Question

ABC company is currently producing and selling 215,000 units a year The selling price is The variable expenses are 12.00 per unit 7.25 per

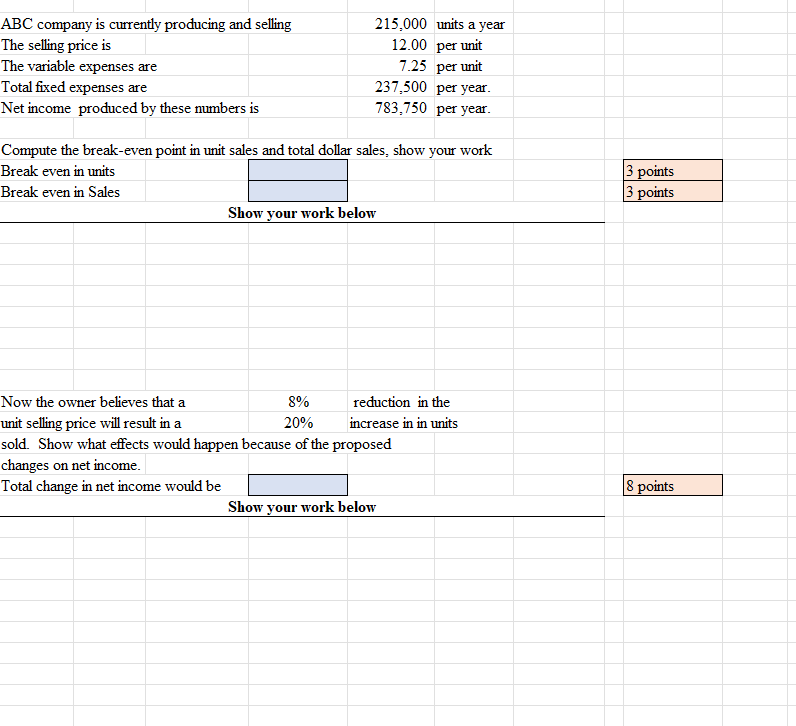

ABC company is currently producing and selling 215,000 units a year The selling price is The variable expenses are 12.00 per unit 7.25 per unit Total fixed expenses are 237,500 per year. Net income produced by these numbers is 783,750 per year. Compute the break-even point in unit sales and total dollar sales, show your work Break even in units Break even in Sales Now the owner believes that a unit selling price will result in a Show your work below 8% 20% reduction in the increase in in units sold. Show what effects would happen because of the proposed changes on net income. Total change in net income would be Show your work below 3 points 3 points 8 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Cost Accounting

Authors: William Lanen, Shannon Anderson, Michael Maher

5th edition

978-1259728877, 1259728870, 978-1259565403

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App