Answered step by step

Verified Expert Solution

Question

1 Approved Answer

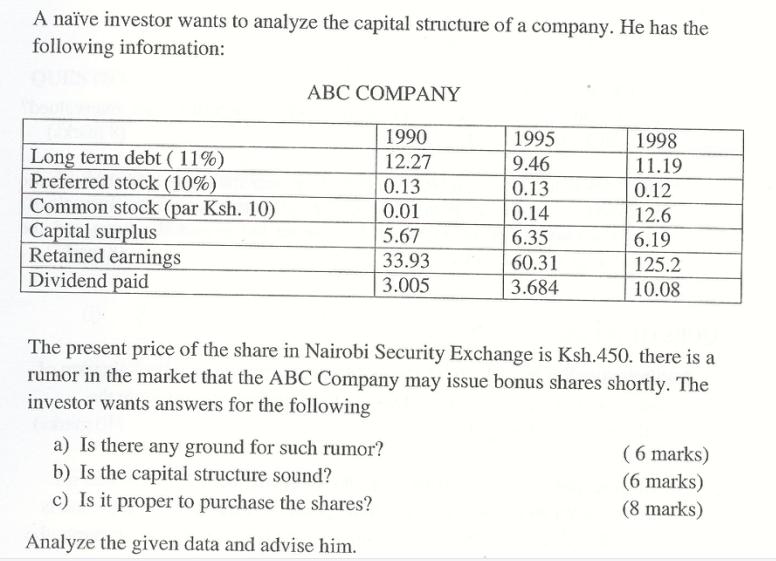

A nave investor wants to analyze the capital structure of a company. He has the following information: Long term debt (11%) Preferred stock (10%)

A nave investor wants to analyze the capital structure of a company. He has the following information: Long term debt (11%) Preferred stock (10%) Common stock (par Ksh. 10) Capital surplus Retained earnings Dividend paid ABC COMPANY 1990 12.27 0.13 0.01 5.67 33.93 3.005 1995 9.46 0.13 0.14 6.35 60.31 3.684 a) Is there any ground for such rumor? b) Is the capital structure sound? c) Is it proper to purchase the shares? Analyze the given data and advise him. 1998 11.19 0.12 12.6 6.19 125.2 10.08 The present price of the share in Nairobi Security Exchange is Ksh.450. there is a rumor in the market that the ABC Company may issue bonus shares shortly. The investor wants answers for the following (6 marks) (6 marks) (8 marks)

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a Yes there is ground for such a ru...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started