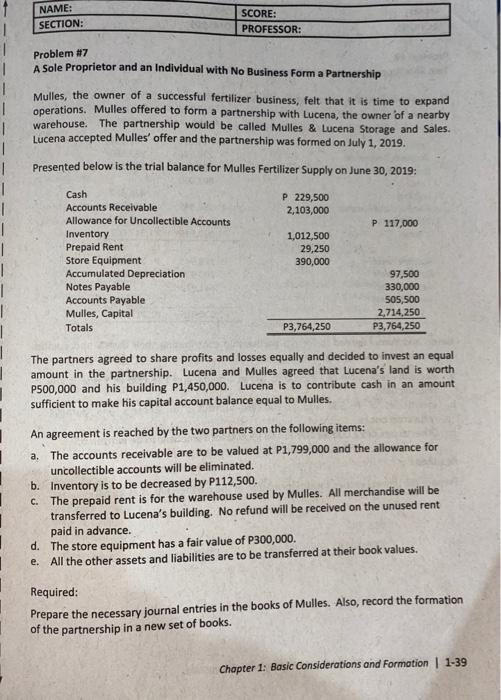

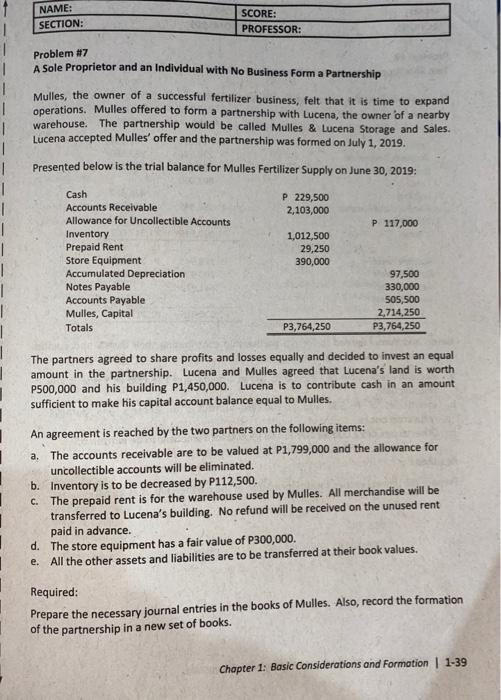

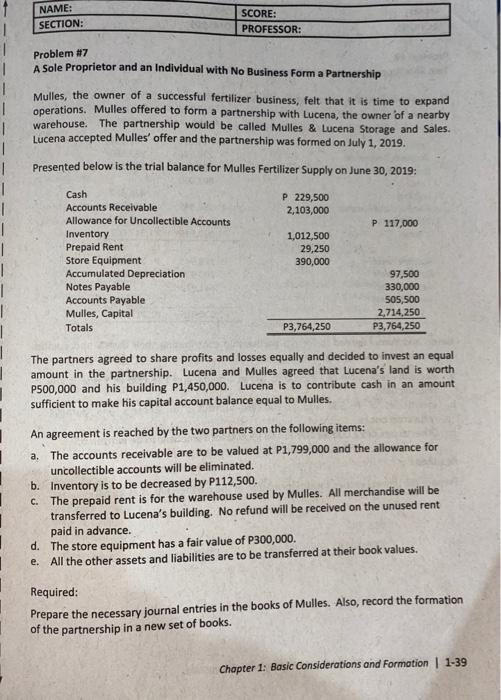

A Sole Proprietor and an Individual with No Business Form a Partnership

NAME: SECTION: SCORE: PROFESSOR: Problem #7 A Sole Proprietor and an Individual with No Business Form a Partnership Mulles, the owner of a successful fertilizer business, felt that it is time to expand operations. Mulles offered to form a partnership with Lucena, the owner of a nearby warehouse. The partnership would be called Mulles & Lucena Storage and Sales Lucena accepted Mulles' offer and the partnership was formed on July 1, 2019. Presented below is the trial balance for Mulles Fertilizer Supply on June 30, 2019: 1 1 1 1 1 1 1 1 1 1 1 P 229,500 2,103,000 P 117,000 Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Prepaid Rent Store Equipment Accumulated Depreciation Notes Payable Accounts Payable Mulles, Capital Totals 1,012,500 29,250 390,000 97,500 330,000 505,500 2,714,250 P3,764,250 P3,764,250 1 The partners agreed to share profits and losses equally and decided to invest an equal amount in the partnership. Lucena and Mulles agreed that Lucena's land is worth P500,000 and his building P1,450,000. Lucena is to contribute cash in an amount sufficient to make his capital account balance equal to Mulles. C. An agreement is reached by the two partners on the following items: a. The accounts receivable are to be valued at P1,799,000 and the allowance for uncollectible accounts will be eliminated. b. Inventory is to be decreased by P112,500. The prepaid rent is for the warehouse used by Mulles. All merchandise will be transferred to Lucena's building. No refund will be received on the unused rent paid in advance. d. The store equipment has a fair value of P300,000. e. All the other assets and liabilities are to be transferred at their book values. Required: Prepare the necessary journal entries in the books of Mulles. Also, record the formation of the partnership in a new set of books. 1-39 Chapter 1: Basic Considerations and Formation NAME: SECTION: SCORE: PROFESSOR: Problem #7 A Sole Proprietor and an Individual with No Business Form a Partnership Mulles, the owner of a successful fertilizer business, felt that it is time to expand operations. Mulles offered to form a partnership with Lucena, the owner of a nearby warehouse. The partnership would be called Mulles & Lucena Storage and Sales Lucena accepted Mulles' offer and the partnership was formed on July 1, 2019. Presented below is the trial balance for Mulles Fertilizer Supply on June 30, 2019: 1 1 1 1 1 1 1 1 1 1 1 P 229,500 2,103,000 P 117,000 Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Prepaid Rent Store Equipment Accumulated Depreciation Notes Payable Accounts Payable Mulles, Capital Totals 1,012,500 29,250 390,000 97,500 330,000 505,500 2,714,250 P3,764,250 P3,764,250 1 The partners agreed to share profits and losses equally and decided to invest an equal amount in the partnership. Lucena and Mulles agreed that Lucena's land is worth P500,000 and his building P1,450,000. Lucena is to contribute cash in an amount sufficient to make his capital account balance equal to Mulles. C. An agreement is reached by the two partners on the following items: a. The accounts receivable are to be valued at P1,799,000 and the allowance for uncollectible accounts will be eliminated. b. Inventory is to be decreased by P112,500. The prepaid rent is for the warehouse used by Mulles. All merchandise will be transferred to Lucena's building. No refund will be received on the unused rent paid in advance. d. The store equipment has a fair value of P300,000. e. All the other assets and liabilities are to be transferred at their book values. Required: Prepare the necessary journal entries in the books of Mulles. Also, record the formation of the partnership in a new set of books. 1-39 Chapter 1: Basic Considerations and Formation