Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Simple Growth Forecast and a Simple Valuation (Easy) An analyst prepares the following reformulated balance sheet (in millions): Core operating income (after tax) for

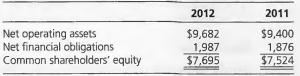

A Simple Growth Forecast and a Simple Valuation (Easy) An analyst prepares the following reformulated balance sheet (in millions):

Core operating income (after tax) for 2012 was $990 million. The required return for operations is 9 percent. For ease, use beginning-of-year balance sheet numbers where pertinent in calculations.

a. What was the core return on net operating assets for 2012?

b. Prepare a growth forecast of operating income and residual operating income for 2013 based on this financial statement information.

c. Value the equity based on the information.

d. What is the intrinsic enterprise price-to-book ratio?

2012 2011 Net operating assets Net financial obligations Common shareholders' equity $9,682 1,987 $7,695 $9,400 1,876 $7,524

Step by Step Solution

★★★★★

3.31 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

Simple forecasts and simple valuations Simple forecast is developed through financial sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started