Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It needs to be recorded in the General Journal format. From January 2019 to May 2020. It must be labelled from Date, Accounts and Debit

It needs to be recorded in the General Journal format. From January 2019 to May 2020.

It needs to be recorded in the General Journal format. From January 2019 to May 2020.It must be labelled from Date, Accounts and Debit and Credit.

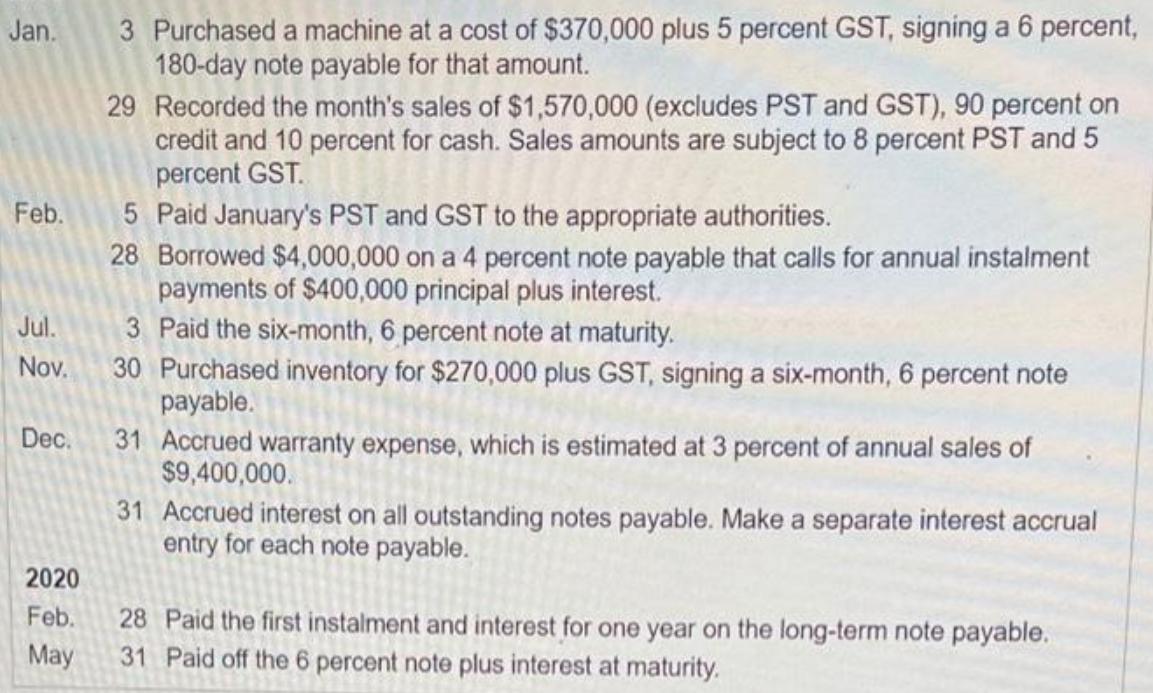

3 Purchased a machine at a cost of $370,000 plus 5 percent GST, signing a 6 percent, 180-day note payable for that amount. 29 Recorded the month's sales of $1,570,000 (excludes PST and GST), 90 percent on credit and 10 percent for cash. Sales amounts are subject to 8 percent PST and 5 percent GST. Jan. Feb. 5 Paid January's PST and GST to the appropriate authorities. 28 Borrowed $4,000,000 on a 4 percent note payable that calls for annual instalment payments of $400,000 principal plus interest. 3 Paid the six-month, 6 percent note at maturity. 30 Purchased inventory for $270,000 plus GST, signing a six-month, 6 percent note payable. 31 Accrued warranty expense, which is estimated at 3 percent of annual sales of $9,400,000. Jul. Nov. Dec. 31 Accrued interest on all outstanding notes payable. Make a separate interest accrual entry for each note payable. 2020 Feb. 28 Paid the first instalment and interest for one year on the long-term note payable. 31 Paid off the 6 percent note plus interest at maturity. May

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started