Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Abbott Laboratories reports its 50% joint venture investment in TAP Pharmaceutical Products Inc. using the equity method of accounting in its 2007 10-K. The

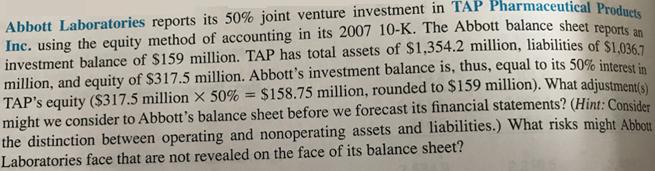

Abbott Laboratories reports its 50% joint venture investment in TAP Pharmaceutical Products Inc. using the equity method of accounting in its 2007 10-K. The Abbott balance sheet reports an investment balance of $159 million. TAP has total assets of $1,354.2 million, liabilities of $1,036.7 million, and equity of $317.5 million. Abbott's investment balance is, thus, equal to its 50% interest in TAP's equity ($317.5 million X 50% = $158.75 million, rounded to $159 million). What adjustment(s) might we consider to Abbott's balance sheet before we forecast its financial statements? (Hint: Consider the distinction between operating and nonoperating assets and liabilities.) What risks might Abbott Laboratories face that are not revealed on the face of its balance sheet?

Step by Step Solution

★★★★★

3.58 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Answer The main adjustment we might consider is to treat TAP as a separate entity for forecasting pu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started