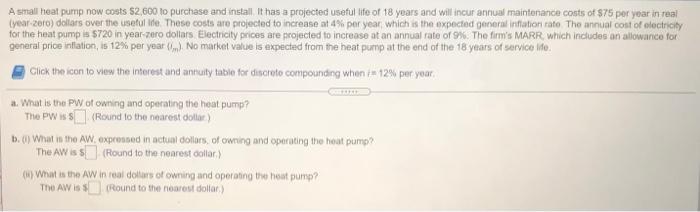

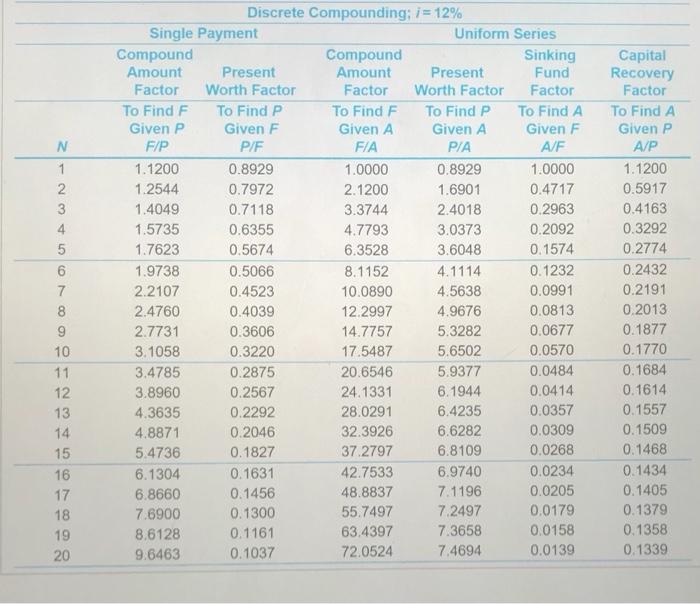

A small heat pump now costs $2,600 to purchase and install. It has a projected useful life of 18 years and will incur annual maintenance costs of $75 per year in real year.2010) dollars over the useful ide. These costs are projected to increase at 4% per year which is the expected general inflation rate The annual cost of clectricity for the heat pump is $720 in year-zero dollars Electricity prices are projected to increase at an annual rate of 9%. The firm's MARR which includes an allowance for general price initiation, is 12% per year (m) No market value is expected from the heat pump at the end of the 18 years of service 10. Click the icon to view the Interest and annuity table for discreto compounding when i+ 12% per year 2. What is the PW of owning and operating the heat pump? The PW $|| (Round to the nearest dollar) b.) What is the AW. expressed in actual colors of owning and operating the heat pump? The AW is (Round to the nearest collar) What is the AW in real dollars of owning and operating the heat pump? The AWISS. Round to the nearest dollar) 000N-2 N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F F/P P/E FIA PIA A/F 1.1200 0.8929 1.0000 0.8929 1.0000 1.2544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3.3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 1.7623 0.5674 6.3528 3.6048 0.1574 1.9738 0.5066 8.1152 4.1114 0.1232 2.2107 0.4523 10.0890 4.5638 0.0991 2.4760 0.4039 12.2997 4.9676 0.0813 2.7731 0.3606 14.7757 5.3282 0.0677 3.1058 0.3220 17.5487 5.6502 0.0570 3.4785 0.2875 20.6546 5.9377 0.0484 3.8960 0.2567 24.1331 6.1944 0.0414 4.3635 0.2292 28.0291 6.4235 0.0357 4.8871 0.2046 32.3926 6.6282 0.0309 5.4736 0.1827 37.2797 6.8109 0.0268 6.1304 0.1631 42.7533 6.9740 0.0234 6.8660 0.1456 48.8837 7.1196 0.0205 7.6900 0.1300 55.7497 7.2497 0.0179 8.6128 0.1161 63.4397 7.3658 0.0158 9.6463 0.1037 72.0524 7.4694 0.0139 Capital Recovery Factor To Find A Given P A/P 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 0.1684 0.1614 0.1557 0.1509 0.1468 0.1434 0.1405 0.1379 0.1358 0.1339