Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A young first-time homebuyer is considering the purchase of a HK$10 million property by taking out an 80% mortgage financing with the following terms:

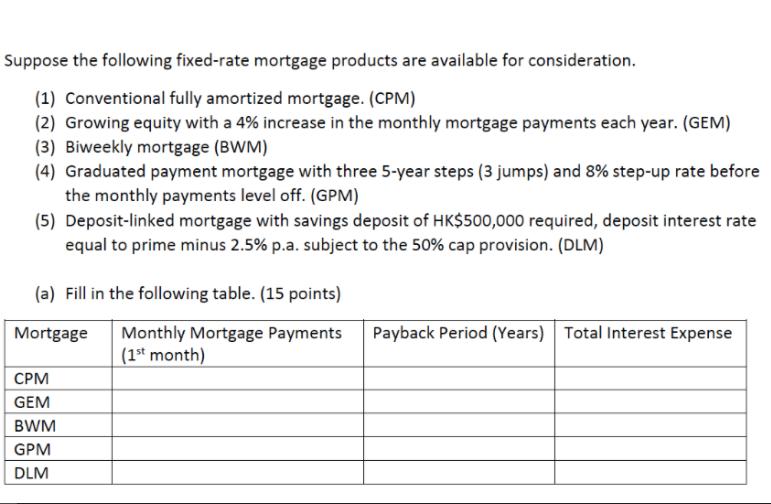

A young first-time homebuyer is considering the purchase of a HK$10 million property by taking out an 80% mortgage financing with the following terms: Tenor: 25 years, monthly payments Mortgage interest rate: "Prime" minus 2.5% p.a., Prime Rate is 5%. Standard deposit savings rate: 0.1% p.a. Suppose the following fixed-rate mortgage products are available for consideration. (1) Conventional fully amortized mortgage. (CPM) (2) Growing equity with a 4% increase in the monthly mortgage payments each year. (GEM) (3) Biweekly mortgage (BWM) (4) Graduated payment mortgage with three 5-year steps (3 jumps) and 8% step-up rate before the monthly payments level off. (GPM) (5) Deposit-linked mortgage with savings deposit of HK$500,000 required, deposit interest rate equal to prime minus 2.5% p.a. subject to the 50% cap provision. (DLM) (a) Fill in the following table. (15 points) Monthly Mortgage Payments (1st month) Mortgage Payback Period (Years) Total Interest Expense CPM GEM BWM GPM DLM A young first-time homebuyer is considering the purchase of a HK$10 million property by taking out an 80% mortgage financing with the following terms: Tenor: 25 years, monthly payments Mortgage interest rate: "Prime" minus 2.5% p.a., Prime Rate is 5%. Standard deposit savings rate: 0.1% p.a. Suppose the following fixed-rate mortgage products are available for consideration. (1) Conventional fully amortized mortgage. (CPM) (2) Growing equity with a 4% increase in the monthly mortgage payments each year. (GEM) (3) Biweekly mortgage (BWM) (4) Graduated payment mortgage with three 5-year steps (3 jumps) and 8% step-up rate before the monthly payments level off. (GPM) (5) Deposit-linked mortgage with savings deposit of HK$500,000 required, deposit interest rate equal to prime minus 2.5% p.a. subject to the 50% cap provision. (DLM) (a) Fill in the following table. (15 points) Monthly Mortgage Payments (1st month) Mortgage Payback Period (Years) Total Interest Expense CPM GEM BWM GPM DLM A young first-time homebuyer is considering the purchase of a HK$10 million property by taking out an 80% mortgage financing with the following terms: Tenor: 25 years, monthly payments Mortgage interest rate: "Prime" minus 2.5% p.a., Prime Rate is 5%. Standard deposit savings rate: 0.1% p.a. Suppose the following fixed-rate mortgage products are available for consideration. (1) Conventional fully amortized mortgage. (CPM) (2) Growing equity with a 4% increase in the monthly mortgage payments each year. (GEM) (3) Biweekly mortgage (BWM) (4) Graduated payment mortgage with three 5-year steps (3 jumps) and 8% step-up rate before the monthly payments level off. (GPM) (5) Deposit-linked mortgage with savings deposit of HK$500,000 required, deposit interest rate equal to prime minus 2.5% p.a. subject to the 50% cap provision. (DLM) (a) Fill in the following table. (15 points) Monthly Mortgage Payments (1st month) Mortgage Payback Period (Years) Total Interest Expense CPM GEM BWM GPM DLM A young first-time homebuyer is considering the purchase of a HK$10 million property by taking out an 80% mortgage financing with the following terms: Tenor: 25 years, monthly payments Mortgage interest rate: "Prime" minus 2.5% p.a., Prime Rate is 5%. Standard deposit savings rate: 0.1% p.a. Suppose the following fixed-rate mortgage products are available for consideration. (1) Conventional fully amortized mortgage. (CPM) (2) Growing equity with a 4% increase in the monthly mortgage payments each year. (GEM) (3) Biweekly mortgage (BWM) (4) Graduated payment mortgage with three 5-year steps (3 jumps) and 8% step-up rate before the monthly payments level off. (GPM) (5) Deposit-linked mortgage with savings deposit of HK$500,000 required, deposit interest rate equal to prime minus 2.5% p.a. subject to the 50% cap provision. (DLM) (a) Fill in the following table. (15 points) Monthly Mortgage Payments (1st month) Mortgage Payback Period (Years) Total Interest Expense CPM GEM BWM GPM DLM A young first-time homebuyer is considering the purchase of a HK$10 million property by taking out an 80% mortgage financing with the following terms: Tenor: 25 years, monthly payments Mortgage interest rate: "Prime" minus 2.5% p.a., Prime Rate is 5%. Standard deposit savings rate: 0.1% p.a. Suppose the following fixed-rate mortgage products are available for consideration. (1) Conventional fully amortized mortgage. (CPM) (2) Growing equity with a 4% increase in the monthly mortgage payments each year. (GEM) (3) Biweekly mortgage (BWM) (4) Graduated payment mortgage with three 5-year steps (3 jumps) and 8% step-up rate before the monthly payments level off. (GPM) (5) Deposit-linked mortgage with savings deposit of HK$500,000 required, deposit interest rate equal to prime minus 2.5% p.a. subject to the 50% cap provision. (DLM) (a) Fill in the following table. (15 points) Monthly Mortgage Payments (1st month) Mortgage Payback Period (Years) Total Interest Expense CPM GEM BWM GPM DLM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

loan amount 8000000 time period 25 interest rate 25 Mortgage Monthly mortgage payment 1st month Payback Period years Total Interest Expense CPM 43333 25 2600000 GEM 44400 18 2009754 BWM 70000 14 13520...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6284dc8d1b1b1_Book222.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started