Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Prior to examining the company's actual balance sheet, read the description of Rocky Mountain Chocolate Factory, above. What accounts do you expect to

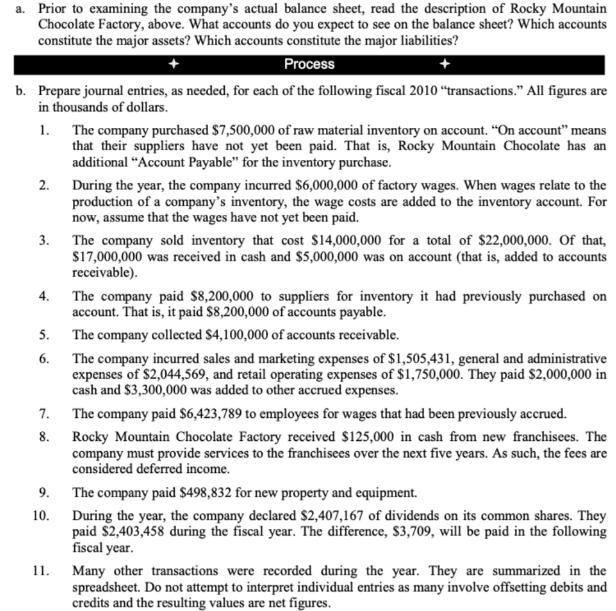

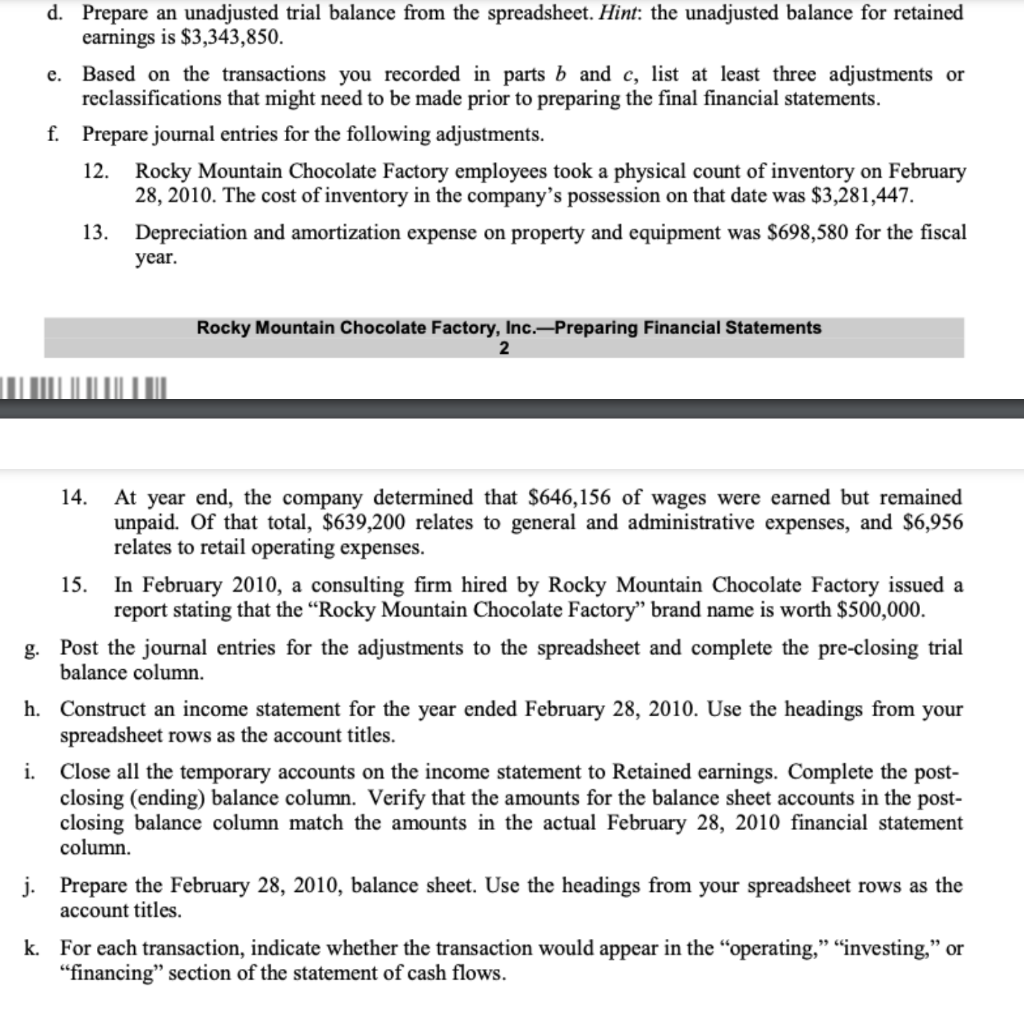

a. Prior to examining the company's actual balance sheet, read the description of Rocky Mountain Chocolate Factory, above. What accounts do you expect to see on the balance sheet? Which accounts constitute the major assets? Which accounts constitute the major liabilities? Process b. Prepare journal entries, as needed, for each of the following fiscal 2010 "transactions." All figures are in thousands of dollars. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. The company purchased $7,500,000 of raw material inventory on account. "On account" means that their suppliers have not yet been paid. That is, Rocky Mountain Chocolate has an additional "Account Payable" for the inventory purchase. During the year, the company incurred $6,000,000 of factory wages. When wages relate to the production of a company's inventory, the wage costs are added to the inventory account. For now, assume that the wages have not yet been paid. The company sold inventory that cost $14,000,000 for a total of $22,000,000. Of that, $17,000,000 was received in cash and $5,000,000 was on account (that is, added to accounts receivable). The company paid $8,200,000 to suppliers for inventory it had previously purchased on account. That is, it paid $8,200,000 of accounts payable. The company collected $4,100,000 of accounts receivable. The company incurred sales and marketing expenses of $1,505,431, general and administrative expenses of $2,044,569, and retail operating expenses of $1,750,000. They paid $2,000,000 in cash and $3,300,000 was added to other accrued expenses. The company paid $6,423,789 to employees for wages that had been previously accrued. Rocky Mountain Chocolate Factory received $125,000 in cash from new franchisees. The company must provide services to the franchisees over the next five years. As such, the fees are considered deferred income. The company paid $498,832 for new property and equipment. During the year, the company declared $2,407,167 of dividends on its common shares. They paid $2,403,458 during the fiscal year. The difference, $3,709, will be paid in the following fiscal year. Many other transactions were recorded during the year. They are summarized in the spreadsheet. Do not attempt to interpret individual entries as many involve offsetting debits and credits and the resulting values are net figures. d. Prepare an unadjusted trial balance from the spreadsheet. Hint: the unadjusted balance for retained earnings is $3,343,850. e. Based on the transactions you recorded in parts b and c, list at least three adjustments or reclassifications that might need to be made prior to preparing the final financial statements. f. Prepare journal entries for the following adjustments. 12. Rocky Mountain Chocolate Factory employees took a physical count of inventory on February 28, 2010. The cost of inventory in the company's possession on that date was $3,281,447. Depreciation and amortization expense on property and equipment was $698,580 for the fiscal year. 13. 14. Rocky Mountain Chocolate Factory, Inc.-Preparing Financial Statements 2 At year end, the company determined that $646,156 of wages were earned but remained unpaid. Of that total, $639,200 relates to general and administrative expenses, and $6,956 relates to retail operating expenses. 15. In February 2010, a consulting firm hired by Rocky Mountain Chocolate Factory issued a report stating that the "Rocky Mountain Chocolate Factory" brand name is worth $500,000. g. Post the journal entries for the adjustments to the spreadsheet and complete the pre-closing trial balance column. h. i. Close all the temporary accounts on the income statement to Retained earnings. Complete the post- closing (ending) balance column. Verify that the amounts for the balance sheet accounts in the post- closing balance column match the amounts in the actual February 28, 2010 financial statement column. Construct an income statement for the year ended February 28, 2010. Use the headings from your spreadsheet rows as the account titles. j. Prepare the February 28, 2010, balance sheet. Use the headings from your spreadsheet rows as the account titles. k. For each transaction, indicate whether the transaction would appear in the "operating," "investing," or "financing" section of the statement of cash flows.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Based on the description of Rocky Mountain Chocolate Factory we can expect to see the following ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started