Answered step by step

Verified Expert Solution

Question

1 Approved Answer

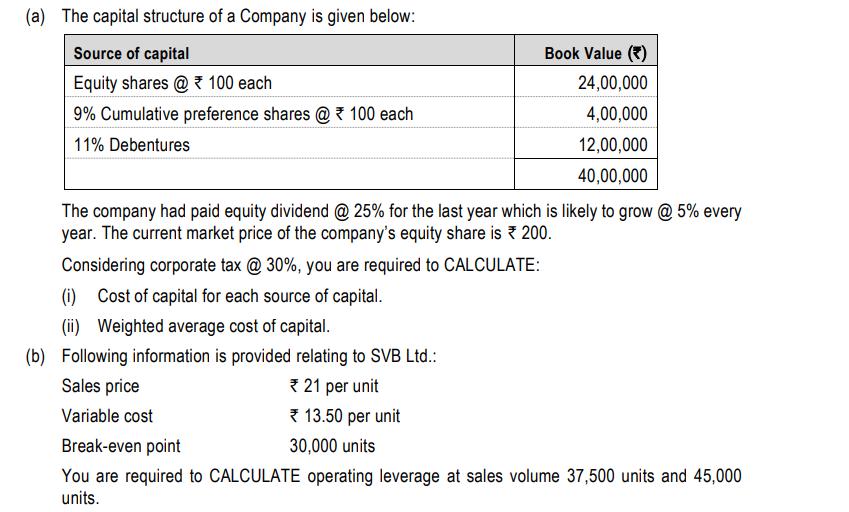

(a) The capital structure of a Company is given below: Source of capital Equity shares@100 each 9% Cumulative preference shares @* 100 each 11%

(a) The capital structure of a Company is given below: Source of capital Equity shares@100 each 9% Cumulative preference shares @* 100 each 11% Debentures Book Value (*) 24,00,000 4,00,000 12,00,000 40,00,000 The company had paid equity dividend @ 25% for the last year which is likely to grow @ 5% every year. The current market price of the company's equity share is * 200. Considering corporate tax @ 30%, you are required to CALCULATE: Cost of capital for each source of capital. (i) (ii) Weighted average cost of capital. (b) Following information is provided relating to SVB Ltd.: Sales price Variable cost 21 per unit 13.50 per unit 30,000 units Break-even point You are required to CALCULATE operating leverage at sales volume 37,500 units and 45,000 units.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a i Cost of capital for each source of capital Cost of equity Dividend per share Market value per sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started