Question

A stock trades at 55. Mike owns a portfolio of the following contracts - Long Two stocks - Long 2 puts with a strike of

A stock trades at 55. Mike owns a portfolio of the following contracts

- Long Two stocks

- Long 2 puts with a strike of 50 and maturity 3 months

- Short 2 calls with a strike of 60 and a maturity of 3 months.

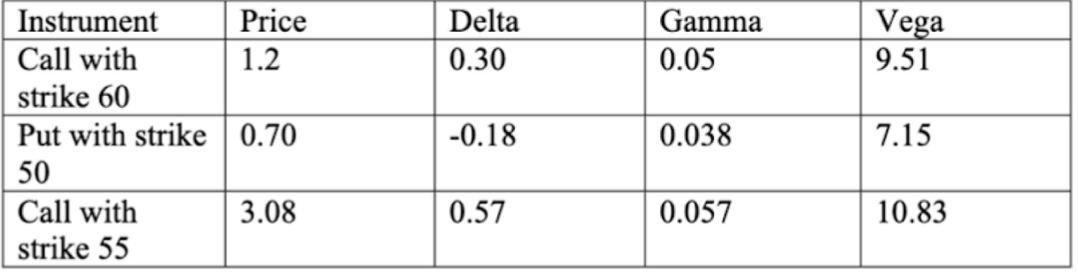

Mike is given the following information on contracts with maturity 3 months

1. What is the current value of the portfolio. (Assume each option controls one stock)

2. If the stock price went up by a dollar, estimate the change in the portfolio value ignoring convexity effects.

3. Suppose you want to make the portfolio both delta and gamma neutral. What is the cost of achieving this if Mike used the 55 strike call and the stock.

Delta 0.30 Gamma 0.05 Vega 9.51 Instrument Price Call with 1.2 strike 60 Put with strike 0.70 50 Call with 3.08 strike 55 -0.18 0.038 7.15 0.57 0.057 10.83Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started