Answered step by step

Verified Expert Solution

Question

1 Approved Answer

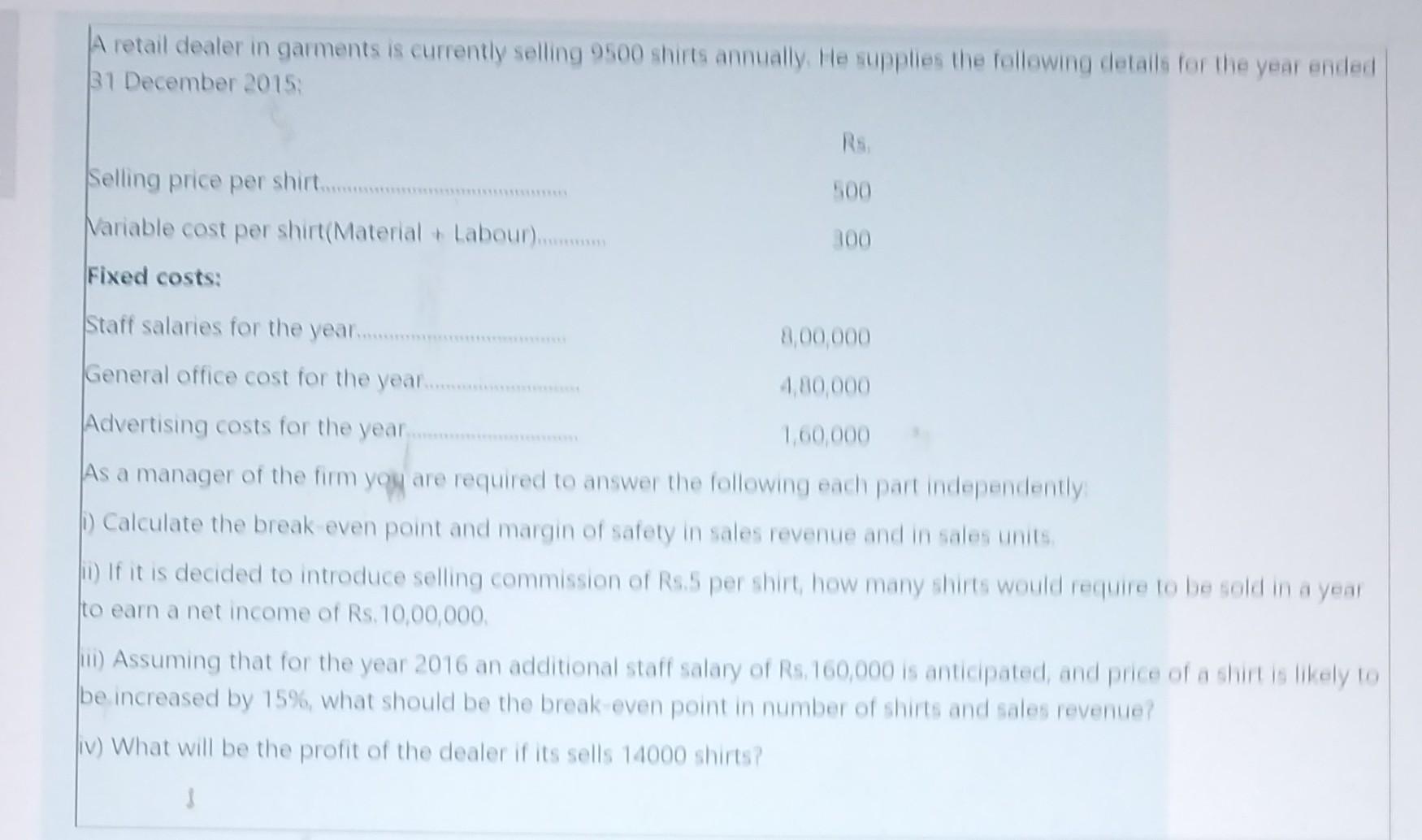

A retail dealer in garments is currently selling 9500 shirts annually. He supplies the following details for the year ended B1 December 2015: 500 Selling

A retail dealer in garments is currently selling 9500 shirts annually. He supplies the following details for the year ended B1 December 2015: 500 Selling price per shirt... Nariable cost per shirt(Material Labour... 100 Fixed costs: Staff salaries for the year....... 8,00 000 General office cost for the year 4,80,000 Advertising costs for the year 1,60,000 As a manager of the firm you are required to answer the following each part independently 1) Calculate the break even point and margin of safety in sales revenue and in sales units if it is decided to introduce selling commission of Rs.5 per shirt, how many shirts would require to be sold in a year to earn a net income of Rs. 10,00,000, ) Assuming that for the year 2016 an additional staff salary of Rs. 160,000 is anticipated, and price of a shirt is likely to be increased by 15%, what should be the break even point in number of shirts and sales revenue? iv) What will be the profit of the dealer if its sells 14000 shirts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started