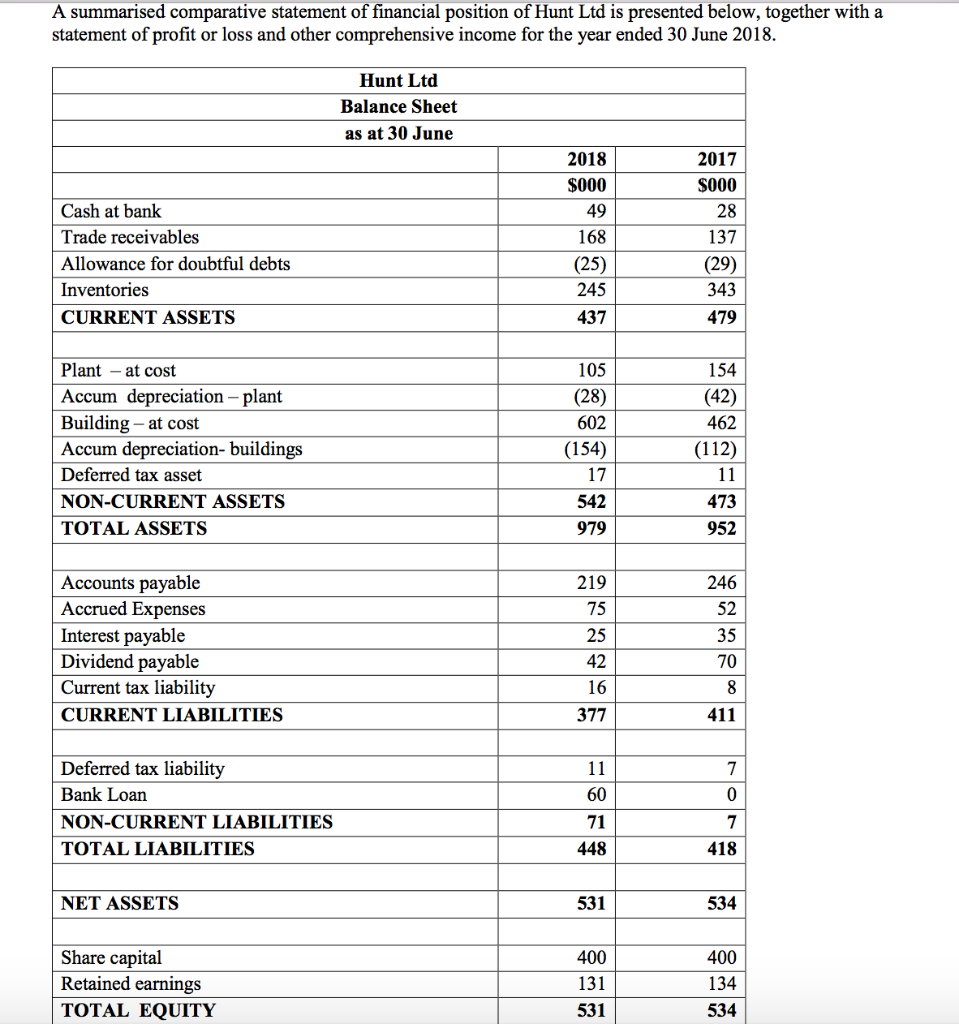

A summarised comparative statement of financial position of Hunt Ltd is presented below, together with a statement of profit or loss and other comprehensive income for the year ended 30 June 2018.

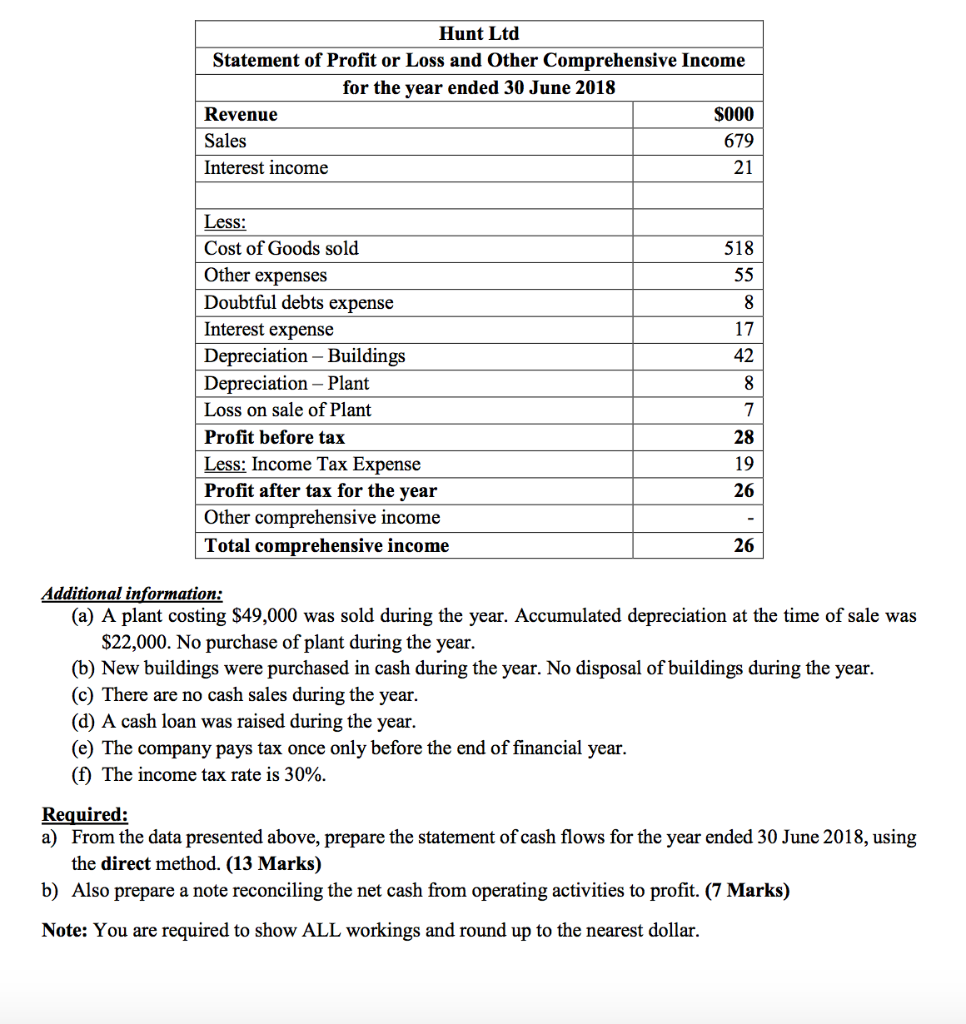

A summarised comparative statement of financial position of Hunt Ltd is presented below, together with a statement of profit or loss and other comprehensive income for the year ended 30 June 2018.

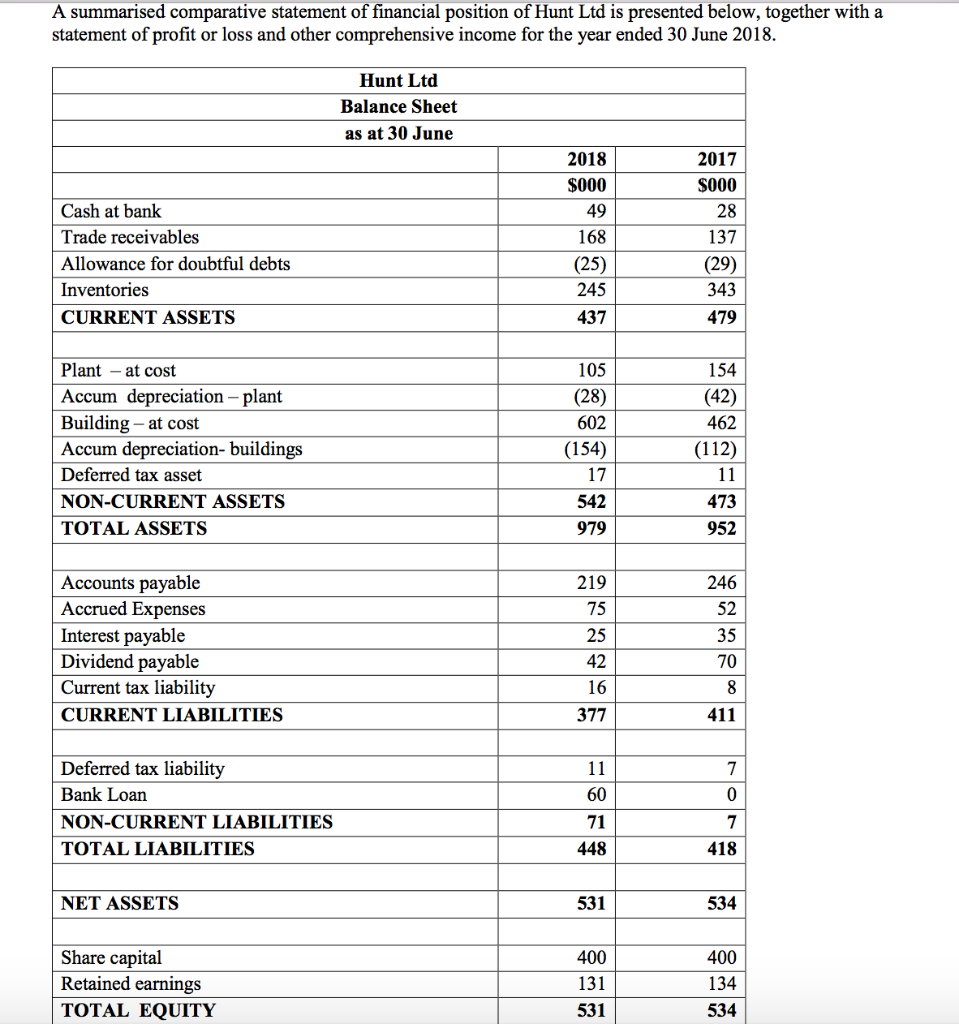

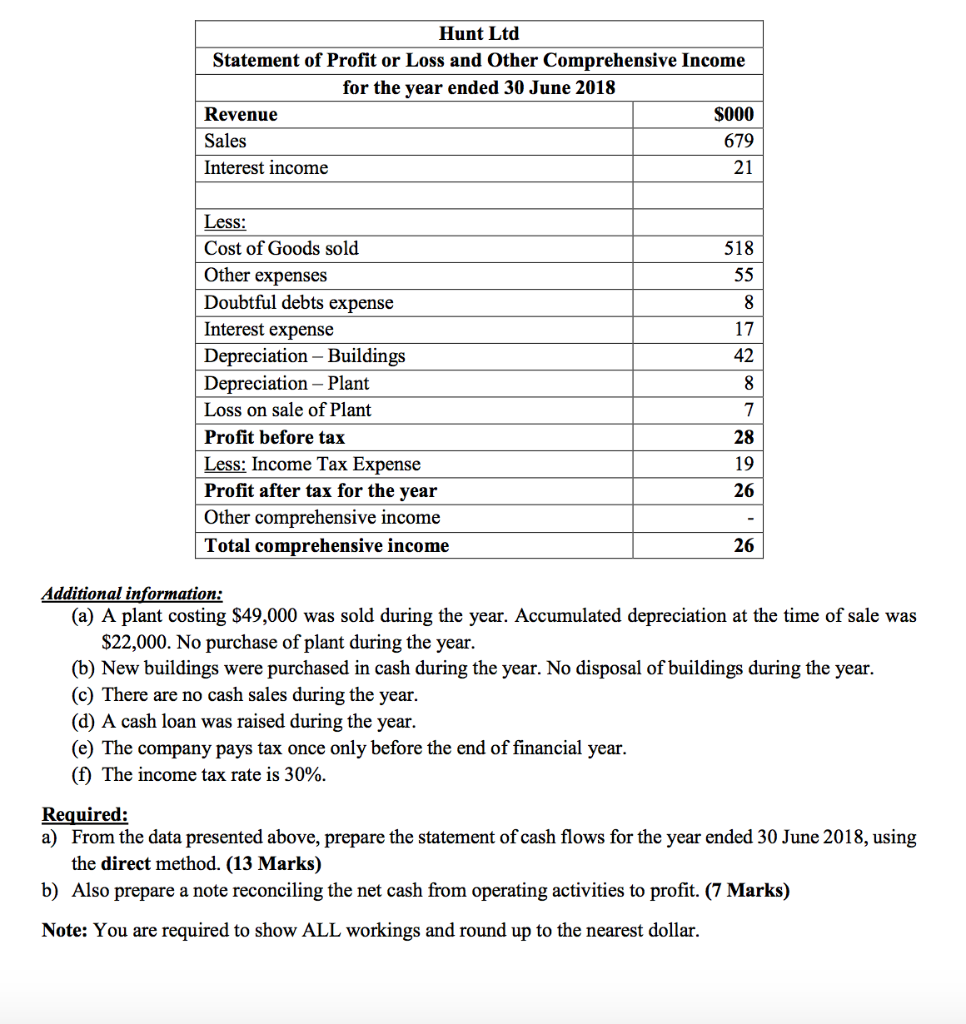

A summarised comparative statement of financial position of Hunt Ltd is presented below, together with a statement of profit or loss and other comprehensive income for the year ended 30 June 2018 Hunt Ltd Balance Sheet as at 30 June 2018 2017 $000 $000 Cash at bank 49 28 Trade receivables 168 137 Allowance for doubtful debts (25) (29) Inventories 245 343 479 CURRENT ASSETS 437 154 Plant 105 - at cost Accum depreciation - plant Building - at cost Accum depreciation- buildings (28) (42) 602 462 (154) (112) Deferred tax asset 17 542 473 NON-CURRENT ASSETS TOTAL ASSETS 979 952 Accounts payable Accrued Expenses 219 246 75 52 Interest payable Dividend payable Current tax liability 25 35 42 70 16 CURRENT LIABILITIES 377 411 Deferred tax liability 11 7 Bank Loan 60 0 NON-CURRENT LIABILITIES 71 7 TOTAL LIABILITIES 448 418 NET ASSETS 531 534 Share capital 400 400 Retained earnings 131 134 TOTAL EQUITY 531 534 Hunt Ltd Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2018 Revenue $000 Sales 679 21 Interest income Less Cost of Goods sold 518 Other expenses Doubtful debts expense 55 8 Interest expense 17 Depreciation Buildings 42 Depreciation Plant Loss on sale of Plant Profit before tax 28 19 Less: Income Tax Expense Profit after tax for the year 26 Other comprehensive income - 26 Total comprehensive income Additional information: (a) A plant costing $49,000 was sold during the year. Accumulated depreciation at the time of sale was $22,000. No purchase of plant during the year. (b) New buildings were purchased in cash during the year. No disposal of buildings during the year (c) There are no cash sales during the year. (d) A cash loan was raised during the year. (e) The company pays tax once only before the end of financial year (f) The income tax rate is 30% Required: a) From the data presented above, prepare the statement of cash flows for the year ended 30 June 2018, using the direct method. (13 Marks) b) Also prepare a note reconciling the net cash from operating activities to profit. (7 Marks) Note: You are required to show ALL workings and round up to the nearest dollar. A summarised comparative statement of financial position of Hunt Ltd is presented below, together with a statement of profit or loss and other comprehensive income for the year ended 30 June 2018 Hunt Ltd Balance Sheet as at 30 June 2018 2017 $000 $000 Cash at bank 49 28 Trade receivables 168 137 Allowance for doubtful debts (25) (29) Inventories 245 343 479 CURRENT ASSETS 437 154 Plant 105 - at cost Accum depreciation - plant Building - at cost Accum depreciation- buildings (28) (42) 602 462 (154) (112) Deferred tax asset 17 542 473 NON-CURRENT ASSETS TOTAL ASSETS 979 952 Accounts payable Accrued Expenses 219 246 75 52 Interest payable Dividend payable Current tax liability 25 35 42 70 16 CURRENT LIABILITIES 377 411 Deferred tax liability 11 7 Bank Loan 60 0 NON-CURRENT LIABILITIES 71 7 TOTAL LIABILITIES 448 418 NET ASSETS 531 534 Share capital 400 400 Retained earnings 131 134 TOTAL EQUITY 531 534 Hunt Ltd Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2018 Revenue $000 Sales 679 21 Interest income Less Cost of Goods sold 518 Other expenses Doubtful debts expense 55 8 Interest expense 17 Depreciation Buildings 42 Depreciation Plant Loss on sale of Plant Profit before tax 28 19 Less: Income Tax Expense Profit after tax for the year 26 Other comprehensive income - 26 Total comprehensive income Additional information: (a) A plant costing $49,000 was sold during the year. Accumulated depreciation at the time of sale was $22,000. No purchase of plant during the year. (b) New buildings were purchased in cash during the year. No disposal of buildings during the year (c) There are no cash sales during the year. (d) A cash loan was raised during the year. (e) The company pays tax once only before the end of financial year (f) The income tax rate is 30% Required: a) From the data presented above, prepare the statement of cash flows for the year ended 30 June 2018, using the direct method. (13 Marks) b) Also prepare a note reconciling the net cash from operating activities to profit. (7 Marks) Note: You are required to show ALL workings and round up to the nearest dollar

A summarised comparative statement of financial position of Hunt Ltd is presented below, together with a statement of profit or loss and other comprehensive income for the year ended 30 June 2018.

A summarised comparative statement of financial position of Hunt Ltd is presented below, together with a statement of profit or loss and other comprehensive income for the year ended 30 June 2018.