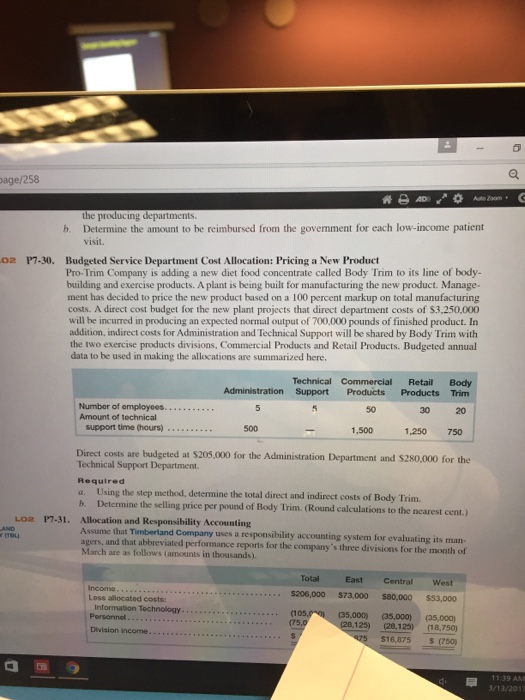

P7-30

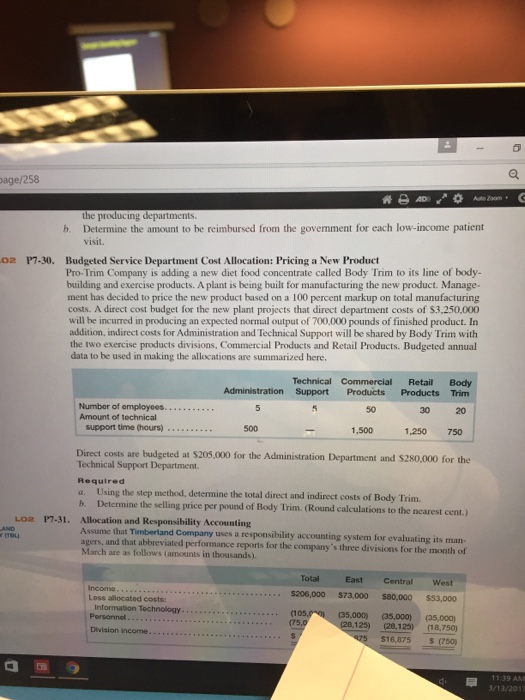

Pro-Trim Company is adding a new diet food concentrate called Body Trim to its line of body-building and exercise products. A plant is being built for manufacturing the new product. Management has decided to price the new product based on a 100 percent markup on total manufacturing costs. A direct cost budget for the new plant projects that direct department costs of $3, 250.000 will he incurred in producing an expected normal output of 700.000 pounds of finished product. In addition, indirect costs for Administration and Technical Support will be shared by Body Trim with the two exercise products divisions. Commercial Products and Retail Products. Budgeted annual data to he used in making the allocations are summarized here. Direct costs are budgeted at $205,000 for the Administration Department and $280,000 for the technical Support Department. Required a. Using the step method, determine the total direct and indirect costs of Body Trim. b. Determine the selling price per pound of Body Trim. (Round calculations to the nearest cent.) Allocation and Responsibility Accounting Assume that Timberland Company uses a responsibility accounting system for evaluating its managers, and that abbreviated performance reports for the company's three divisions for the month of March are as follows (amounts in thousands). Pro-Trim Company is adding a new diet food concentrate called Body Trim to its line of body-building and exercise products. A plant is being built for manufacturing the new product. Management has decided to price the new product based on a 100 percent markup on total manufacturing costs. A direct cost budget for the new plant projects that direct department costs of $3, 250.000 will he incurred in producing an expected normal output of 700.000 pounds of finished product. In addition, indirect costs for Administration and Technical Support will be shared by Body Trim with the two exercise products divisions. Commercial Products and Retail Products. Budgeted annual data to he used in making the allocations are summarized here. Direct costs are budgeted at $205,000 for the Administration Department and $280,000 for the technical Support Department. Required a. Using the step method, determine the total direct and indirect costs of Body Trim. b. Determine the selling price per pound of Body Trim. (Round calculations to the nearest cent.) Allocation and Responsibility Accounting Assume that Timberland Company uses a responsibility accounting system for evaluating its managers, and that abbreviated performance reports for the company's three divisions for the month of March are as follows (amounts in thousands)

P7-30

P7-30