Question

A project's initial Investment is $200,000 straight line depreciated to $20,000 salvage value over 5 year life. Projected sales: 2,500 units @ $88 /

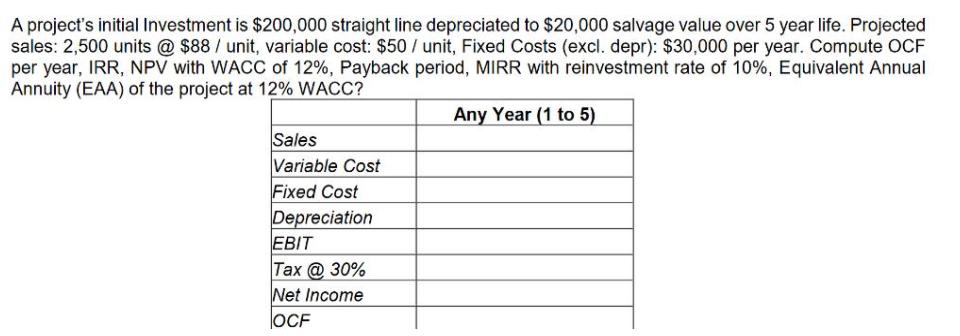

A project's initial Investment is $200,000 straight line depreciated to $20,000 salvage value over 5 year life. Projected sales: 2,500 units @ $88 / unit, variable cost: $50 / unit, Fixed Costs (excl. depr): $30,000 per year. Compute OCF per year, IRR, NPV with WACC of 12%, Payback period, MIRR with reinvestment rate of 10%, Equivalent Annual Annuity (EAA) of the project at 12% WACC? Any Year (1 to 5) Sales Variable Cost Fixed Cost Depreciation EBIT |x @ 30% Net Income lOCF

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Required solution Sales 220000 Variable cost 125000 Contribution margin 95000 Fixed cost 30000 Depre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

12th edition

978-1133952428, 1285078578, 1133952429, 978-1285078571

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App