Answered step by step

Verified Expert Solution

Question

1 Approved Answer

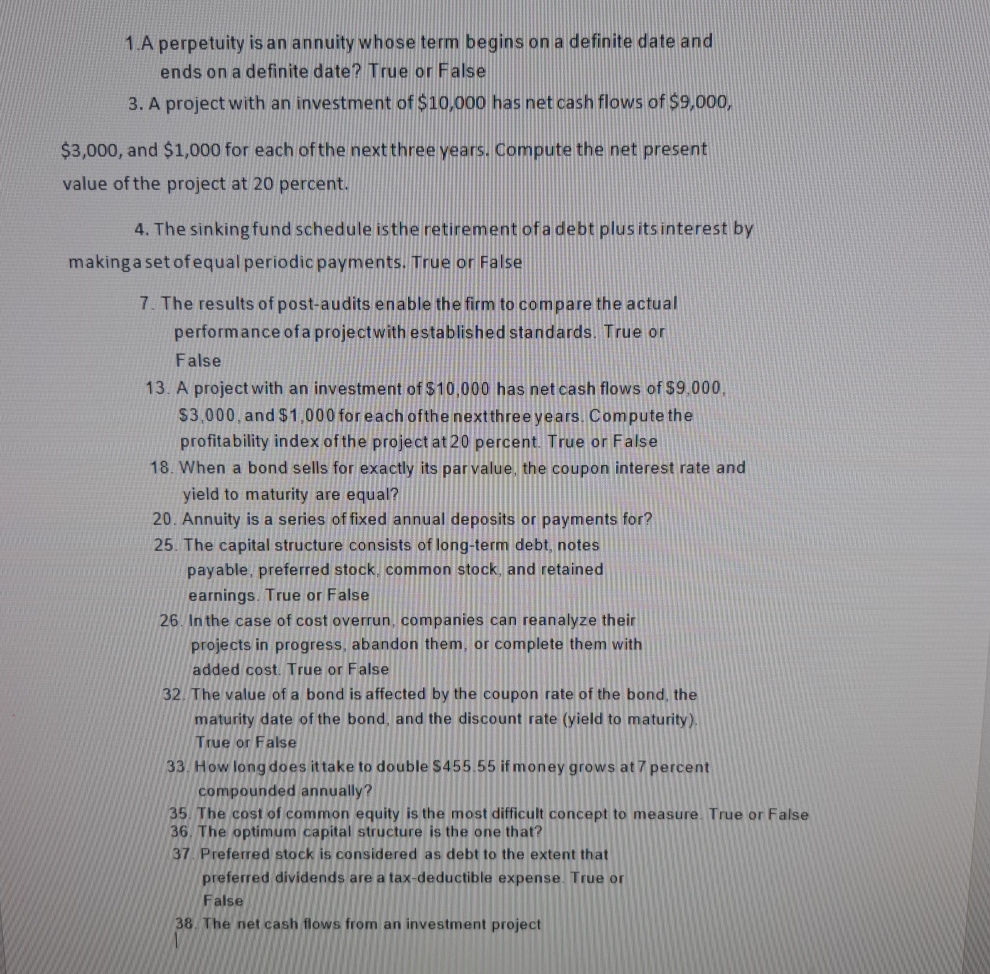

A perpetuity is an annuity whose term begins on a definite date and ends on a definite date? True or False A project with an

A perpetuity is an annuity whose term begins on a definite date and ends on a definite date? True or False

A project with an investment of $ has net cash flows of $

$ and $ for each of the next three years. Compute the net present value of the project at percent.

The sinking fund schedule is the retirement of a debt plus its interest by making a set of equal periodic payments. True or False

The results of postaudits enable the firm to compare the actual performance of a projectwith established standards. True or False

A project with an investment of $ has net cash flows of $ $ and $ for each of the next three years. Compute the profitability index of the project at percent. True or False

When a bond sells for exactly its par value, the coupon interest rate and yield to maturity are equal?

Annuity is a series of fixed annual deposits or payments for?

The capital structure consists of longterm debt, notes payable, preferred stock, common stock, and retained earnings. True or False

In the case of cost overrun, companies can reanalyze their projects in progress, abandon them, or complete them with added cost. True or False

The value of a bond is affected by the coupon rate of the bond, the maturity date of the bond, and the discount rate yield to maturity True or False

How long does it take to double $ if money grows at percent compounded annually?

The cost of common equity is the most difficult concept to measure. True or False

The optimum capital structure is the one that?

Preferred stock is considered as debt to the extent that preferred dividends are a taxdeductible expense. True or False

The net cash flows from an investment project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started