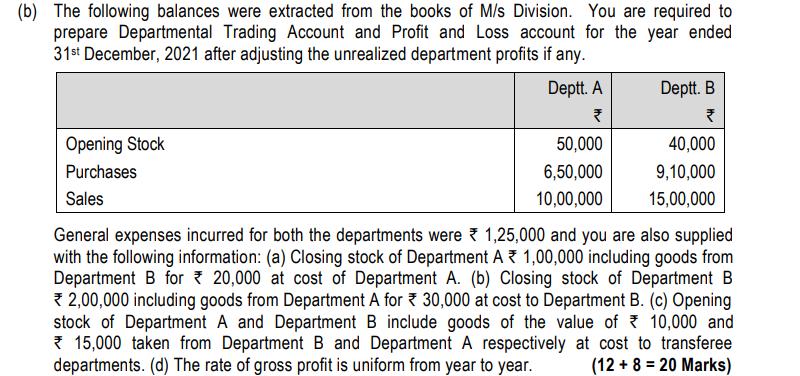

(a) M/s Heera & Co. has head office at U.S.A. and branch in Patna(India). Patna branch is an integral foreign operation of Heera & Co. Patna branch furnishes you with its trial balance as on 31st March, 2022 and the additional information given thereafter: Stock on 1st April, 2021 Purchases and Sales Sundry Debtors & Creditors Bills of Exchange Wages & Salaries Rent, Rates & Taxes Sundry Charges Plant Bank Balance U.S.A. Office A/c Dr. (Rupees in thousands) 300 800 400 120 560 360 160 240 420 3,360 Cr. 1,200 300 240 1,620 3,360 Information: (a) Plant was acquired from a remittance of US $ 6,000 received from USA head office and paid to the suppliers. Depreciate Plant at 60% for the year. (b) Unsold stock of Patna branch was worth 4,20,000 on 31st March, 2022. (c) The rates of exchange may be taken as follows: On 01.04.2021 @ 55 per US $ On 31.03.2022 @ 60 per US $ Average exchange rate for the year @ * 58 per US $ Conversion in $ shall be made up to two decimal accuracy. You are asked to prepare in US dollars the revenue statement for the year ended 31st March, 2022 and the balance sheet as on that date of Patna branch as would appear in the books of USA head office of Heera & Co. You are informed that Patna branch account showed a debit balance of US $ 29845.35 on 31.3.2022 in USA books and there were no items pending reconciliation. (b) The following balances were extracted from the books of M/s Division. You are required to prepare Departmental Trading Account and Profit and Loss account for the year ended 31st December, 2021 after adjusting the unrealized department profits if any. Opening Stock Purchases Sales Deptt. A 50,000 6,50,000 10,00,000 Deptt. B 40,000 9,10,000 15,00,000 General expenses incurred for both the departments were 1,25,000 and you are also supplied with the following information: (a) Closing stock of Department A 1,00,000 including goods from Department B for 20,000 at cost of Department A. (b) Closing stock of Department B 2,00,000 including goods from Department A for 30,000 at cost to Department B. (c) Opening stock of Department A and Department B include goods of the value of 10,000 and * 15,000 taken from Department B and Department A respectively at cost to transferee departments. (d) The rate of gross profit is uniform from year to year. (12 + 8 = 20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Revenue Statement in US Dollars for the year ended 31st March 2022 Particulars Amount in USD Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started