Answered step by step

Verified Expert Solution

Question

1 Approved Answer

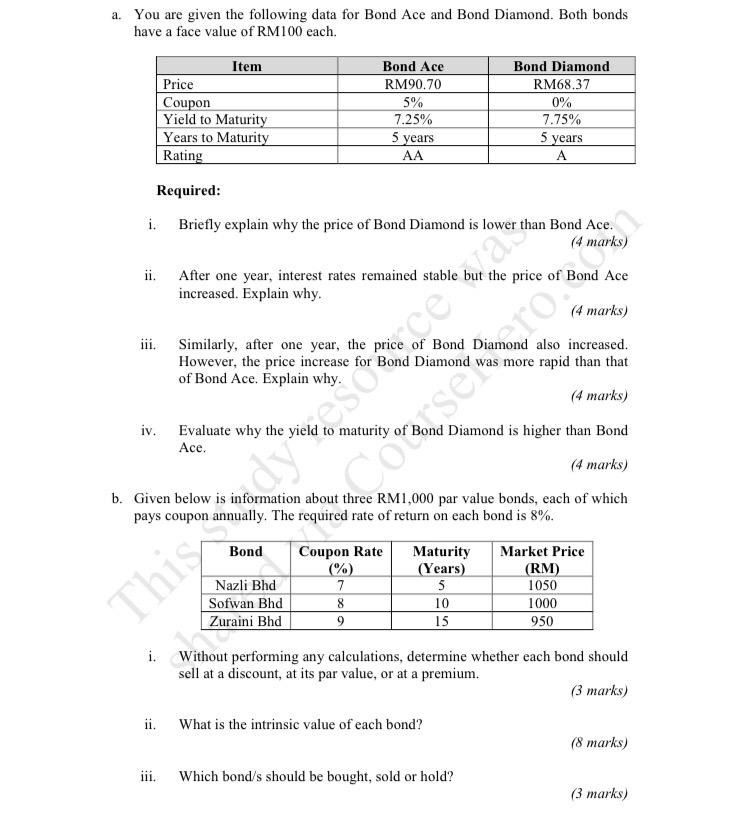

a. You are given the following data for Bond Ace and Bond Diamond. Both bonds have a face value of RM100 each. ii. iii.

a. You are given the following data for Bond Ace and Bond Diamond. Both bonds have a face value of RM100 each. ii. iii. iv. Item Price Coupon Yield to Maturity Years to Maturity Rating Required: i. Briefly explain why the price of Bond Diamond is lower than Bond Ace. ii. iii. Bond Ace RM90.70 5% 7.25% Similarly, after one year, the price of Bond also increased. However, the price increase for Bond Diamond was more rapid than that of Bond Ace. Explain why. (4 marks) Evaluate why the yield to maturity of Bond Diamond is higher than Bond Ace. (4 marks) b. Given below is information about three RM1,000 par value bonds, each of which pays coupon annually. The required rate of return on each bond is 8%. Bond 5 years AA Nazli Bhd Sofwan Bhd Zuraini Bhd After one year, interest rates remained stable but the price of Bond Ace increased. Explain why. (4 marks) Coupon Rate (%) 7 8 9 Bond Diamond RM68.37 0% 7.75% 5 years A Cosero Maturity (Years) 5 10 15 This dyes ren i. Without performing any calculations, determine whether each bond should sell at a discount, at its par value, or at a premium. (3 marks) What is the intrinsic value of each bond? Which bond/s should be bought, sold or hold? Market Price (RM) 1050 1000 950 (8 marks) (3 marks)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer i The price of a bond is determined by its yield to maturity YTM which represents the rate of return an investor can expect to receive if the b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started