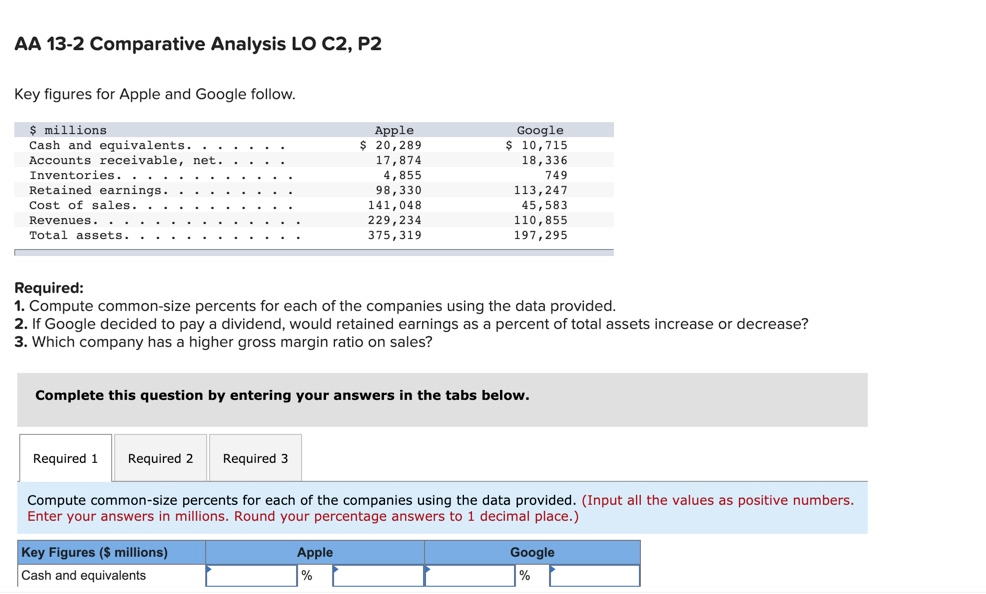

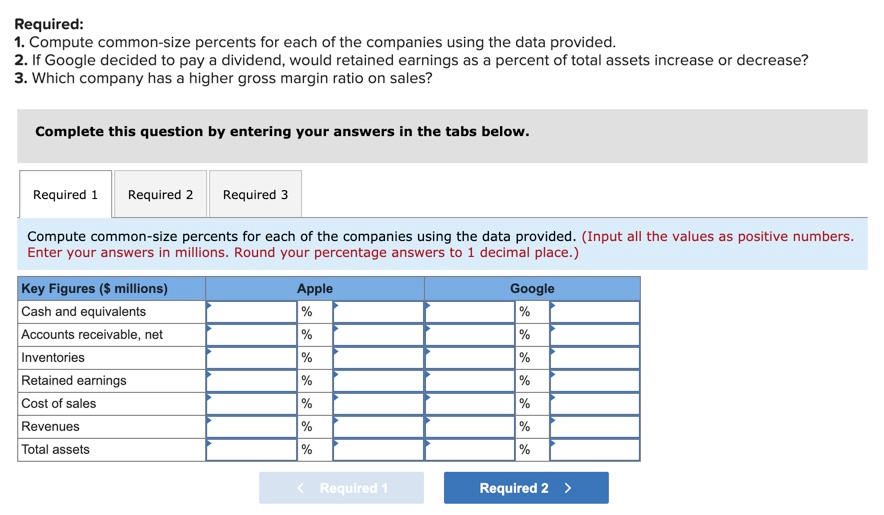

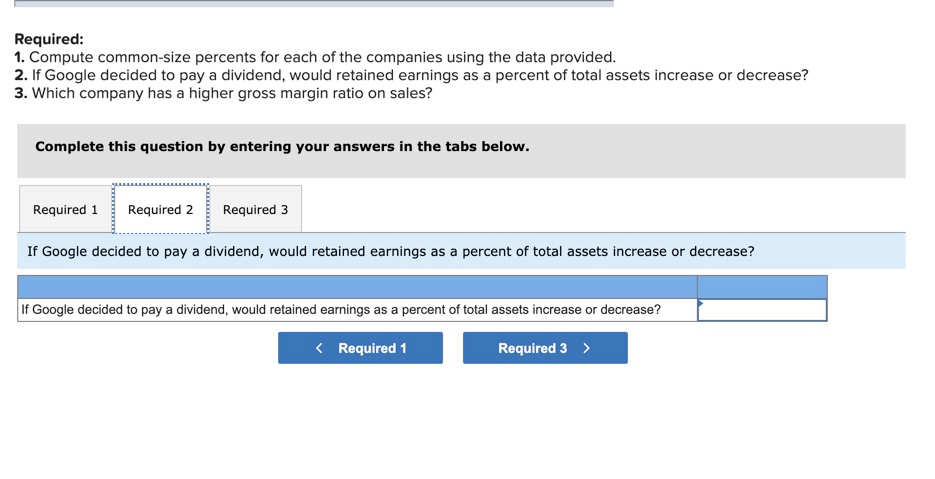

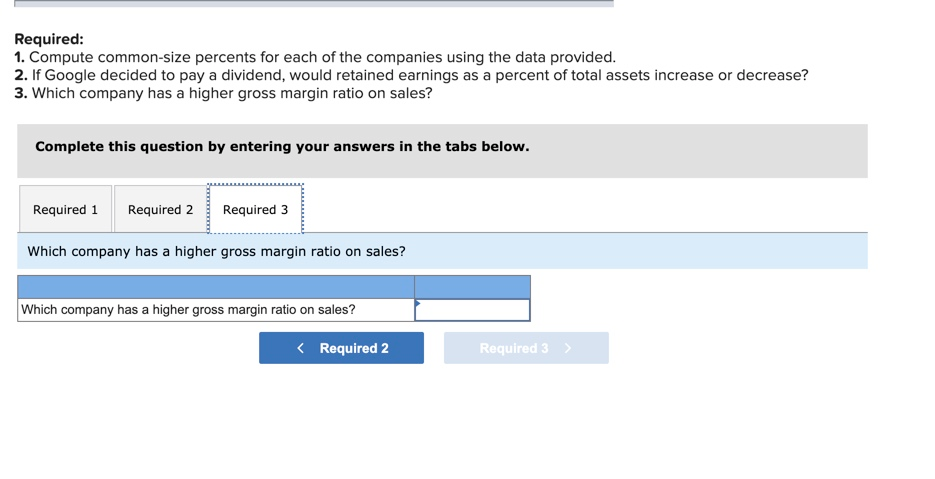

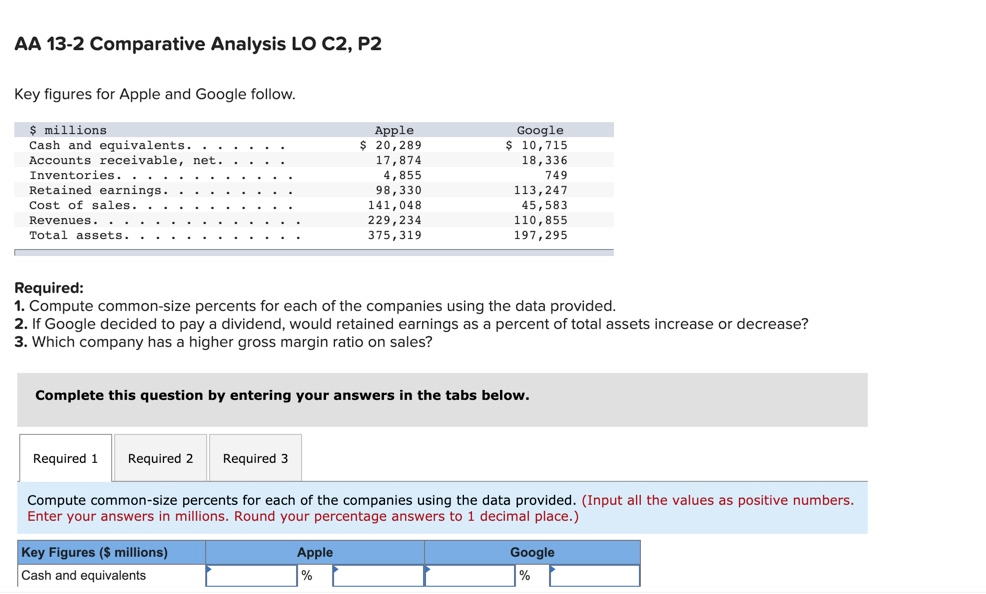

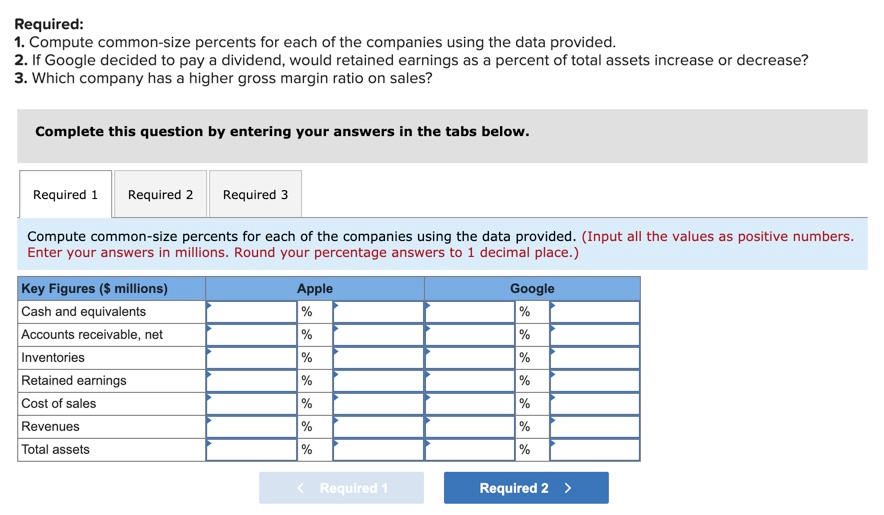

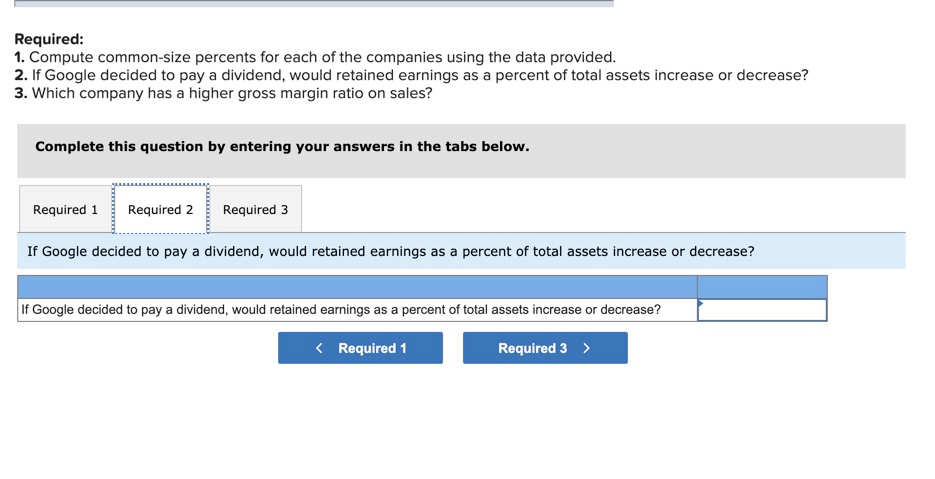

AA 13-2 Comparative Analysis LO C2, P2 Key figures for Apple and Google follow. $ millions Cash and equivalents. Accounts receivable, net. Inventories.. Retained earnings. Cost of sales. Revenues. Total assets. Apple $ 20,289 17,874 4,855 98,330 141,048 229, 234 375, 319 Google $ 10,715 18,336 749 113,247 45,583 110,855 197,295 Required: 1. Compute common-size percents for each of the companies using the data provided. 2. If Google decided to pay a dividend, would retained earnings as a percent of total assets increase or decrease? 3. Which company has a higher gross margin ratio on sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute common-size percents for each of the companies using the data provided. (Input all the values as positive numbers. Enter your answers in millions. Round your percentage answers to 1 decimal place.) Apple Google Key Figures ($ millions) Cash and equivalents % % Required: 1. Compute common-size percents for each of the companies using the data provided. 2. If Google decided to pay a dividend, would retained earnings as a percent of total assets increase or decrease? 3. Which company has a higher gross margin ratio on sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute common-size percents for each of the companies using the data provided. (Input all the values as positive numbers. Enter your answers in millions. Round your percentage answers to 1 decimal place.) Key Figures ($ millions) Cash and equivalents Accounts receivable, net Inventories Retained earnings Cost of sales Revenues Apple % % % % % % Google % % % % % % % Total assets % Required 1 Required 2 > Required: 1. Compute common-size percents for each of the companies using the data provided. 2. If Google decided to pay a dividend, would retained earnings as a percent of total assets increase or decrease? 3. Which company has a higher gross margin ratio on sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 If Google decided to pay a dividend, would retained earnings as a percent of total assets increase or decrease? If Google decided to pay a dividend, would retained earnings as a percent of total assets increase or decrease? Required: 1. Compute common-size percents for each of the companies using the data provided. 2. If Google decided to pay a dividend, would retained earnings as a percent of total assets increase or decrease? 3. Which company has a higher gross margin ratio on sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Which company has a higher gross margin ratio on sales? Which company has a higher gross margin ratio on sales?