Certain fringe benefits (such as health insurance) are deductible for the employer and non-taxable for the employee. 1. What is the difference between the

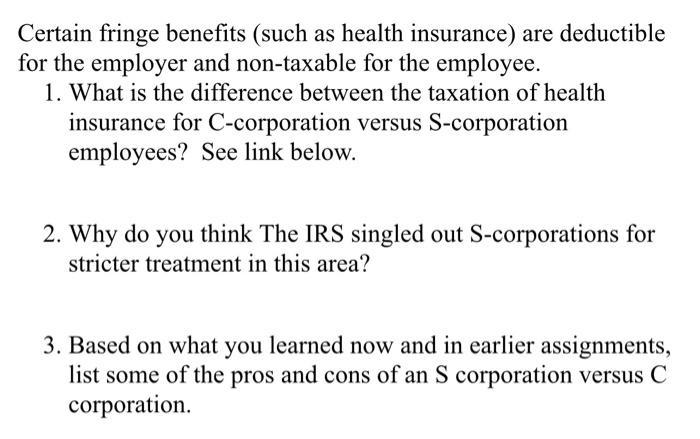

Certain fringe benefits (such as health insurance) are deductible for the employer and non-taxable for the employee. 1. What is the difference between the taxation of health insurance for C-corporation versus S-corporation employees? See link below. 2. Why do you think The IRS singled out S-corporations for stricter treatment in this area? 3. Based on what you learned now and in earlier assignments, list some of the pros and cons of an S corporation versus C corporation.

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Table Schemas 1 BOOKTitleNrISBNCopyNrTitlePubYearAuthorAuthoNat Primary Key given TitleNrCopyNrAuthor Alternative Key given ISBN CopyNrAuthor Functional Dependencies present in the table TitleNr Title ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started